BTC bounced from the $80.7–83.4k zone, but the market remains fragile. Bulls defended support, and futures hint at a potential liquidity squeeze toward $93.5k — but this is not the start of a major move.

🧊 The core issue is liquidity

Glassnode is explicit: without liquidity inflows, rallies don’t last.

The key metric is the realized P/L ratio (90D).

All sustainable rallies in recent years only began once it held above 5. Right now — it doesn’t.

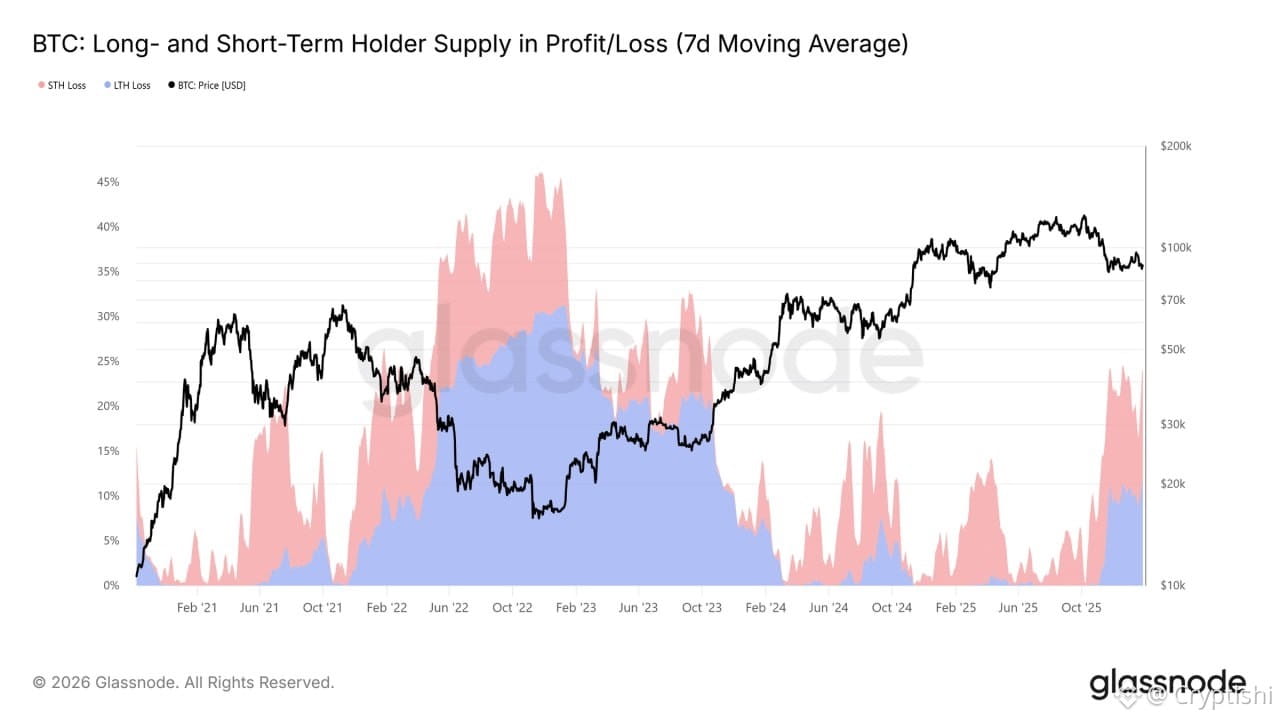

📉 Pressure beneath the surface

— Over 22% of BTC supply is at a loss

— Similar levels were seen in 2018 and 2022

— The market is nervous: a support break risks a chain reaction

If BTC loses key levels (STH cost basis and true market mean), even long-term holders could start reacting.

🏦 No sellers — for now

According to CryptoQuant:

— BTC inflows to Binance ≈ 5.7k BTC per month

— That’s 2× below normal and the lowest since 2020

Low inflows mean investors are holding, not preparing to sell. This reduces dump risk but does not replace liquidity.

🧠 Bottom line

The market isn’t bearish — it’s empty.

Without fresh capital, every pump looks the same:

fast up → exhaustion → back into range.

📌 Conclusion

Until liquidity returns, Bitcoin is stuck with short bursts, not trends. The real move won’t start with a candle — it will start with on-chain numbers.

$BTC