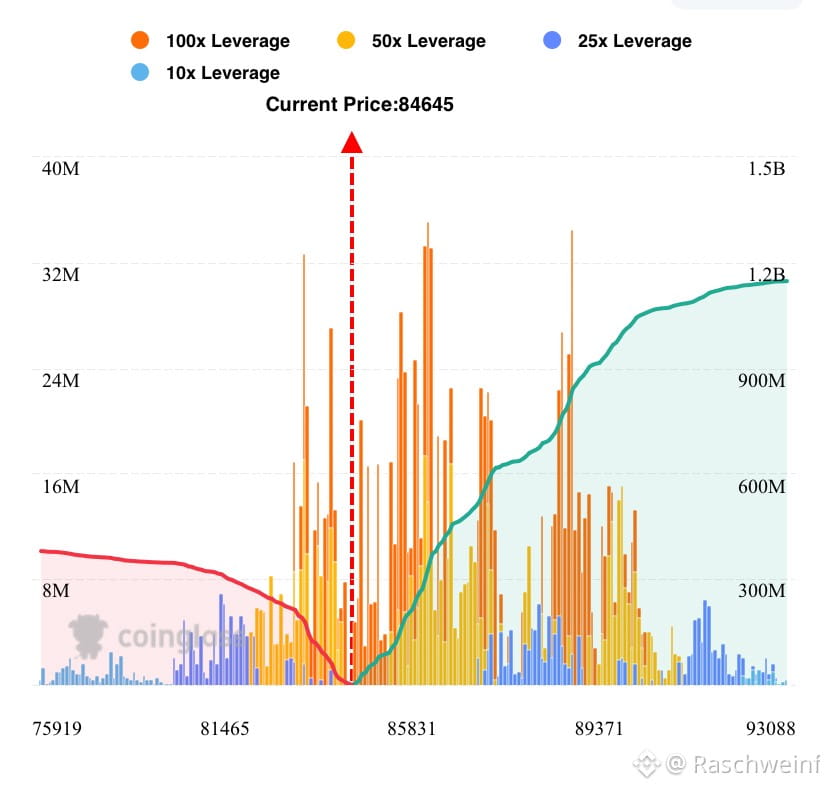

Based on my analysis, the price is currently showing strong momentum. The monthly resistance level has been successfully broken, and price is now trading around the 83K area, indicating that the bullish structure remains intact.

From a projection standpoint, the price is expected to continue its upward move toward the 86K level in the near term, as long as market sentiment stays positive and no significant selling pressure emerges. This zone serves as the next upside target before the market potentially enters a corrective phase.

After reaching this area, a technical correction is likely, with the 76K–74K range acting as a healthy retracement zone within the broader bullish trend. This area will be critical in determining whether buyers are still strong enough to defend the upward structure.

If the market lacks strong positive news or supportive fundamental catalysts, selling pressure could extend further. In this scenario, the price may decline toward the 54K level, which represents the next major correction target and a key support zone.

The 54K area will be a decisive level, determining whether the market can stabilize and continue its medium-term bullish trend, or instead transition into a prolonged consolidation phase—or even shift toward a bearish structure.

Conclusion

The short- to medium-term trend remains bullish, with an upside target toward 86K. However, traders and investors should remain cautious, as a corrective move is still likely if the market loses positive momentum and supporting catalysts.