When I think about Plasma, I don’t frame it as a blockchain that happens to support stablecoins. I frame it as a settlement system that happens to use a blockchain. That distinction matters to me because it immediately shifts how I judge its design choices. Instead of asking whether it is expressive, flexible, or innovative in the abstract, I find myself asking a more mundane question: does this feel like something that could quietly sit underneath real economic activity without demanding attention? The more time I spend with Plasma, the more it feels like it is trying to answer that question directly, without theatrics.

What stands out early is how clearly the project seems to observe actual user behavior. Most people who rely on stablecoins are not exploring ecosystems or experimenting with composability. They are moving value. They are paying, settling, remitting, or holding something that behaves predictably across borders and time zones. The data implied by Plasma’s focus points toward users who care about speed, certainty, and familiarity more than novelty. Sub-second finality is not framed as a performance metric here, but as a way to reduce the uncomfortable pause that exists between intent and confirmation. For everyday users, that pause is not a technical delay. It is a moment of doubt.

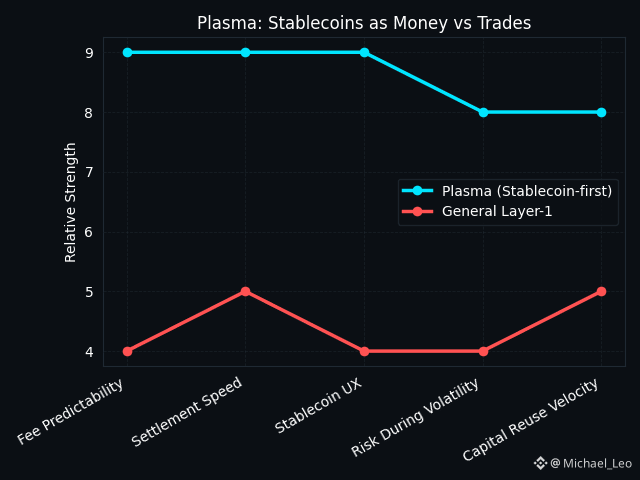

Many of Plasma’s product decisions read to me as deliberate attempts to remove small but cumulative sources of friction. Gasless USDT transfers, for example, are not an ideological statement about abstraction. They are a practical acknowledgement that asking a user to hold, manage, and understand a second asset just to move a dollar-denominated balance is a tax on adoption. Stablecoin-first gas follows the same logic. It aligns the unit of cost with the unit of value the user already trusts. This does not make the system simpler internally, but it makes it simpler where it matters, which is at the point of use.

What I appreciate most is how little Plasma seems interested in celebrating its own complexity. Full EVM compatibility via Reth and a custom consensus mechanism with PlasmaBFT are not exposed as selling points for users to admire. They function quietly in the background, supporting familiar tooling and fast settlement without asking the user to learn new mental models. Complexity exists, but it is contained. The system absorbs it so the user does not have to. That choice feels intentional, and it feels respectful of the reality that most people do not want to become infrastructure experts to move money reliably.

What I appreciate most is how little Plasma seems interested in celebrating its own complexity. Full EVM compatibility via Reth and a custom consensus mechanism with PlasmaBFT are not exposed as selling points for users to admire. They function quietly in the background, supporting familiar tooling and fast settlement without asking the user to learn new mental models. Complexity exists, but it is contained. The system absorbs it so the user does not have to. That choice feels intentional, and it feels respectful of the reality that most people do not want to become infrastructure experts to move money reliably.

There are also components that I view with cautious curiosity rather than blind enthusiasm. The idea of anchoring security to Bitcoin as a neutrality and censorship-resistance layer is ambitious, not because it is flashy, but because it introduces a long-term external reference point for trust. If executed carefully, it could provide a form of assurance that does not rely solely on internal governance or social consensus. At the same time, it adds architectural weight and coordination challenges. I don’t see this as a guaranteed advantage, but I do see it as a thoughtful attempt to ground the system in something broadly recognized and difficult to manipulate.

When I imagine real applications on Plasma, I don’t picture demo dashboards or promotional use cases. I think about stress tests. High-volume retail payments in regions where stablecoins already function as daily financial tools. Institutional settlement flows where predictability and finality matter more than expressiveness. These environments are unforgiving. They expose weaknesses quickly. A system either keeps working under load and ambiguity, or it doesn’t. Plasma appears to be designed with the expectation that it will be judged by these conditions, not by how compelling it sounds in theory.

The token, in this context, feels less like an object of attention and more like a piece of connective tissue. Its role is to support usage, align incentives, and keep the system operational in everyday conditions. I don’t find much value in discussing it outside of that frame. If the infrastructure works as intended, the token’s purpose becomes almost invisible, which is often a sign that it is doing its job.

The token, in this context, feels less like an object of attention and more like a piece of connective tissue. Its role is to support usage, align incentives, and keep the system operational in everyday conditions. I don’t find much value in discussing it outside of that frame. If the infrastructure works as intended, the token’s purpose becomes almost invisible, which is often a sign that it is doing its job.

Stepping back, what Plasma signals to me is a quiet shift in how consumer-focused blockchain infrastructure is being approached. There is less interest here in persuasion and more interest in accommodation. Less emphasis on teaching users why the system is elegant, and more emphasis on making sure it does not get in their way. If this approach continues to mature, it suggests a future where blockchains earn relevance not by being noticed, but by being relied upon. For someone who values systems that work over systems that impress, that direction feels both realistic and overdue.