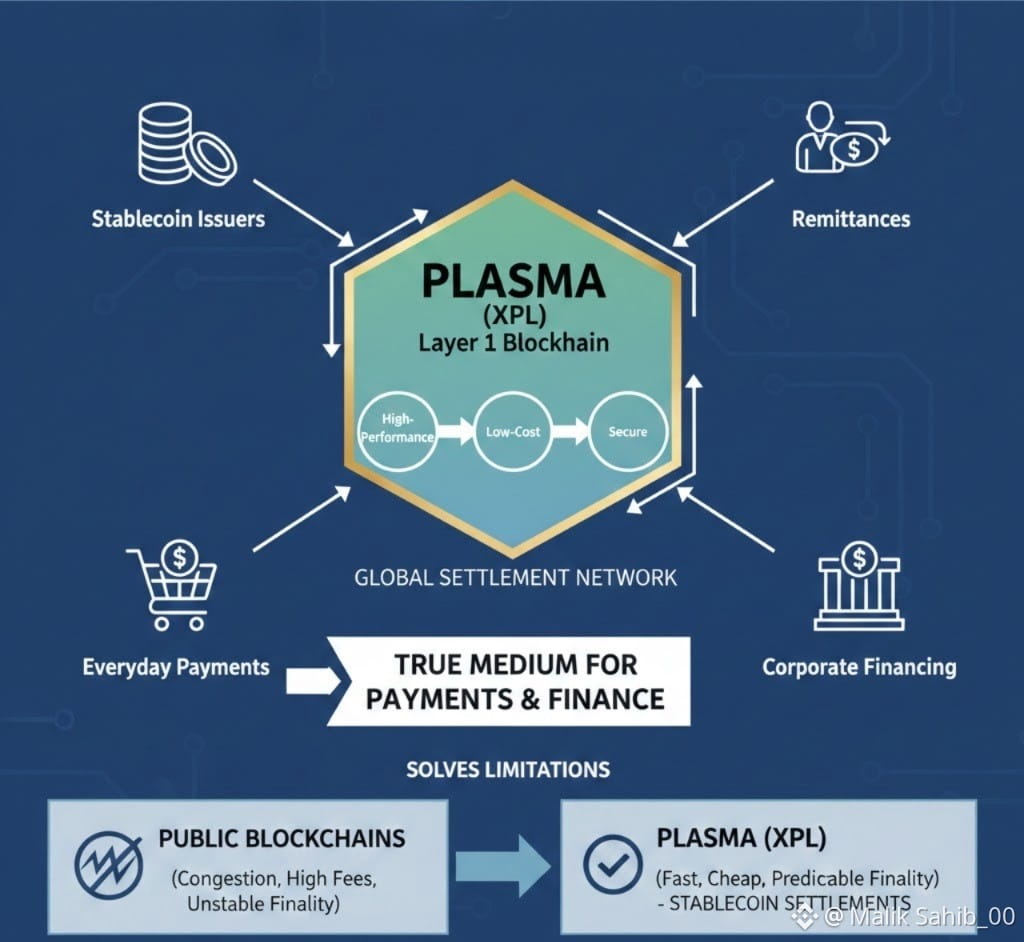

Plasma is a dedicated Layer 1 blockchain designed to provide a high-performance, low-cost, and secure global settlement network for stablecoins. Unlike public blockchains, which often suffer from congestion, high gas fees, and unstable final results, Plasma focuses on a core mission: making stablecoins a true medium for everyday payments, remittances, and corporate financing.

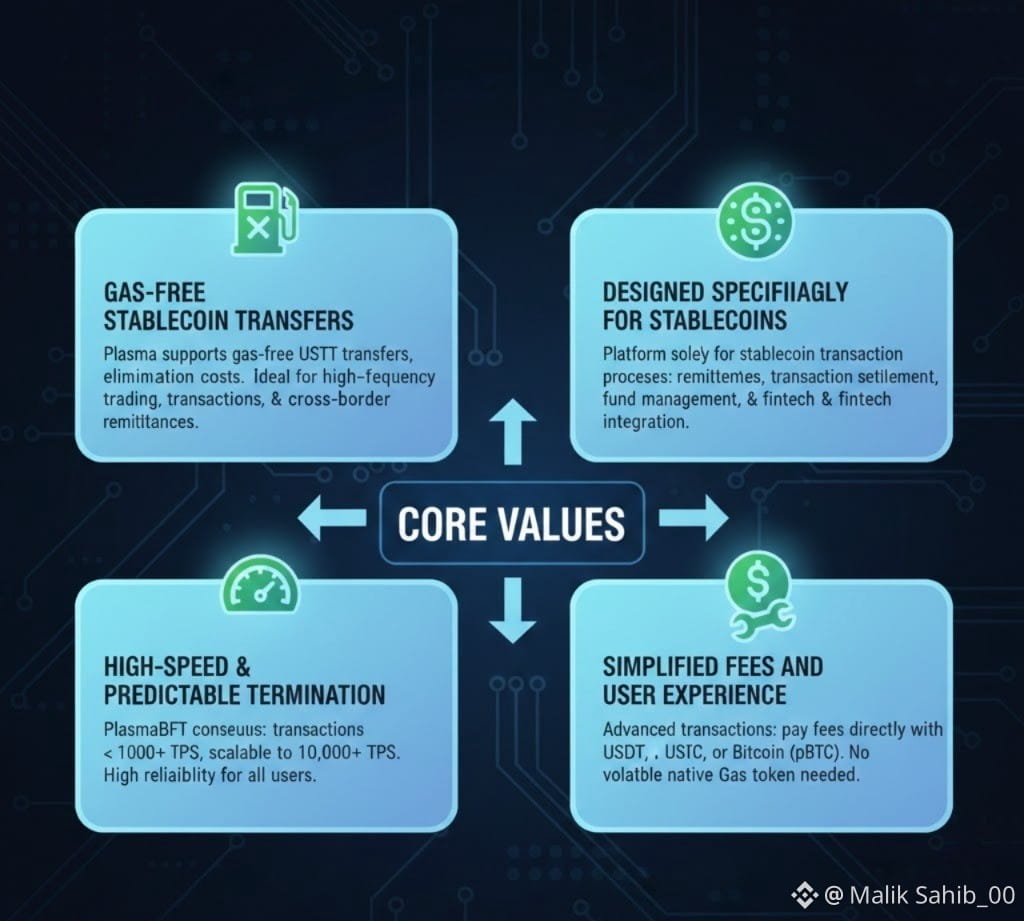

• Core Values:

Gas-Free Stablecoin Transfers

Plasma supports gas-free USDT transfers, eliminating transaction costs associated with payments between standard wallets. This makes it ideal for high-frequency trading, small transactions, and cross-border remittances.

Designed Specifically for Stablecoins

The Plasma platform does not support all possible use cases; rather, it is designed specifically for stablecoin transaction processes, including remittances, transaction settlement, fund management, and fintech integration.

High-Speed and Predictable Termination

The Plasma network uses the PlasmaBFT consensus mechanism, enabling transactions to be completed in less than a second. At launch, transaction speeds exceeded 1000 transactions per second and can scale to over 10,000 transactions per second, ensuring high reliability for both individual and institutional users.

Simplified Fees and User Experience

For advanced transactions, users can directly pay fees using USDT, USDC, or Bitcoin (pBTC), eliminating the need to purchase the highly volatile native Gas token for daily use.

Technology and Security Architecture

Ethereum Virtual Machine (EVM) Compatibility

The Plasma platform is built on the Wraith execution client, written in Rust, and is fully compatible with the Ethereum Virtual Machine (EVM). Developers can easily migrate existing Ethereum applications.

Strong Network Security

The network uses a BFT-based consensus mechanism and committed over $2 billion in liquidity at launch, providing robust economic security from the outset. Key Architecture and Economic Features

Plasma One Digital Bank

A native fintech application offering:

Over 10% stablecoin savings yield

4% cashback on credit card spending

Coverage in over 150 countries/regions worldwide

Native Bitcoin Bridge

A low-security Bitcoin bridge allows Bitcoin to enter the ecosystem as pBTC, enabling seamless interaction between Bitcoin liquidity and stablecoin-based decentralized finance (DeFi).

XPL Tool

With free underlying transactions, XPL ensures network security, supports smart contract execution, and supports verification-based governance.

Inflation-Resistant Economic Mechanism

Employs an EIP-1559-style burn mechanism to compensate verification rewards, initially at 5%, gradually decreasing to 3%, ensuring long-term sustainability.

Target Markets and Application Scenarios

Cross-border remittances and payments in high-inflation economies

Settling merchant transactions without traditional card organizations

Fintech companies and stablecoin issuers seeking compatible infrastructure

Machine-to-machine (M2M) payments for AI and IoT systems

Competitive Positioning

Plasma aims to become the primary settlement layer for the global stablecoin economy, directly competing with networks like Tron through free transfers, faster transaction processing, enhanced security, and enterprise-grade infrastructure.

By transforming stablecoins from speculative assets into functional digital currencies, Plasma positions itself as the cornerstone of next-generation payments and blockchain-based digital banking.