💵 Stablecoins Are No Longer an Experiment

Stablecoins have quietly become the most widely used financial instrument in crypto.

They now settle billions of dollars every day across:

🔁 Exchanges

🌍 Remittance corridors

🏪 Payment providers

⛓️ On-chain protocols

In many regions, stablecoins already function as money.

Yet most blockchains still treat stablecoin transfers as a side effect of general activity.

@Plasma does not.

🧱 Plasma’s Core Design Choice

Plasma is a Layer 1 blockchain built specifically for stablecoin settlement.

Not for:

❌ NFTs

❌ Memecoin speculation

❌ Congestion-heavy DeFi experiments

That single design decision changes everything.

🧠 The Hidden Cost of General-Purpose Blockchains

Most chains optimize for:

🔗 Composability

🧪 Experimentation

📦 Maximum app diversity

Powerful traits — but they come at a cost.

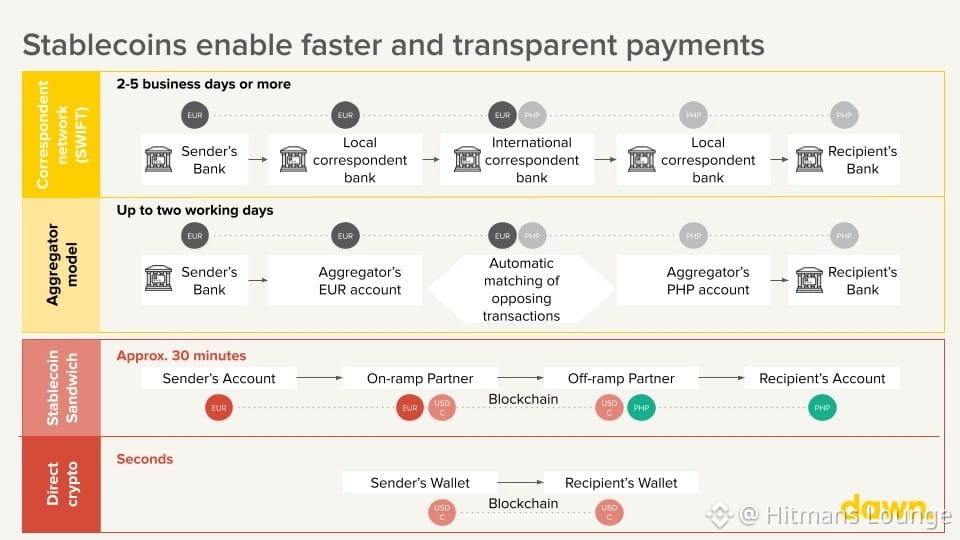

Payments need something different:

✅ Predictable fees

✅ Deterministic settlement

✅ Minimal friction

✅ Operational neutrality

When stablecoin transfers compete with:

🤖 Arbitrage bots

⚡ Liquidations

🖼️ NFT mints

🎯 MEV strategies

The outcome is inevitable:

📈 Fees spike

⏳ Confirmation times fluctuate

😵 User experience collapses

This volatility may be acceptable for traders.

It is unacceptable for people sending salaries, paying merchants, or protecting savings.

Plasma removes this competition entirely.

🪙 Stablecoins as First-Class Citizens

On Plasma, stablecoins are not an afterthought.

They are the primary unit of interaction.

This shows up everywhere:

💸 Gasless USDT transfers

⚙️ Stablecoin-first gas mechanics

📱 UX built for payment flows, not trading terminals

Users don’t need to buy volatile assets just to move value.

They transact in the same currency they already trust.

This is the difference between:

🎰 Speculative infrastructure

🏦 Settlement infrastructure

🌍 Who Plasma Is Actually Built For

Plasma focuses on users often ignored by crypto narratives:

👤 Retail Users in High-Adoption Regions

🌍 Remittances

🛒 Everyday payments

🛡️ Savings preservation

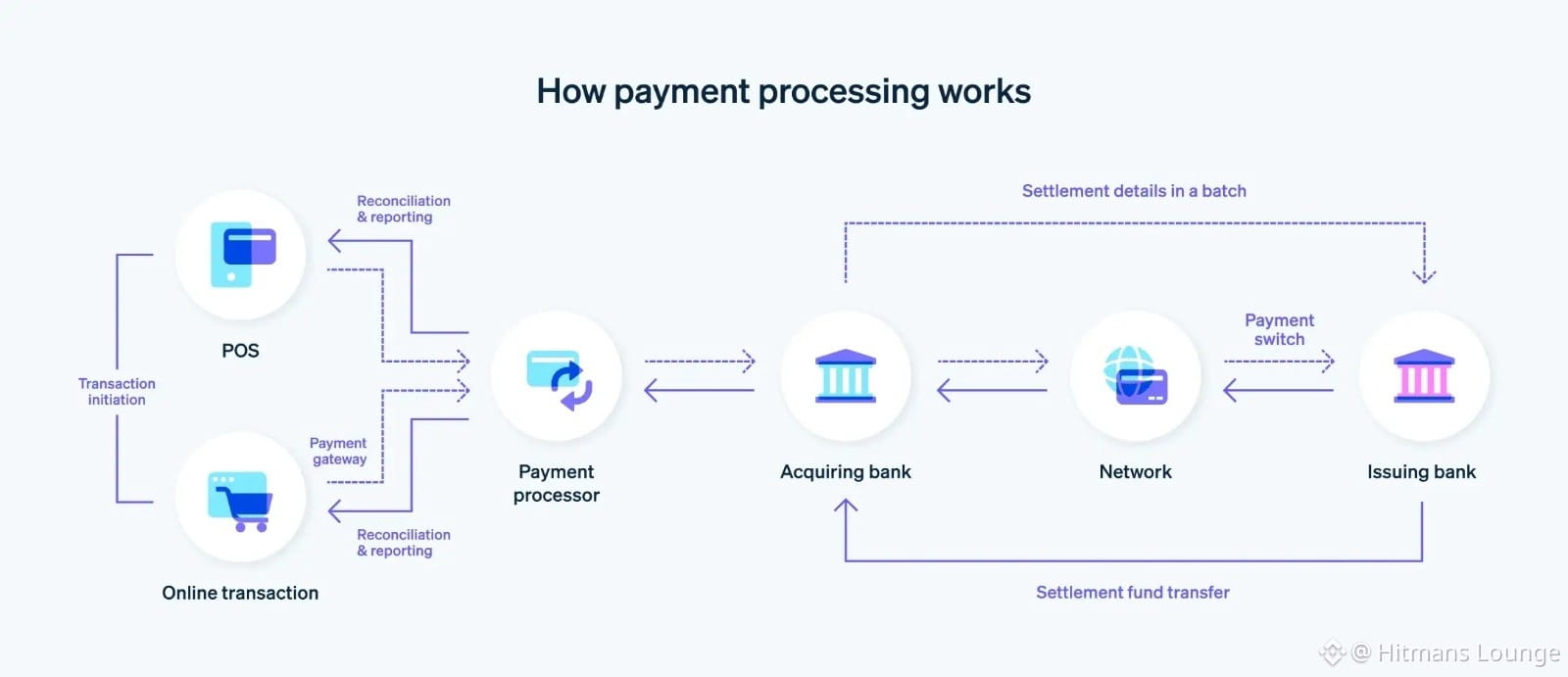

🏢 Institutions Running Financial Rails

🏦 Settlement providers

💳 Payment processors

🏗️ Financial infrastructure companies

Both groups value reliability over flexibility.

🧠 Comments

Stablecoins are not apps.

They are financial infrastructure.

Blockchains built for everything will struggle to serve them at scale.

Blockchains built for settlement will quietly become indispensable.

$XPL belongs to the second category.

🔖 Article Hashtags

#Plasma #StablecoinSettlement #CryptoPayments #USDT #BlockchainInfrastructure 🚀