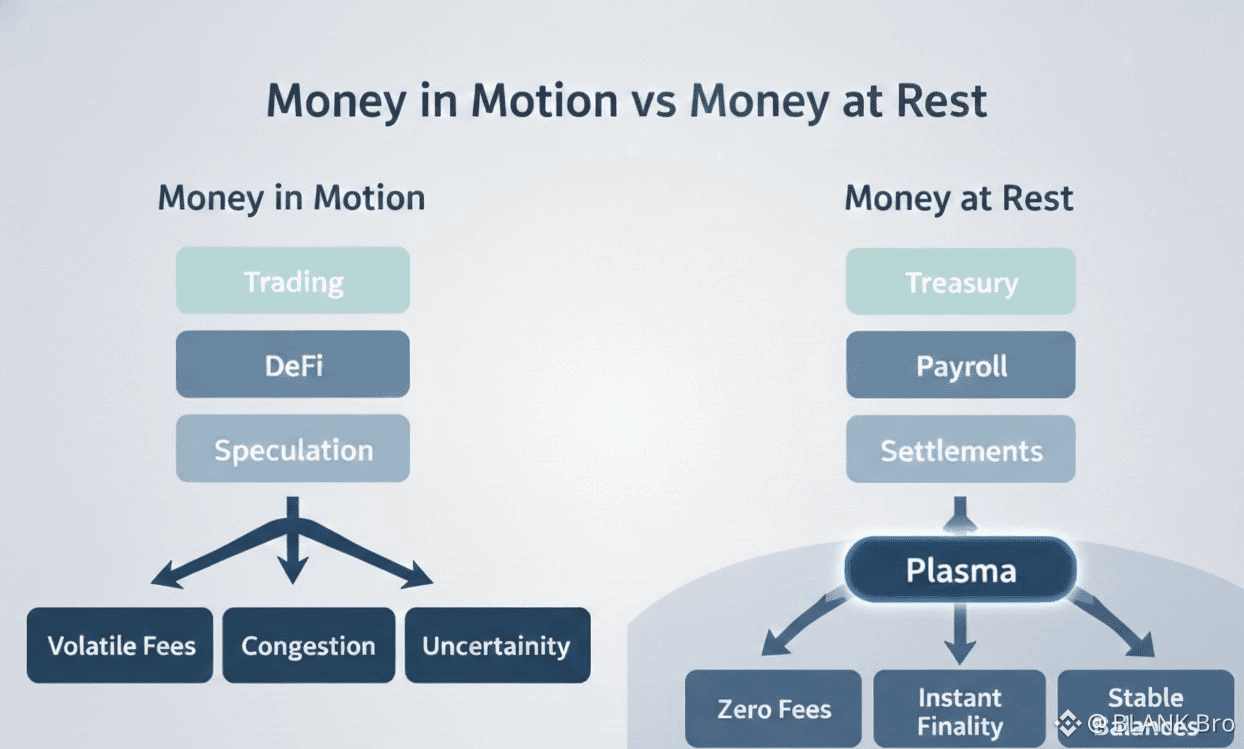

Most blockchain discussions obsess over motion — faster transactions, higher throughput, and more on-chain activity. But Plasma introduces a more meaningful financial question: why does money not move? Instead of optimizing for constant flow, Plasma studies financial stillness — the reality that most money spends its time sitting idle.

In real financial systems, the majority of money resides in corporate treasuries, payroll reserves, settlement buffers, merchant balances, savings pools, and liquidity backstops. Banks, accounting platforms, and payment processors are designed around this principle. Yet most crypto networks ignore this reality, treating every participant as a trader rather than a financial operator. Plasma stands out by building infrastructure optimized for financial stability, predictability, and institutional-grade reliability rather than speculation.

Traditional blockchains assume every user is chasing market activity. This creates volatile fee markets, unpredictable congestion, probabilistic finality, and settlement uncertainty — conditions that work for traders but fail businesses, auditors, payroll teams, and financial controllers who require certainty. Plasma flips this model by treating users as balance-sheet managers, not gamblers. Its mission is not to fuel market hype, but to make money boring again — predictable, dependable, auditable, and boring in the best possible way.

A single design shift changes everything. Plasma decouples economic activity from economic risk, meaning higher usage does not translate into rising costs, congestion stress, or settlement uncertainty. On most blockchains, activity increases risk — more transactions mean more fees, more competition for block space, and more volatility in execution costs. Plasma eliminates this coupling.

With zero-fee stablecoin transfers, transaction volume never distorts operational expenses. This ensures businesses can forecast costs accurately — something impossible on conventional networks. PlasmaBFT finality guarantees that once a transaction is confirmed, it is final instantly — no chain reorganizations, no waiting periods, no probabilistic settlement. This is critical for payroll systems, vendor payments, treasury settlements, and regulatory reporting.

This stability is not theoretical — it solves real business problems. A payroll system should never have to explain to employees that payment fees increased due to network congestion. Accounting teams cannot justify fluctuating settlement costs to auditors or regulators. Plasma removes this friction, enabling financial operations to behave like real infrastructure rather than experimental technology.

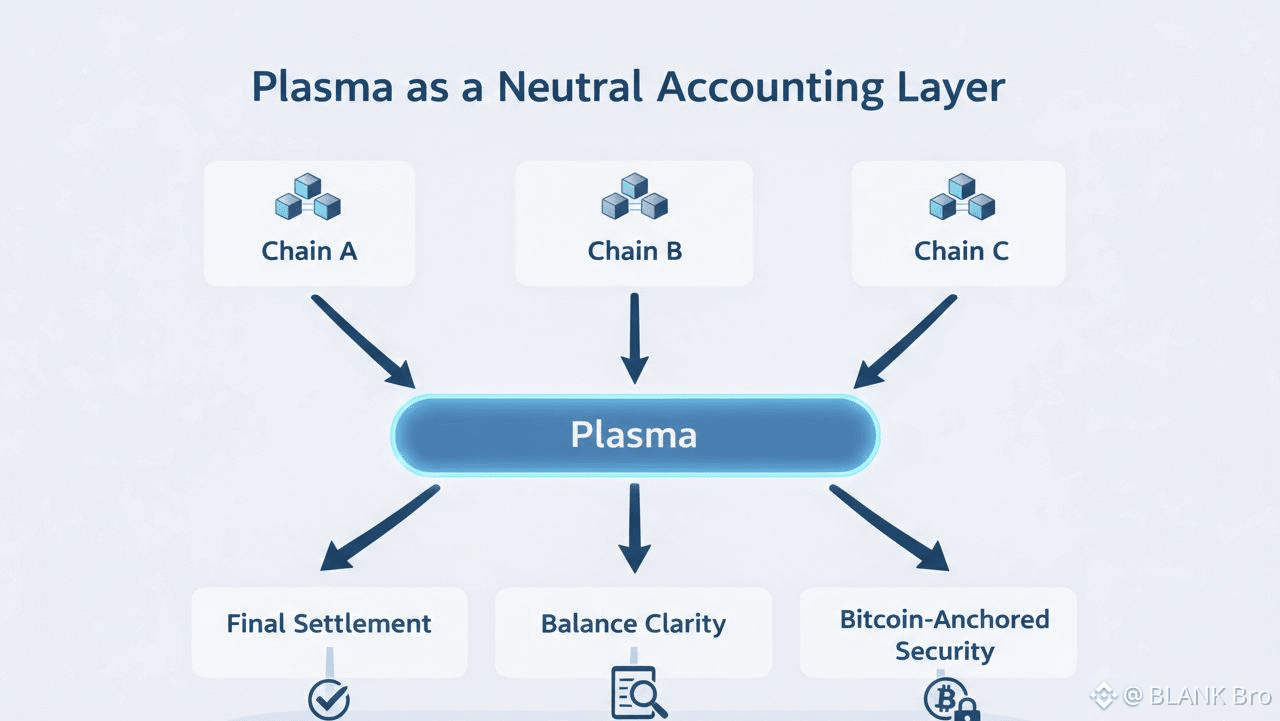

Another underappreciated strength of Plasma is its role as a neutral accounting and settlement layer across blockchains. Instead of competing to host every application, Plasma acts as a stable financial backbone — similar to a clearinghouse in traditional finance. Assets may live on different chains, but balances, records, and settlements can remain legible, verifiable, and stable on Plasma. This positions Plasma as infrastructure rather than an application platform.

Security is also approached differently. Plasma borrows credibility instead of trying to manufacture it, anchoring trust to Bitcoin’s proven security model. While Bitcoin is not optimized for speed or programmability, it remains the most trusted settlement layer in crypto. Plasma builds atop that trust while delivering efficient, low-friction financial operations underneath. This separation of trust at the base layer and efficiency at the execution layer is rare in crypto — and powerful.

Privacy within Plasma is designed for financial realism, not secrecy theater. Businesses do not want every internal transfer, payroll entry, or vendor payment broadcast publicly. Plasma enables confidential by default financial activity, while still allowing verification where required. This aligns with compliance, auditing, and regulatory realities — rather than fighting them.

Another subtle but transformative advantage is cognitive simplicity. Most blockchains force users to constantly think about gas fees, confirmation times, bridges, liquidity fragmentation, wallet routing, and network congestion. Plasma removes these mental burdens. When systems stop demanding attention, adoption becomes organic. People trust infrastructure that just works without needing constant monitoring.

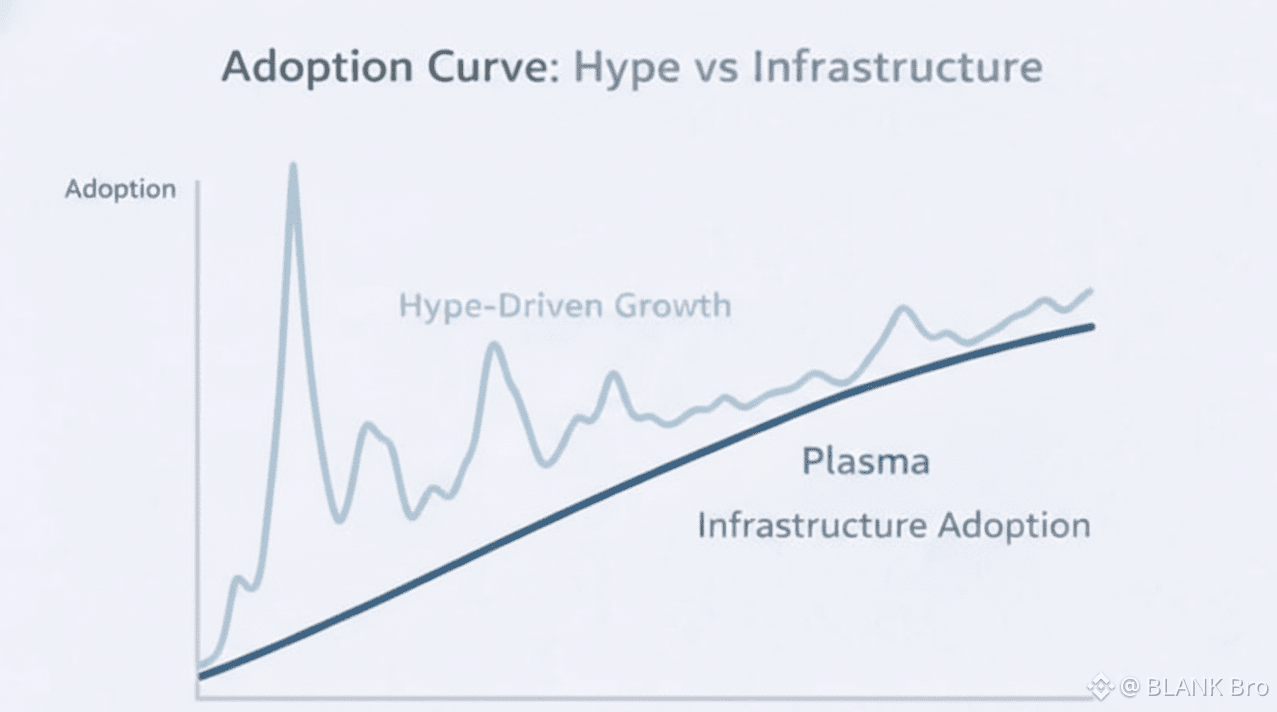

This creates a fundamentally different adoption curve. Plasma grows through silent integration, not loud marketing or speculative incentives. Treasury teams integrate it. Payroll systems adopt it. Enterprises build recurring workflows on it. Growth may appear slower than viral DeFi platforms, but it is stickier, more durable, and structurally sustainable.

Decentralization in Plasma is also redefined. Instead of decentralizing every application layer, Plasma decentralizes financial truth — balances, settlements, and records remain neutral, verifiable, and tamper-resistant. Applications remain flexible on top, much like how the internet decentralizes protocols while allowing centralized and decentralized services to coexist.

Resilience is another overlooked pillar. Plasma is designed to thrive during long low-activity periods. It does not depend on speculative trading volume to maintain security or value. When market hype fades — Plasma continues operating. When speculation dries up — Plasma remains relevant. This makes it anti-fragile during market downturns, unlike many crypto ecosystems tied to hype cycles.

In many ways, Plasma represents a maturation phase for crypto. It acknowledges that endless growth metrics are not the only measure of value. Trust, predictability, silence, and long-term reliability are themselves forms of value — especially in financial infrastructure. While much of the crypto market chases narratives, Plasma focuses on building something that can last decades.

Plasma does not attempt to overthrow banks overnight. Instead, it quietly replaces inefficient components — reducing fees, improving finality, simplifying accounting, and removing friction. Over time, expectations shift. When people experience money that simply works — everything else starts to feel broken.

This is why Plasma cannot be compared to high-performance Layer-1 chains or DeFi ecosystems. It is not chasing application dominance or scaling hype. Plasma is financial infrastructure built for long-term durability — predictable, explainable, verifiable, and engineered to survive generations of financial evolution.

Making money boring again may be crypto’s most radical innovation.