When I sit with Dusk for a while, the way I understand it stops being about technology choices and starts being about intent. I don’t see it as a system trying to persuade people to rethink finance. I see it as a system designed to fit into finance as it already exists, with all its constraints, sensitivities, and expectations. That framing matters to me because it explains why Dusk feels measured rather than expressive, and why so many of its decisions prioritize control, discretion, and predictability over visibility.

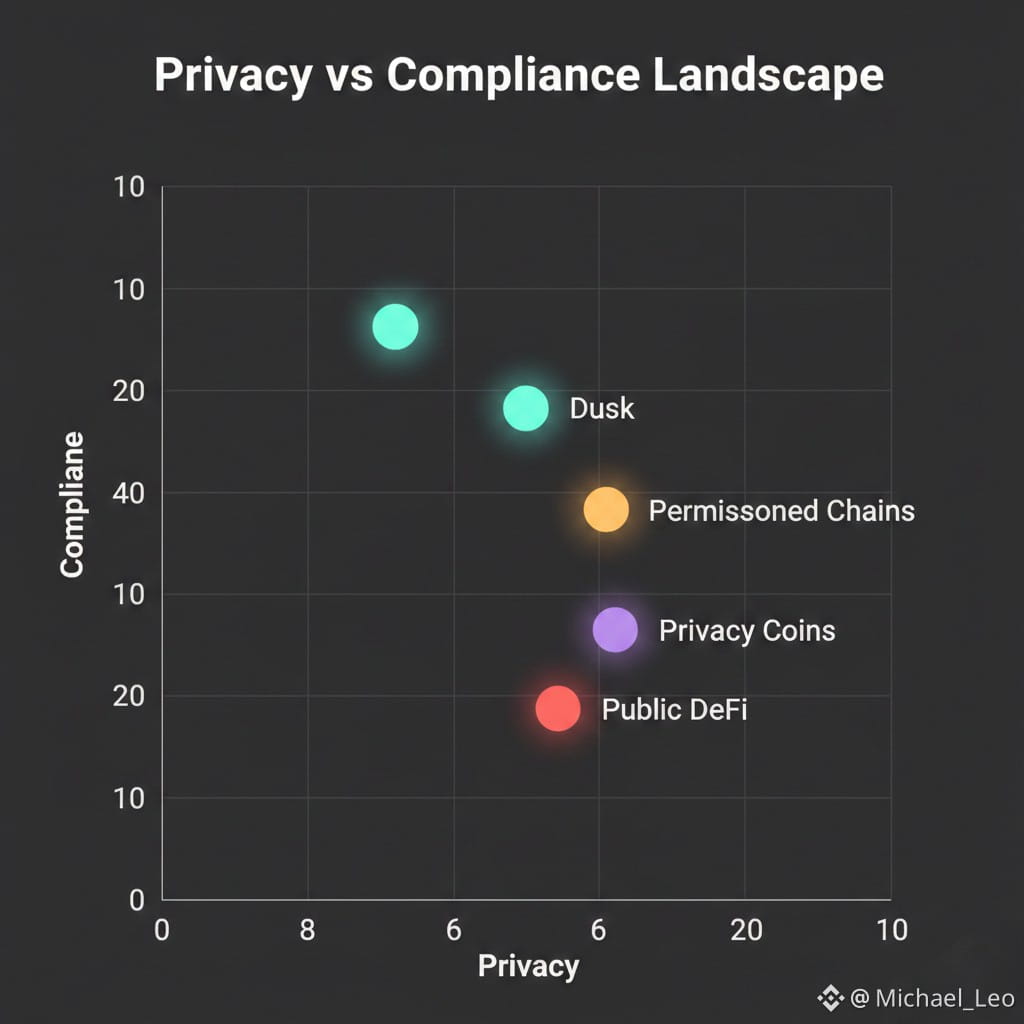

Most real users in financial environments are not looking for radical transparency or constant experimentation. They are trying to move value, issue instruments, or manage obligations without exposing internal activity to the world. From that perspective, privacy is not a philosophical position; it is a default requirement. What Dusk seems to recognize is that privacy alone is not enough. Financial systems also need to be inspectable when the moment calls for it. The balance between confidentiality and auditability feels less like a feature set and more like an assumption baked into the system from the start.

As I look at the structure of Dusk, I read its modular approach as a response to friction rather than ambition. Financial applications tend to break when too many concerns are bundled together. Compliance rules change, reporting requirements differ by jurisdiction, and internal controls evolve over time. A modular foundation allows these pressures to be absorbed without forcing users or institutions to constantly rewire how they operate. That kind of flexibility usually comes from understanding that real-world usage is uneven, regulated, and rarely elegant.

What I find most telling is how the system treats complexity. Instead of celebrating it or pushing it to the surface, Dusk appears to work hard to keep it out of the user’s way. Everyday users should not need to understand cryptographic proofs or transaction models to trust a financial action. They should only need confidence that the system behaves correctly under scrutiny. By hiding complexity rather than showcasing it, Dusk aligns itself with how mature infrastructure has always worked: quietly, consistently, and without demanding attention.

There are parts of the design that invite cautious curiosity, particularly around how regulated financial instruments can exist on a shared ledger without becoming exposed by default. These ideas only prove themselves under real operational stress, where edge cases and oversight demands collide. Tokenized assets and compliant financial workflows serve as pressure tests rather than promotional examples. They reveal whether the system can handle the uncomfortable realities of finance, not just ideal conditions.

The role of the token, as I interpret it, is functional rather than expressive. It exists to support usage, participation, and alignment within the network. Its value is tied to whether the system is used correctly and consistently, not to external excitement. That grounding reinforces the sense that Dusk is built to persist quietly in the background, supporting activity rather than drawing attention to itself.

Stepping back, what Dusk signals to me is a version of blockchain infrastructure that has made peace with being invisible. It suggests a future where success is measured by reliability and discretion, not by spectacle. For everyday users and institutions alike, that kind of infrastructure is often the most valuable, precisely because it fades into the workflow and simply does its job.