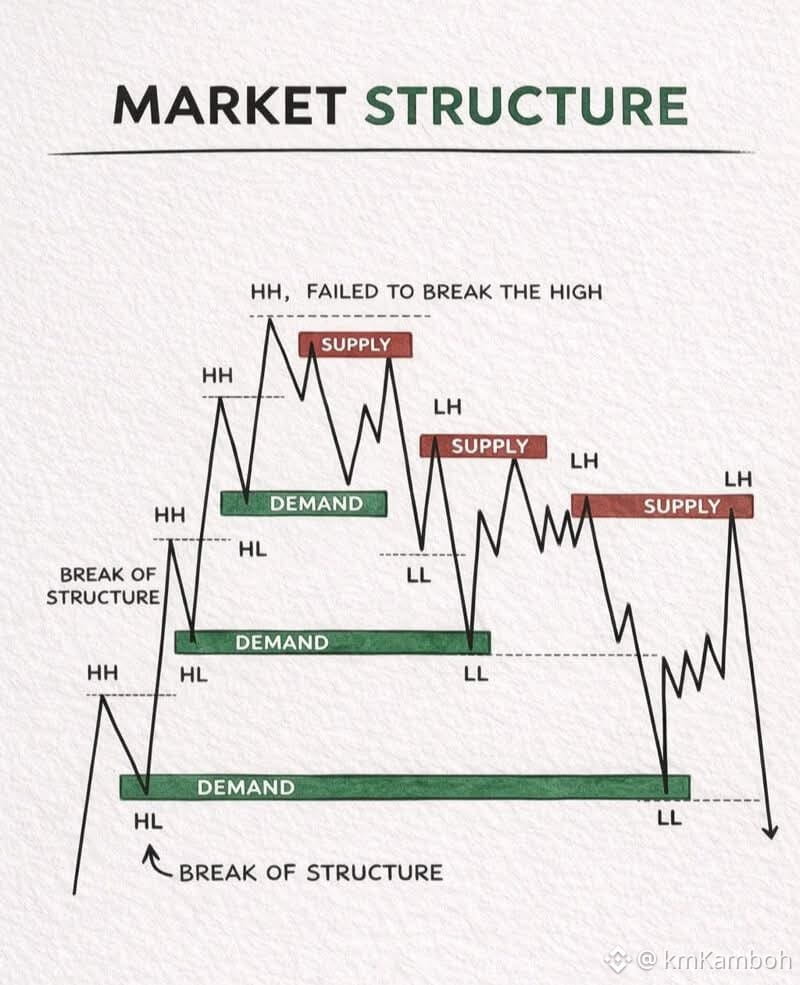

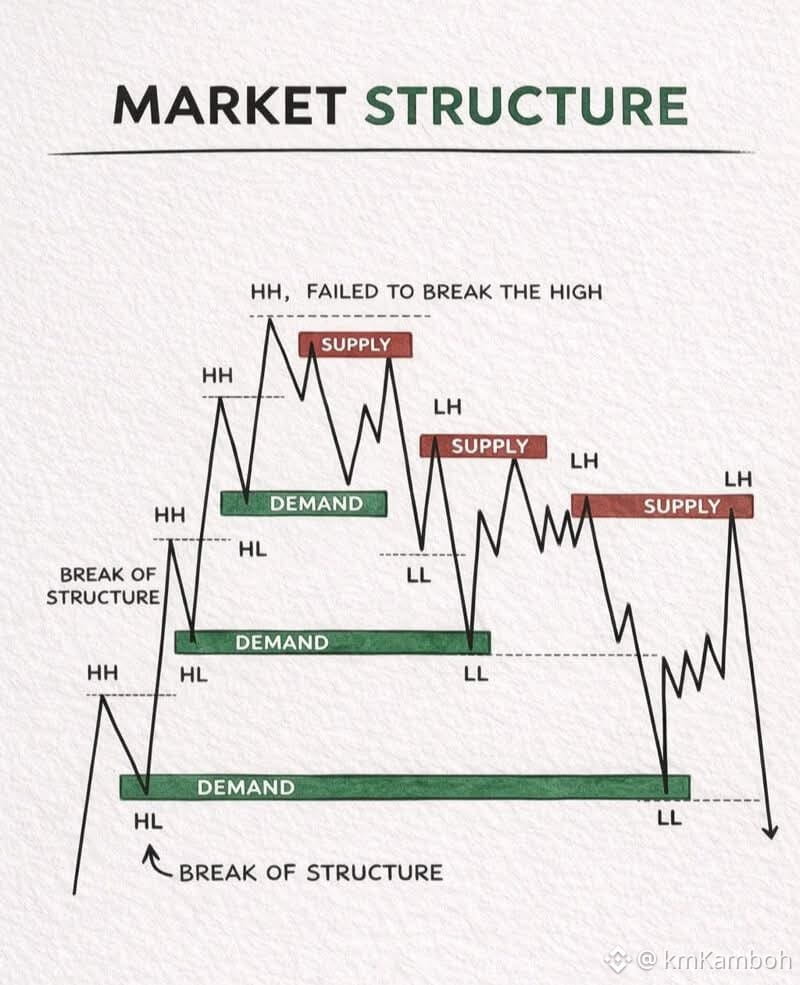

1️⃣ Market Structure Basics

Market structure is built from swing highs and swing lows:

HH (Higher High) → bullish strength

HL (Higher Low) → bullish continuation

LH (Lower High) → bearish weakness

LL (Lower Low) → bearish continuation

An uptrend = HH + HL

A downtrend = LH + LL

2️⃣ Demand Zones (Green Areas)

Green boxes represent demand zones:

Areas where buyers previously stepped in strongly

Price often reacts or bounces from these zones

In an uptrend, demand zones form at higher lows

In the image:

Price keeps respecting demand during the bullish phase

Each pullback into demand creates a new HH

3️⃣ Supply Zones (Red Areas)

Red boxes represent supply zones:

Areas where sellers dominated

Price struggles or reverses from these zones

In a weakening market, supply forms at lower highs

In the image:

Price fails to break the high at supply

This failure is an early sign of trend exhaustion

4️⃣ Break of Structure (BOS)

A Break of Structure happens when:

In an uptrend → a Higher Low is broken

In a downtrend → a Lower High is broken

In the image:

Price breaks below a previous HL

This confirms a shift from bullish to bearish

Demand fails → structure flips

This is one of the most important confirmation signals in price action trading.

5️⃣ Trend Shift Confirmation

After BOS:

Price forms a Lower Low (LL)

Pullbacks create Lower Highs (LH)

Supply zones now hold instead of demand

This confirms:

Bullish → Bearish market structure change

6️⃣ Trading Insight from This Structure

❌ Buying at old demand after BOS is risky

✅ Best sells come from LH + Supply zones

✅ Trend continuation trades align with LL formation

⚠️ warning = failure to break HH at supply

📌 Key Takeaway

This image teaches how trends start, weaken, and reverse using:

Market structure

Supply & demand

Break of structure confirmation

Mastering this concept helps you: ✔ Avoid fake breakouts

✔ Trade with trend bias

✔ Enter at high-probability zones