If you’re not financially secure with plenty of flexibility, this might not be the easiest time to buy a home. For many people, renting a bit longer could actually be the smarter move.

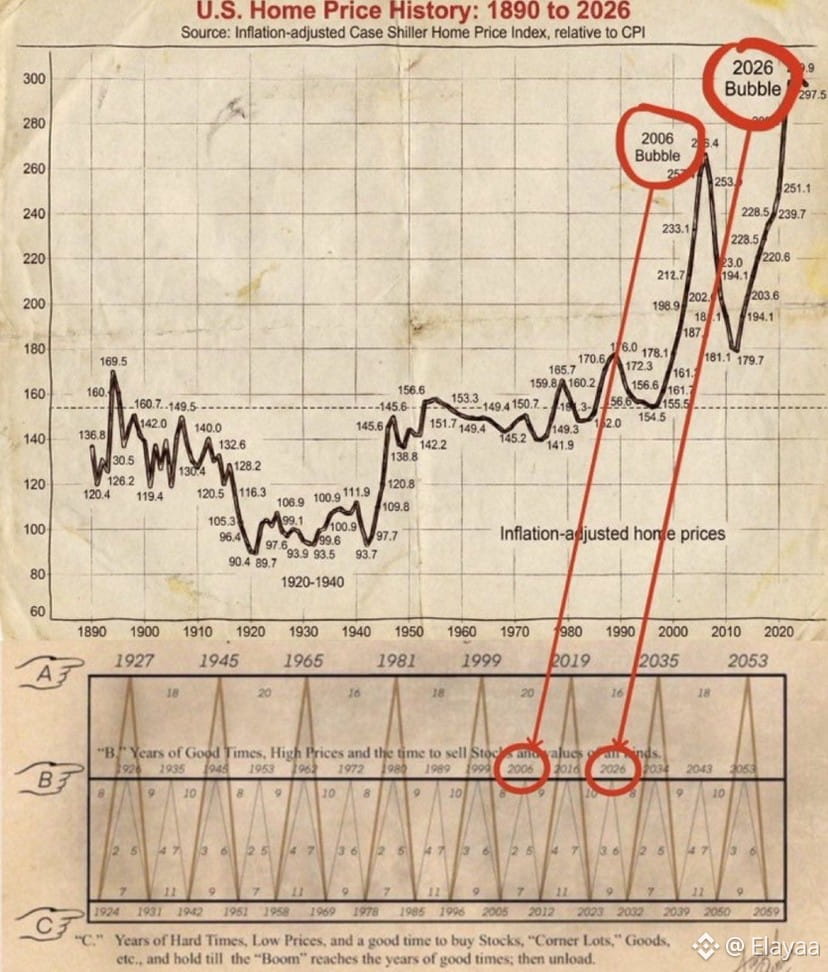

Housing markets move in cycles. We’ve seen major peaks before — like 2006 before the crash — and periods where prices ran far ahead of fundamentals. Today’s market doesn’t look overheated in the same way, but it does look tight, expensive, and low-activity.

Why buying right now feels difficult

• There are more sellers than buyers in many areas

• Mortgage rates are much higher than they were a few years ago

• Many homeowners are locked into ultra-low rates and aren’t selling

• Fewer transactions = less true price discovery

That creates a “frozen” market where prices stay high, but affordability is stretched.

If you buy at high prices with high rates, your monthly payment is heavy and your upside may be limited if prices stay flat for years. In that situation, a house behaves less like a fast-growing investment and more like a long-term commitment with carrying costs.

The patient strategy

Some analysts believe better opportunities could appear if economic pressure forces more selling in the next couple of years. Life events — job changes, relocations, financial stress — are what usually bring real supply back into the market.

Waiting doesn’t mean timing perfectly. It means keeping flexibility while conditions are uncertain.

If you must buy anyway

Buy defensively, not emotionally:

• Make sure you could handle a drop in income

• Avoid stretching your budget to the maximum

• Plan to hold the home long term

• Don’t rely on quick appreciation to “bail you out”

If the numbers only work in a perfect scenario, it’s probably too risky.