The crypto market just hit a massive speed bump. In a sudden wave of volatility, over $1.1 billion in positions were liquidated (wiped out) across the futures market.

What actually happened?

This wasn't a case of everyone selling their coins in a panic. Instead, it was a "leverage flush."

The Gamblers vs. The Holders: Traders were betting heavily with borrowed money (leverage) that prices would go up. When prices dipped slightly, those bets were forcibly closed by exchanges.

The Good News: The "Spot" market (people who actually own and hold the coins) remained calm. This tells us the crash was technical, not fundamental.

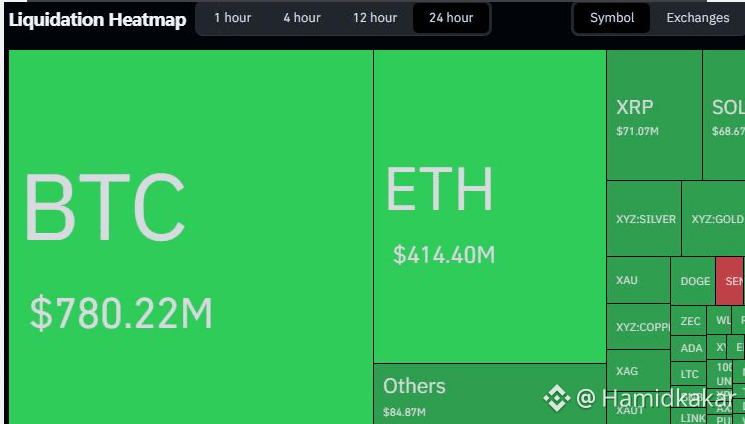

Who got hit the hardest?

The bulls took the biggest hit. About two-thirds of the losses came from traders betting on a price increase (Longs).

Bitcoin: Accounted for roughly $780 million of the losses.

Ethereum: Followed with over $414 million wiped out.

Together, BTC and ETH made up 70% of the damage, though altcoins also suffered as risky bets were cleared out.

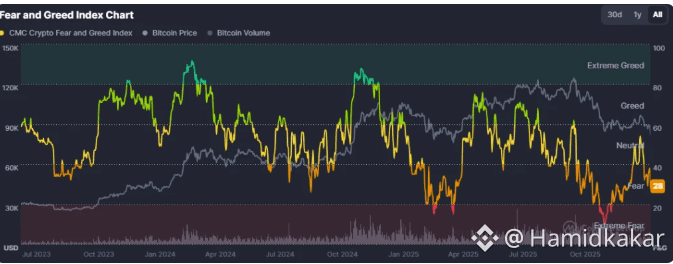

The "Fear" Factor

Naturally, when a billion dollars vanishes, people get nervous. The Crypto Fear & Greed Index plummeted to 28, putting the market firmly back into "Fear" territory. However, analysts believe the fear is a reaction to the crash, not the cause of it.

Bottom Line: The market is hitting the reset button. With the excess leverage flushed out, the market is safer but might move sideways for a while as traders lick their wounds. It’s a reset, not a collapse.