If you’re not a millionaire+

Rent.

Yes — rent.

Buying a house right now is how average people trap themselves into financial mediocrity for decades.

If you’re planning to buy your first home —

wait for a real crash.

A real reset.

A 2008-style housing collapse, not this fake “cooling” narrative.

I’ve seen every cycle: • 2008 crash

• 2020 blow-off top

• Post-COVID liquidity bubble

• Artificial price support

And I’ll say it clearly:

📉 This market is not stable

❄️ It’s frozen

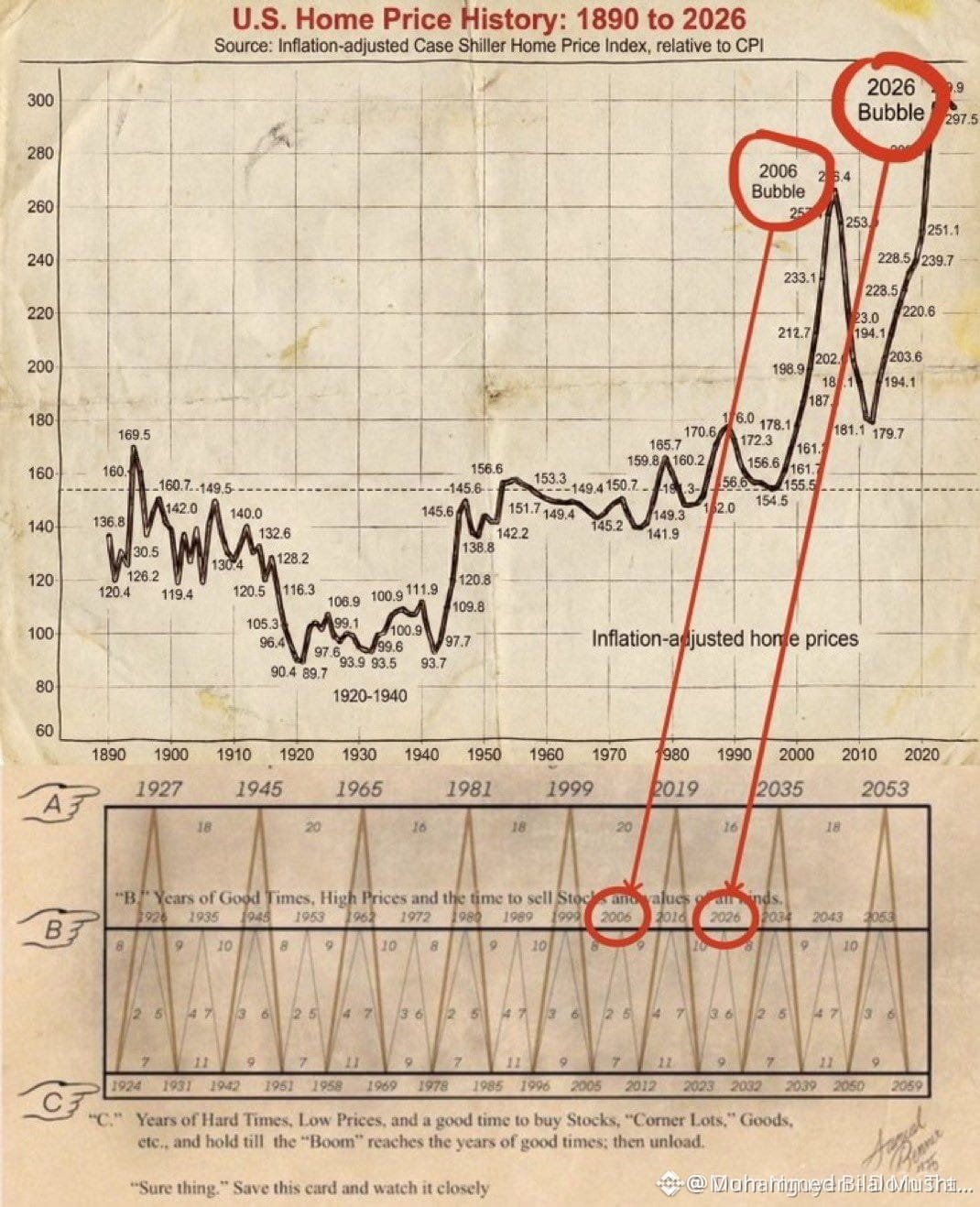

The last real housing bubble topped near 266 in 2006

If you think today’s market is “healthy” —

You’re not early.

You’re late and in denial.

🧠 WHY BUYING IN 2026 IS A FINANCIAL TRAP

📊 Data shows: • 36.8% more sellers than buyers

• Demand at lowest levels since 2020 lockdowns

This isn’t a dip.

This is lost momentum.

🏦 Reality check: • Old homeowners locked at ~3% mortgages

• New buyers forced into ~6.5% 30-year rates

Translation? 👉 Nobody can move

👉 Nobody can transact

👉 No real price discovery

👉 No real liquidity

You’re paying full price for an asset that: • Has no volume

• No stress testing

• No true market clearing

Buying now =

❌ Max monthly payment

❌ Minimal upside

❌ Peak duration risk

If you’re levered 5:1 on a house that goes sideways for years while paying 6.5% interest: You’re not “building equity.”

👉 You’re bleeding capital slowly.

🏠 Homeownership in this market isn’t an investment.

It’s a liability disguised as a dream.

📉 THE REAL MACRO PLAY (UNCOMFORTABLE TRUTH)

🕰️ Wait for late 2026 → 2027

That’s when reality hits the “we’ll just wait it out” crowd:

• Divorce

• Job loss

• Relocation

• Retirement

• Cash-flow stress

• Debt pressure

This creates forced sellers in a slowing economy.

Not emotional sellers — forced sellers.

That’s when: 💥 Prices reset

💥 Liquidity returns

💥 Real opportunity appears

💥 Capital wins

Patience gets paid.

🐺 IF YOU ABSOLUTELY MUST BUY

Buy like a predator, not a consumer:

✔ Assume income drops 20%

✔ Conservative LTV only

✔ Must survive 10 years of flat/negative prices

✔ No emotional buying

✔ No lifestyle leverage

If that scares you —

👉 You can’t afford the house.

🧠 Final Truth:

Wealth is built through timing, liquidity, patience, and positioning —

not emotional decisions sold as “security”.

Renting with capital > Owning with debt

Liquidity > Illiquidity

Optionality > Obligation

Strategy > Sentiment