$XPL is moving into a new chapter. Not the early stage where people ask “what is this?” Not the speculation wave either. This is the phase where a blockchain begins to behave like actual infrastructure.

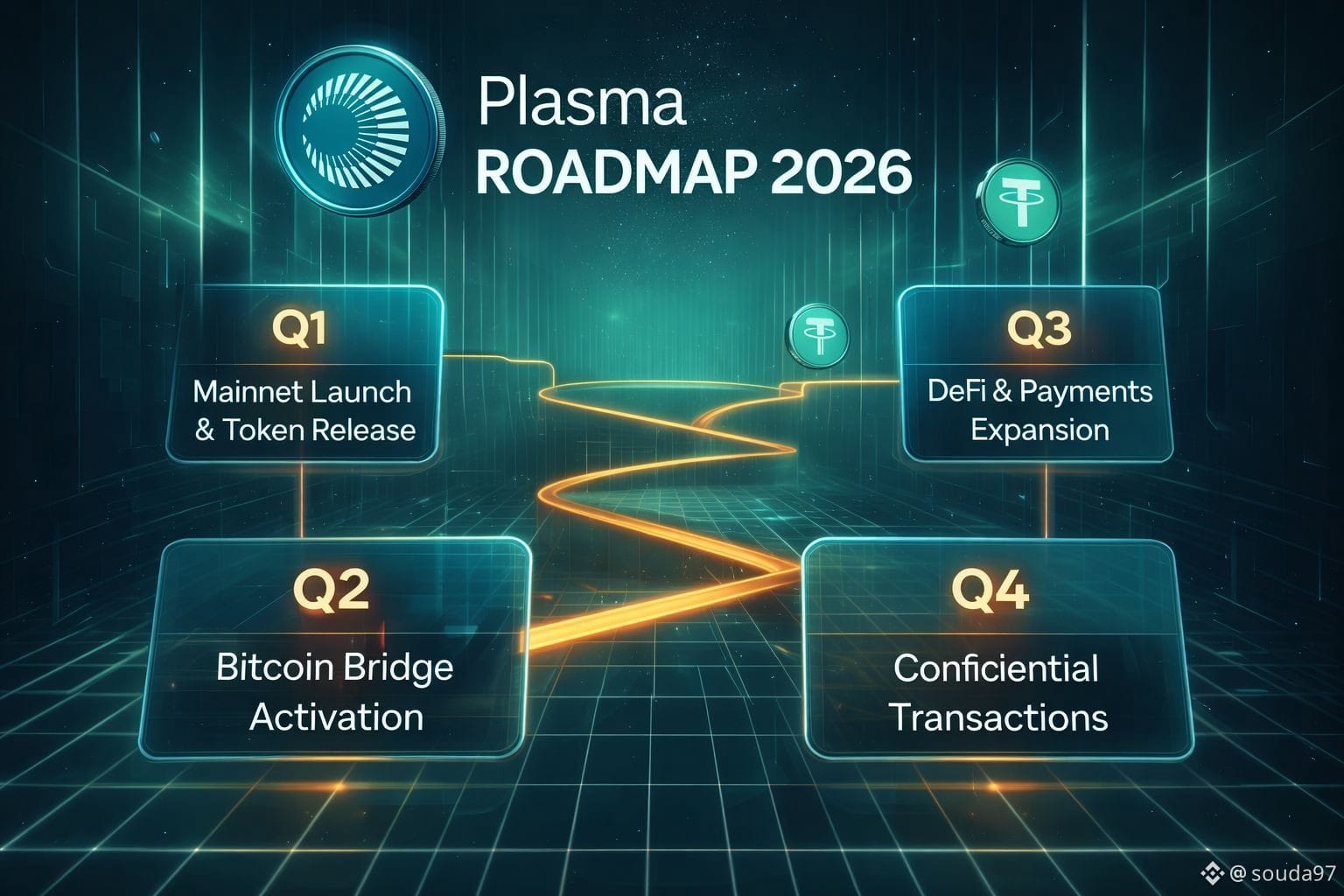

Publishing a roadmap is standard for any project.

But a roadmap supported by integrations, liquidity layers, and real payment connections is something else entirely.

That is where Plasma seems to be heading.

Instead of staying in the world of ideas, Plasma is outlining how it transitions from a concept into a functioning system. A system where stablecoins, lending, cards, and privacy are not separate pieces but parts of one machine.

To me, this is the line between experimental chains and serious networks.

Most blockchains begin with technology.

Only a few mature into utility.

Plasma’s direction centers on three long-term foundations:

• Deep on-chain finance

• Movement of money beyond crypto

• Strong developer and user experience

Together, those elements carry real weight.

Starting with DeFi.

When lending infrastructure launches through platforms like Superlend, and when major protocols such as Aave extend into a chain, it signals confidence. Capital is selective. It flows where it can be productive, not idle.

A lending layer acts as financial scaffolding. It lets users borrow, leverage, hedge, and construct strategies. It may not grab headlines, but it is structural. That forms one pillar of an ecosystem.

Now payments.

Bringing in stablecoin card infrastructure like Rain shifts the story. Moving assets within crypto is one step. Connecting those assets to everyday economic activity is another level entirely.

Cards, fiat on-ramps, and off-ramps link blockchains with merchants, businesses, and users outside the crypto bubble. Without these bridges, value circulates in a closed loop.

Plasma appears focused on breaking that boundary.

That suggests the target is not only DeFi participants.

The aim is practical financial usage.

This is where #Plasma begins to resemble a money network rather than just another Layer 1.

Then comes privacy and performance.

It often receives less attention, yet payments without privacy are incomplete. Businesses, institutions, and individuals rarely want permanent public exposure of every transaction.

Plasma’s attention to confidential transactions and performance upgrades reflects an understanding that usability is essential.

Speed alone is not enough.

Low fees alone are not enough.

Reliability and privacy are what open the door to adoption.

Bringing this back to XPL.

XPL is more than a tradable token. It functions as the coordination layer of the network. It supports validators, aligns incentives, and sits beneath everything operating on Plasma.

As lending, payments, and applications expand, the relevance of XPL increases alongside network activity.

From my perspective, this is where narratives shift.

Early phase: “What is it?”

Middle phase: “Does it function?”

Later phase: “Can it be trusted?”

Plasma seems to be moving from the second stage into the third. And that transition is where ecosystems truly take shape.

This does not look like a short-term cycle to me.

It looks like a network working to earn long-term relevance.

Not through noise.

Through construction.

In crypto, the builders who stay focused often end up being heard the loudest in the end.