When I spend time with Dusk, I don’t think about it as a blockchain in the way the industry usually encourages us to think. I don’t approach it as a venue for experimentation or a canvas for innovation theater. I frame it as financial infrastructure, and that framing changes everything. Infrastructure is not judged by how expressive it is, but by how well it absorbs complexity without leaking it to the people who depend on it. Once I started looking at Dusk through that lens, the design choices began to make a quiet kind of sense.

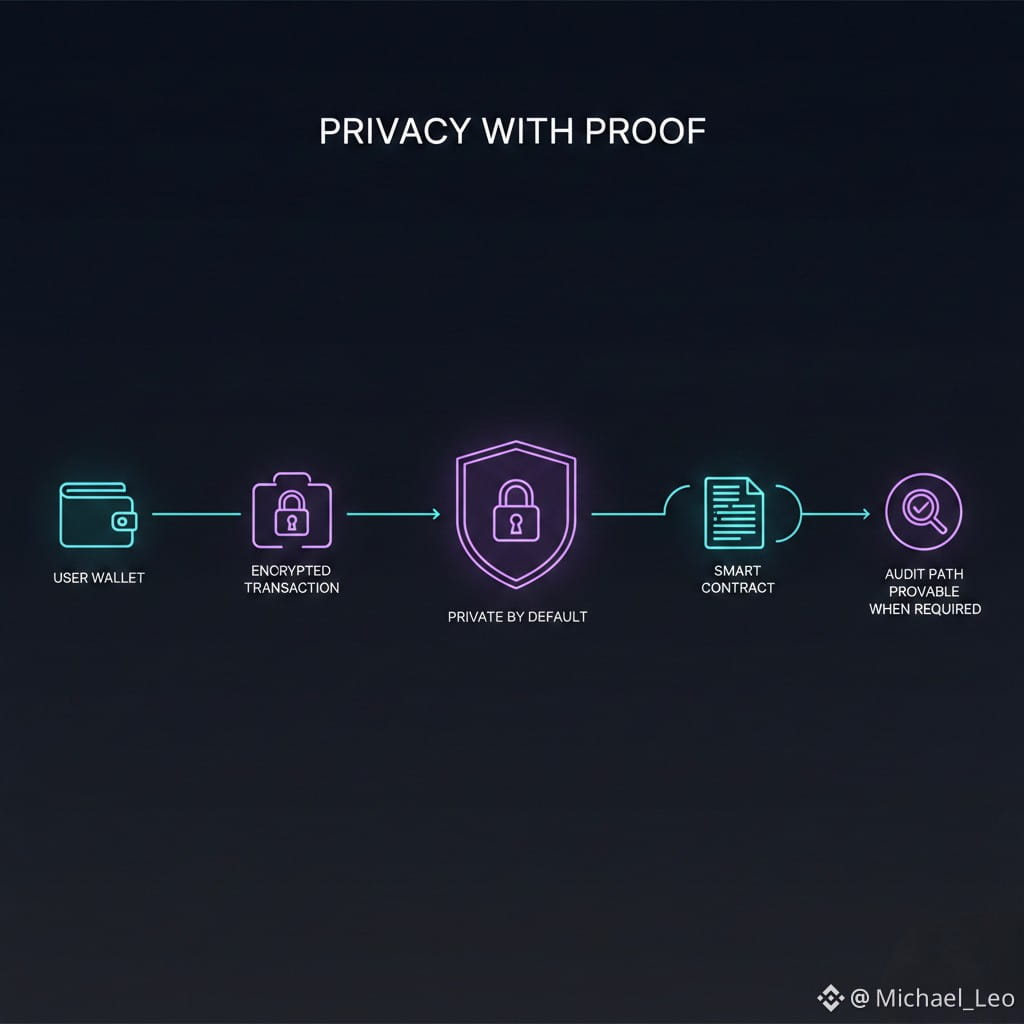

What strikes me first is how deliberately the system seems to assume indifference from its users. Most people interacting with financial products do not want to understand the underlying mechanics. They want transfers to settle, records to be accurate, and sensitive information to stay contained. Dusk appears to accept that as a baseline rather than a failure of education. Privacy is not treated as an optional feature that users must consciously opt into or manage. It is embedded as a default condition, while auditability is preserved as a controlled capability rather than a constant exposure. That balance feels less ideological and more operational, which is usually a sign that a system has been designed with real constraints in mind.

As I look at how the architecture is structured, I see a consistent effort to separate responsibilities rather than collapse them into a single abstraction. The modular approach is not there to impress developers with flexibility. It exists to make sure that different requirements do not interfere with one another. Compliance logic, privacy mechanisms, and application behavior are allowed to coexist without constantly negotiating for control. In practical terms, this reduces the risk that a change in one area creates unintended consequences elsewhere. For systems that are meant to handle regulated financial activity, that kind of compartmentalization is not a luxury. It is a survival strategy.

What the data and usage patterns suggest, at least from my interpretation, is that Dusk is oriented toward repetition rather than novelty. Financial activity tends to be cyclical and routine: issuance, settlement, verification, reporting. A system that performs well under those conditions needs to be predictable above all else. Dusk does not appear to optimize for surprise or discovery. It optimizes for consistency. That choice limits certain forms of creativity, but it also reduces operational risk. In environments where mistakes carry legal or financial consequences, that trade-off is often worth making.

What the data and usage patterns suggest, at least from my interpretation, is that Dusk is oriented toward repetition rather than novelty. Financial activity tends to be cyclical and routine: issuance, settlement, verification, reporting. A system that performs well under those conditions needs to be predictable above all else. Dusk does not appear to optimize for surprise or discovery. It optimizes for consistency. That choice limits certain forms of creativity, but it also reduces operational risk. In environments where mistakes carry legal or financial consequences, that trade-off is often worth making.

I also notice how much effort has gone into hiding complexity instead of showcasing it. Many technical systems celebrate their inner workings, almost daring users to understand them. Dusk does the opposite. The complexity is real and unavoidable, but it is pushed downward, away from the surface where everyday users interact. This is not about making the system simplistic; it is about making it resilient. A system that requires constant attention to avoid failure does not scale well in the real world. By reducing the number of decisions users have to make, Dusk increases the likelihood that those decisions, when they are made, are correct.

Onboarding is where this philosophy becomes especially visible. Bringing new participants into a regulated financial environment is not just a technical challenge. It is a behavioral one. Users need to be able to participate without accidentally violating rules they may not fully understand. Dusk’s design suggests an awareness of that problem. Defaults are conservative, boundaries are clear, and the system does not assume that users will read instructions carefully or act optimally. That may feel restrictive to some, but restriction is often what allows systems to function safely at scale.

There are elements of the platform that I find ambitious, but they are expressed in a restrained way. Embedding both privacy and auditability at the base layer is not an easy path. It forces difficult decisions early and removes the option to defer responsibility to higher layers. That choice narrows the range of possible applications, but it strengthens the ones that do exist. It signals a willingness to accept limitation in exchange for coherence, which is something I tend to associate with mature system design.

When I think about applications built on Dusk, I don’t view them as proof points meant to impress an audience. I see them as stress tests. Each real-world use case exposes assumptions about user behavior, regulatory interaction, and operational load. Systems built for attention can survive light usage and still appear successful. Systems built for finance are tested by monotony. They are tested by months of uneventful operation, by audits that uncover edge cases, and by users who only notice the system when something goes wrong. The fact that Dusk appears oriented toward that kind of testing tells me more than any announcement ever could.

When I think about applications built on Dusk, I don’t view them as proof points meant to impress an audience. I see them as stress tests. Each real-world use case exposes assumptions about user behavior, regulatory interaction, and operational load. Systems built for attention can survive light usage and still appear successful. Systems built for finance are tested by monotony. They are tested by months of uneventful operation, by audits that uncover edge cases, and by users who only notice the system when something goes wrong. The fact that Dusk appears oriented toward that kind of testing tells me more than any announcement ever could.

The role of the token fits neatly into this broader picture. It functions as part of the system’s internal mechanics rather than as a focal point for speculation. Its value is tied to participation, alignment, and usage, not to visibility. In infrastructure, components that do their job quietly are often the most important ones. A token that supports the functioning of the network without demanding attention becomes part of the background machinery, which is exactly where it belongs if the goal is long-term reliability.

Stepping back, what Dusk represents to me is a particular attitude toward building consumer-facing financial systems on blockchain rails. It prioritizes discretion over expression, predictability over flexibility, and correctness over creativity. That does not make it exciting in the conventional sense, but it makes it credible. Most people do not want their financial infrastructure to be interesting. They want it to be dependable.

If this approach signals anything about where blockchain-based infrastructure may be heading, it is toward systems that accept human behavior as it is rather than as we wish it were. People will continue to prefer simplicity, to avoid thinking about technical details, and to rely on systems they do not fully understand. Dusk feels designed with that reality in mind. It is not trying to educate users into caring about blockchain mechanics. It is trying to make those mechanics irrelevant to their daily experience.

That quiet ambition is what stays with me. Dusk does not ask to be admired. It asks to be used correctly, repeatedly, and without incident. In my experience, that is usually the mark of infrastructure that is built to last.