Sit down. We need to talk about Plasma, and I’m not going to feed you the usual crypto hype nonsense.

You’ve probably seen the headlines—$7 billion in stablecoin deposits, 1,000+ transactions per second, zero fees, 100+ countries. Sounds incredible, right? Like someone finally cracked the code on making crypto payments actually work for normal people instead of just DeFi degens trading dog coins at 3 AM.

But here’s the thing. The more I dig into Plasma, the more questions I have. And weirdly, those questions might be more interesting than the answers.

So What Even Is This Thing?

Plasma calls itself a “purpose-built Layer 1 blockchain for stablecoins.” Translation: they built an entire blockchain that does exactly one thing—move stablecoins around—and nothing else. No smart contracts. No NFTs. No DeFi protocols. Just payments.

At first, that sounds limiting. But think about it like this: would you trust a surgeon who also does plumbing and tax accounting on the side? Or would you want the person who’s done 10,000 heart surgeries and literally nothing else?

Plasma bet that specialization beats generalization. Ethereum tries to do everything—payments, DeFi, NFTs, gaming. Plasma said screw that, we’re just doing payments and we’re going to be impossibly good at it.

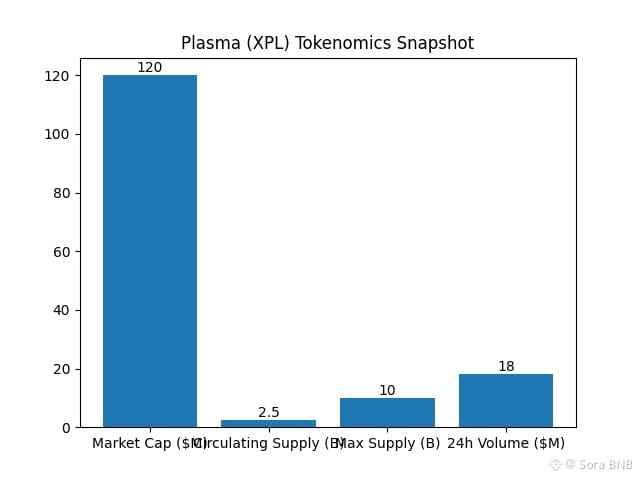

And honestly? The performance numbers suggest they might be onto something. Sub-second finality. Zero transaction fees. Over 1,000 TPS. Those aren’t incremental improvements—they’re fundamentally different from what general-purpose blockchains can deliver.

But here’s where it gets weird.

The Economics Don’t Add Up (Until They Do)

Zero fees. Let that sink in. You can move stablecoins on Plasma and pay literally nothing.

Now, I don’t know about you, but I learned pretty early that nothing in life is actually free. Validators need to get paid somehow. Servers cost money. Bandwidth costs money. Security costs money.

So where’s the money coming from?

The answer is hiding in plain sight: Bitfinex, Tether, Flow Traders, DRW, Founders Fund. These aren’t just investors throwing money at Plasma hoping it moons. They’re entities with direct business interests in efficient stablecoin infrastructure existing.

Market makers like Flow Traders and DRW? They make money when stablecoins move efficiently between exchanges and markets. Lower friction means more trading volume means more profit for them. Running a validator isn’t charity—it’s infrastructure investment that pays dividends elsewhere in their business.

Tether is even more obvious. They issue USDT, which generates profit from the interest on reserves backing those stablecoins. But USDT lives on other people’s blockchains—Ethereum, Tron, whatever. Every time there’s network congestion or high fees, USDT becomes harder to use. That’s bad for Tether’s business.

Plasma gives Tether infrastructure they partially control. It’s like Amazon building their own delivery network instead of relying on FedEx forever. Makes total sense strategically, even if nobody wants to say it that directly.

So the economics work, just not through traditional blockchain fee models. The value capture happens somewhere else in the ecosystem. Honestly? That might be smarter than normal crypto tokenomics where everyone’s just farming fees from retail users.

But it also means Plasma’s sustainability depends on those institutional players continuing to subsidize infrastructure. What happens if their incentives change? Does Plasma pivot to charging fees and destroy its competitive advantage? Does the network just… stop?

I don’t know. And importantly, Plasma hasn’t really explained this publicly.

The Tether Situation Is Both Brilliant and Sketchy

Let’s talk about the elephant in the room. Tether doesn’t just back Plasma—they’ve made it the 4th largest network by USDT balance. That’s not passive investment. That’s strategic infrastructure play.

And look, I get it. If I were running Tether, I’d be doing the same thing. Relying entirely on Ethereum and Tron for your $140+ billion stablecoin empire is dangerous. One regulatory action, one catastrophic bug, one governance change you don’t control—and suddenly your entire business model is at risk.

Plasma gives Tether optionality. Alternative rails. Insurance against dependency on chains they don’t control.

But from the outside? That concentration is concerning. When your biggest investor is also your biggest user and probably has significant governance influence, who actually controls this network?

Plasma markets itself with typical blockchain decentralization rhetoric. But the reality looks more like a consortium of institutional players running infrastructure for mutual benefit. That’s not necessarily bad—it might actually be perfect for payment infrastructure that needs reliability over theoretical decentralization.

I just wish they’d say that instead of pretending to be something they’re not.

The Geographic Play Nobody Appreciates

Here’s where Plasma actually gets interesting. While most crypto projects are chasing US retail traders and European DeFi users, Plasma went to Africa, Southeast Asia, Latin America—places where traditional banking infrastructure barely functions.

Their partners aren’t slick Silicon Valley startups. They’re companies like Yellow Card operating across Africa, WalaPay serving underbanked regions, payment processors in markets where remittance fees are still 8% and settlement takes four days.

This is where zero fees stop being a marketing gimmick and become genuinely essential. If you’re sending $50 home to family in the Philippines, a $2 transaction fee is a 4% tax. Zero fees make the entire use case economically viable in ways traditional crypto never could.

The 1.4 billion unbanked people globally don’t need another way to speculate on coins. They need protection against local currency devalation. They need to send money home without Western Union taking 10%. They need payment infrastructure that works when banks won’t serve them.

Plasma is actually trying to solve that problem. Not as charity—there’s real business opportunity in emerging market payments once you get the economics right—but as the core use case.

And honestly? That’s more valuable than 99% of DeFi protocols that just help crypto-rich people get slightly richer.

But it also means navigating regulatory complexity most chains never touch. Processing payments in 100+ countries means 100+ different legal frameworks, compliance requirements, and political risks. One hostile government action in a major market and the whole “global payment network” promise fragments.

The Interoperability Problem Is Real

I need to be honest about Plasma’s biggest weakness. It’s an island.

Plasma moves stablecoins brilliantly within its ecosystem. But moving money between Plasma and literally anywhere else? That requires bridges. And bridges are where crypto goes to die.

Every major hack you’ve heard about—Ronin Bridge ($600M), Wormhole ($320M), Nomad ($200M)—these weren’t the blockchains getting hacked. They were the bridges connecting them.

Plasma can’t fix this. Bridge security operates outside their architecture. So you end up with this weird situation where Plasma is incredibly secure internally, but accessing it requires trusting bridge code that’s historically been catastrophically vulnerable.

For pure payment use cases, maybe this doesn’t matter. If money comes in, circulates, and goes out all within Plasma’s ecosystem, you never touch a bridge. But building that kind of contained economic loop is incredibly hard. You need merchants accepting Plasma-based stablecoins, employees getting paid in them, services priced in them—basically a parallel economy.

That’s a much higher bar than just being fast and cheap.

And if users constantly need to bridge elsewhere for DeFi opportunities or different services, the interoperability friction destroys Plasma’s performance advantages. You’re back to slow, expensive, risky infrastructure the moment you leave the ecosystem.

I don’t have an answer for this. Neither does Plasma, apparently.

The Regulatory Time Bomb

Okay, real talk. The biggest risk to Plasma isn’t technical. It’s that regulators in 100+ countries haven’t decided what stablecoins are or whether cross-border stablecoin payments are legal.

Right now, Plasma is building infrastructure in a regulatory vacuum. That’s either brilliant timing or catastrophic depending on how the next 24 months play out.

Scott Bessent says he wants stablecoins defending dollar dominance. Great for Plasma. The CFTC is investigating stablecoin issuers. Less great. Europe has MiCA requiring licensing. Definitely complicated. Some countries might just ban the whole thing.

The bet Plasma’s making is infrastructure-first, compliance-second. Build the rails now, figure out regulations later. That’s the same gamble Uber made. Sometimes you win and regulations adapt around you. Sometimes you get shut down.

What worries me is fragmentation. If European regulations require protocol-level KYC but Southeast Asian markets reject that, does Plasma fork into regional versions? Does it implement geographic restrictions that defeat the entire borderless payment promise?

Traditional payment networks solved this through centralization—Visa complies jurisdiction by jurisdiction with different rules. Blockchain infrastructure is supposed to be different, but delivering on that promise while satisfying vastly different legal systems worldwide might be impossible.

And here’s the thing: Plasma’s institutional backing means they can’t just ignore regulations and hope decentralization protects them. Bitfinex and Tether have their names attached. They have assets governments can freeze, licenses governments can revoke, executives governments can prosecute.

This isn’t some anonymous DeFi protocol running on IPFS. This is financial infrastructure that will eventually need licenses, compliance teams, and legal strategies in every major market.

The technology might be ready. The regulatory environment definitely isn’t.

What I Actually Think

Look, I’m not trying to FUD Plasma. If anything, I think they’re building something genuinely useful in a sea of crypto projects solving problems nobody has.

But I also think there’s a huge gap between their public messaging and operational reality. The validator economics aren’t explained. The regulatory strategy is unclear. The multi-stablecoin approach might fragment rather than strengthen the network. The interoperability challenges are brushed aside.

These aren’t necessarily dealbreakers. They’re just things I wish someone from Plasma would address directly instead of repeating generic blockchain talking points.

The honest assessment? Plasma is probably the best infrastructure available for moving stablecoins in emerging markets. That’s valuable. That’s needed. That might be worth billions.

But “best available infrastructure for a specific use case” is different from “revolutionary payment network disrupting global finance.” The first is achievable and probably sustainable. The second requires solving regulatory, interoperability, and network effect problems that have nothing to do with transaction throughput.

I’m watching Plasma because they’re building something real rather than something speculative. But I’m also watching with skepticism because the questions they’re not answering are more important than the features they’re promoting.

The Bottom Line

If you’re building a payment app serving emerging markets, Plasma might be perfect. If you’re looking for composable DeFi infrastructure, look elsewhere. If you’re trying to understand whether purpose-built payment chains are the future of stablecoins, Plasma is the test case we’re all watching.

Just don’t expect them to explain their business model clearly anytime soon. Some things are apparently better left unsaid in crypto. Even when saying them might actually make the project more credible.

That’s my take. Make of it what you will.