Success in trading stocks or cryptocurrencies rarely comes down solely to charts, news, or economic data. More often, it depends on how well you manage the inner workings of your own mind. Human psychology drives much of market behavior, turning rational analysis into emotional reactions that can either build wealth or destroy it. In traditional stock markets, where companies have earnings, dividends, and historical performance to anchor decisions, emotions still create bubbles and crashes. Cryptocurrencies intensify these dynamics with round-the-clock access, extreme price swings, social media influence, and limited fundamental anchors, making psychological control even more critical for consistent gains.

Core Emotional Drivers in Trading

Two primary forces—fear and greed—underpin most trading mistakes. Greed fuels the urge to buy more as prices climb, often leading people to enter positions at inflated levels in pursuit of quick riches. Fear, on the other hand, prompts selling during downturns, frequently at the worst possible moments, turning temporary setbacks into realized losses. These emotions explain why many exit winning trades prematurely while clinging to losers in hopes of recovery.

In stocks, fear might surface during broad economic uncertainty, causing widespread sell-offs. In crypto, the same fear can trigger cascading liquidations in leveraged positions, amplifying drops. Greed appears in both but shines brighter in crypto during hype cycles, where stories of overnight millionaires push participants to ignore risks.

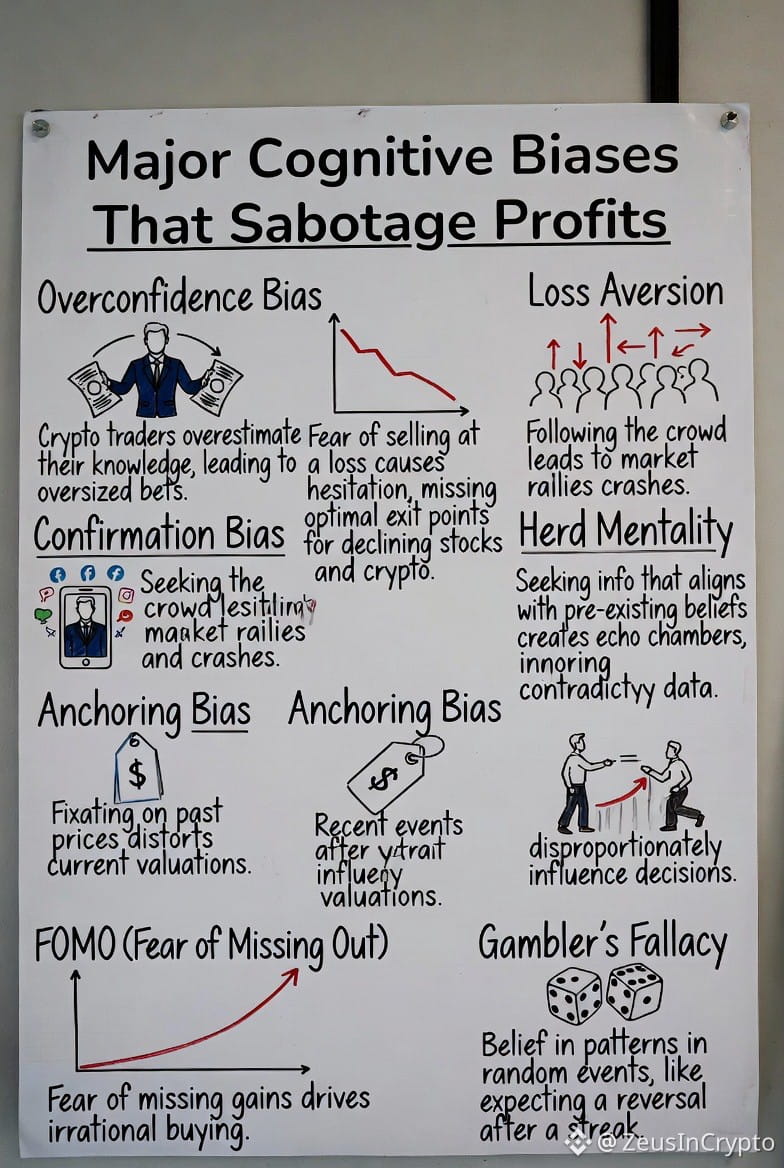

Major Cognitive Biases That Sabotage Profits

Our brains use mental shortcuts that work well in everyday life but frequently backfire in markets.

Overconfidence leads traders to believe they possess superior insight or timing ability. After a few winning trades, many increase risks dramatically, convinced their success stems from skill rather than luck. This bias appears strongly in crypto among newer participants who overestimate their grasp of volatile assets, resulting in oversized bets and frequent wipeouts.

Loss aversion describes the tendency to experience the sting of losses far more intensely than the joy of equivalent gains. Traders often hold declining positions longer than logic dictates, avoiding the pain of admitting a mistake, while cashing out winners too soon to secure profits. This pattern shows up in stocks through the "disposition effect" and in crypto during sharp corrections, where holders refuse to sell despite deteriorating conditions.

Confirmation bias causes people to favor information supporting their views and dismiss anything contradictory. A bullish stock investor might highlight positive analyst reports while downplaying competitive threats. In crypto communities, this manifests as echo chambers on social platforms, where enthusiastic posts reinforce beliefs in a token's potential without balanced scrutiny.

Herd mentality drives participants to follow the crowd, assuming collective wisdom prevails. It creates explosive rallies when everyone piles in and brutal crashes when panic spreads. Stocks see this in momentum-driven sectors; crypto experiences it more dramatically through viral trends and influencer endorsements that spark massive inflows followed by sharp reversals.

Anchoring occurs when an initial price or reference point overly influences judgments. Traders fixate on a past high for a stock or crypto, refusing to sell below it even as circumstances change. Recency bias prioritizes the latest events, leading to expectations that short-term trends will persist indefinitely—buying aggressively after a rally or selling everything after a dip.

Crypto-specific amplifiers include intense FOMO (fear of missing out), where rising prices create urgency to join before it's "too late," and the gambler's fallacy, believing a string of losses signals an impending win. These thrive in the always-on, high-stakes environment of digital assets.

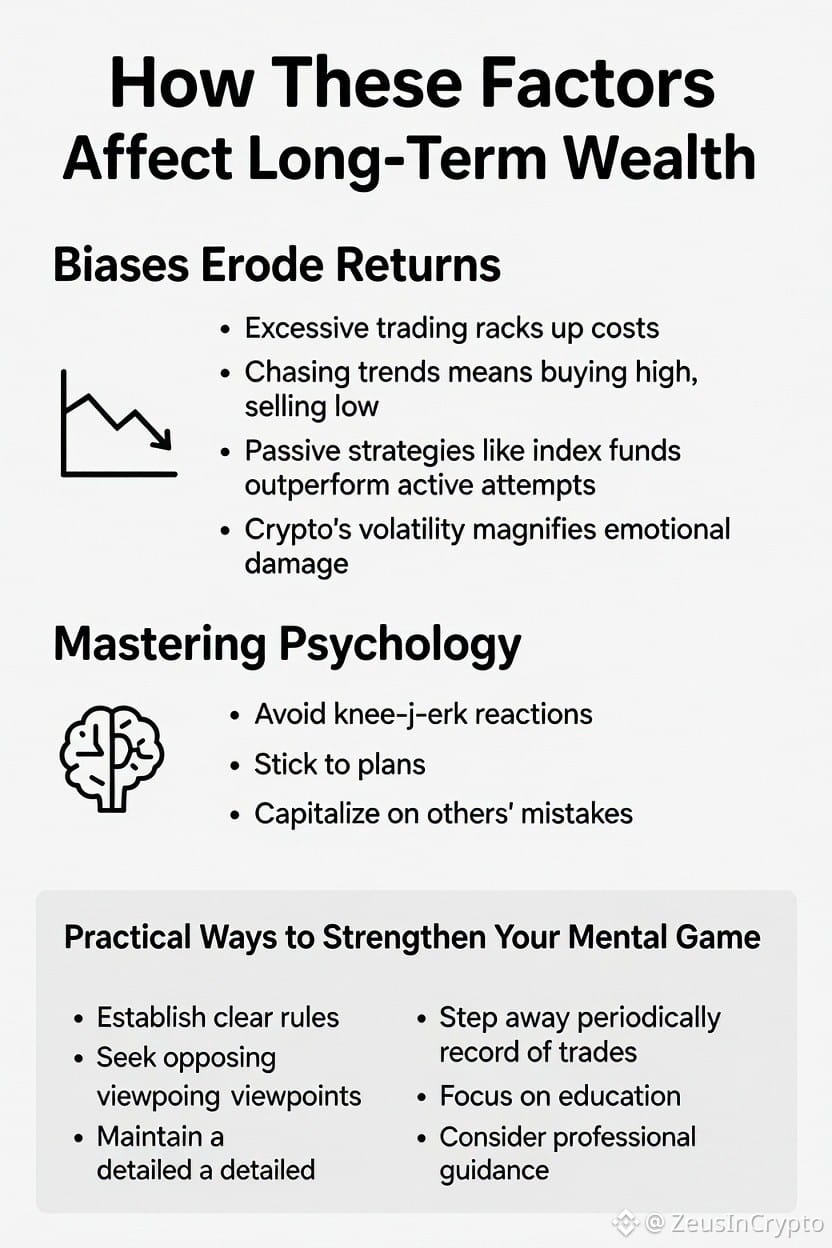

How These Factors Affect Long-Term Wealth

Biases erode returns by encouraging excessive trading, poor timing, and unnecessary risks. Frequent buying and selling rack up costs while chasing trends often means buying high and selling low. In stocks, passive strategies like index funds frequently outperform active attempts riddled with emotional errors. Crypto's volatility magnifies the damage—emotional decisions during swings can lead to devastating drawdowns or missed recoveries.

Those who master their psychology, however, gain an edge. Disciplined participants avoid knee-jerk reactions, stick to plans, and capitalize on others' predictable

Practical Ways to Strengthen Your Mental Game

Building mental resilience requires deliberate habits:

- Establish clear rules beforehand, such as position limits, stop-loss triggers, and profit targets, to remove emotion from execution.

- Seek opposing viewpoints actively before committing capital, challenging assumptions and reducing confirmation traps.

- Maintain a detailed record of trades, including rationale and outcomes, to spot recurring patterns like overconfidence or herd following.

- Step away periodically, especially in crypto's nonstop market, to prevent burnout and impulsive moves driven by constant monitoring.

- Focus on education about market realities, including volatility and uncertainty, which tempers unrealistic expectations and curbs FOMO.

- Consider professional guidance or objective accountability to counter personal blind spots.

In both stocks and crypto, patience and rationality pay off more than clever timing or hot tips. Markets reward those who control impulses over those who follow them.

Ultimately, profiting consistently means winning the battle within. By acknowledging these psychological forces and implementing safeguards, you transform trading from an emotional gamble into a more deliberate pursuit of sustainable gains. Start by examining your own tendencies—the market won't change, but your approach can.