One Trade. One Plan. One Calm Decision.

This trade is a perfect example of how I approach the market and why I believe consistency matters more than excitement.

When I entered this position, the goal was never to chase a big win or force the market to give me something. The goal was simple: follow my strategy, manage risk properly, and let the trade do its job. Nothing more, nothing less.

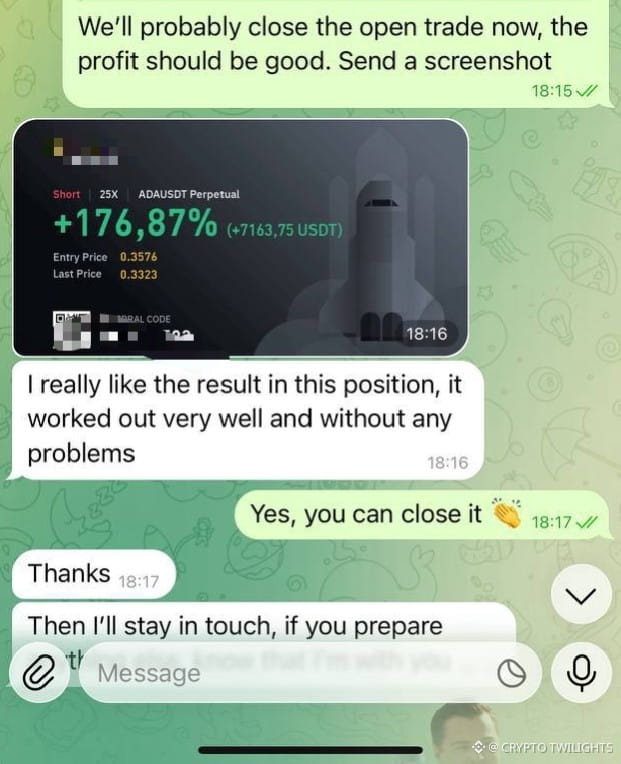

I was short on ADAUSDT with clear reasoning behind the entry. The market structure supported the idea, momentum was aligned, and risk was already defined before clicking the button. Once the trade was open, there was no emotional attachment to the outcome. That’s a rule I strictly follow.

Too many traders lose not because their analysis is bad, but because their execution and management are weak. They enter correctly, then panic. Or they enter emotionally and hope the market forgives them. My approach is different.

My Trading Philosophy

I don’t believe in trading all the time.

I don’t believe in overtrading.

And I definitely don’t believe in revenge trading.

I believe in waiting.

Waiting for price to come to my level.

Waiting for confirmation.

Waiting until risk and reward make sense.

Most of the time, doing nothing is the best decision a trader can make.

About My Strategy

My strategy is built on three core principles:

1. Structure First

I focus on market structure before anything else. If structure doesn’t make sense, the trade doesn’t exist for me. Simple.

2. Risk Is Decided Before Entry

I know exactly how much I’m willing to lose before entering any trade. If that loss makes me uncomfortable, I reduce position size or skip the trade entirely.

3. Let Winners Breathe

Once a trade moves in my favor, I don’t rush to close it out of fear. I let price reach logical areas. Patience is a skill, not luck.

This trade worked well not because of leverage or speed, but because the plan was respected from start to finish.

Trade Management Matters

Notice something important here:

The trade wasn’t closed in panic.

It wasn’t closed because of excitement.

It was closed because the objective was reached.

Good trading is boring. And that’s a good thing.

If you’re constantly feeling stress, fear, or adrenaline while trading, that’s a sign something is wrong with your process. Calm execution is a sign of clarity.

Final Thoughts

I don’t aim to be right every time.

I aim to be disciplined every time.

Losses are part of the game. Wins are a result of discipline. Over time, discipline compounds.

This trade is just one example, but the mindset behind it is the real edge.

Stay patient.

Stay focused.

Respect your strategy.

The market rewards consistency — not emotions.

---