When I look at Plasma, I don’t start by asking what makes it impressive. I start by asking what kind of problem it’s actually trying to solve and whether its design choices line up with the way people already behave. The clearest way I’ve found to frame it is as settlement infrastructure that happens to be implemented as a Layer 1, rather than as a general-purpose blockchain trying to express an ideology. That framing matters because it changes the criteria for success. The question becomes whether the system reduces friction in moving stable value, not whether it maximizes flexibility or novelty.

After spending time with the design, what stands out is how narrowly Plasma defines its job. Stablecoins are not an abstract use case. They are already used as everyday money in many parts of the world, often by people who don’t think of themselves as crypto users at all. These users don’t care about virtual machines or consensus models. They care about whether a transfer goes through quickly, whether the cost is predictable, and whether the system feels trustworthy enough to rely on repeatedly. Plasma seems to start from that reality and work backward.

The choice to remain fully EVM-compatible through Reth reads to me as a practical decision rather than a philosophical one. Payments infrastructure benefits from familiarity and operational maturity. Using a well-understood execution environment lowers the risk of subtle failures at the layer where mistakes are least forgivable. What matters more is how Plasma constrains that environment to serve its purpose. Sub-second finality through PlasmaBFT is not about chasing performance for its own sake. It reflects the simple fact that when people move money, delays feel like uncertainty. Fast finality aligns the system with human expectations around settlement, especially in everyday contexts where waiting even a minute feels broken.

I also pay attention to what Plasma chooses to hide. Gasless USDT transfers and stablecoin-first gas are not flashy features, but they reveal a lot about priorities. Asking users to manage volatile assets just to pay fees introduces unnecessary cognitive overhead. In the real world, people expect to spend the same unit they are transferring. By treating the stablecoin as the primary economic unit, Plasma removes a layer of mental translation that most users never asked for. Complexity still exists, but it is absorbed by the system instead of pushed onto the user.

I also pay attention to what Plasma chooses to hide. Gasless USDT transfers and stablecoin-first gas are not flashy features, but they reveal a lot about priorities. Asking users to manage volatile assets just to pay fees introduces unnecessary cognitive overhead. In the real world, people expect to spend the same unit they are transferring. By treating the stablecoin as the primary economic unit, Plasma removes a layer of mental translation that most users never asked for. Complexity still exists, but it is absorbed by the system instead of pushed onto the user.

The Bitcoin-anchored security model is one of the elements I approach with the most curiosity. I don’t see it as a symbolic attachment, but as an attempt to introduce an external anchor for neutrality and censorship resistance. If it works as intended, it adds a layer of assurance without requiring users to understand or interact with it. That balance is important. Security mechanisms are most effective when they fade into the background and only become visible when something goes wrong. Whether Plasma can maintain that invisibility as usage scales is an open question, but the intent feels grounded.

What I find useful is to think about Plasma’s real applications as stress tests rather than showcases. Retail transfers in high-adoption regions, merchant settlements, and institutional payment flows all place different demands on the system. They test whether fees remain stable under load, whether finality stays predictable, and whether failures are handled cleanly. These scenarios are not glamorous, but they are where infrastructure proves itself. A system built for stablecoin settlement should feel uneventful in these moments. Reliability is the product.

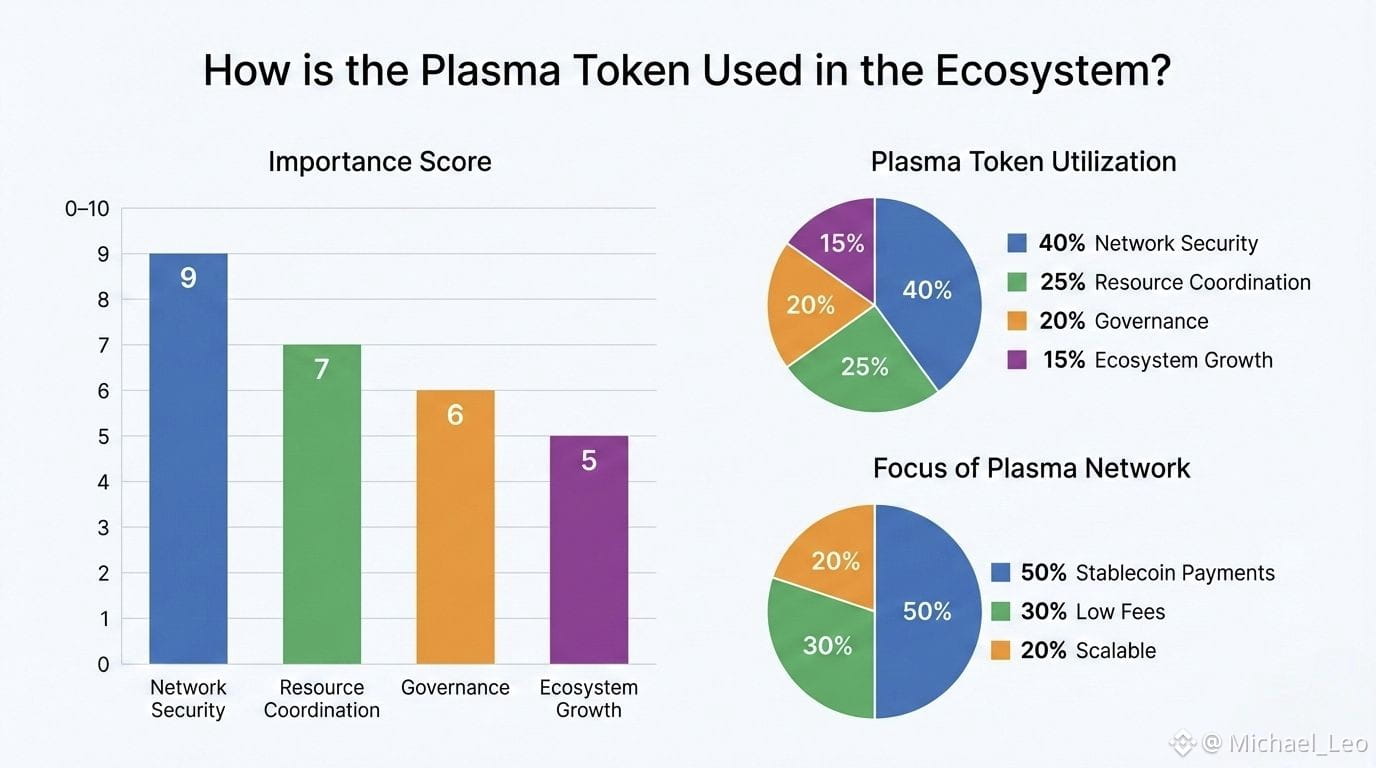

When it comes to the token, I deliberately avoid thinking about it in speculative terms. Its relevance is in how it supports usage, aligns participants, and sustains the network’s operation. Ideally, most users never need to think about it at all. In my experience, the best infrastructure fades from view as it becomes more useful. The token’s role should be to make the system function smoothly, not to demand attention.

When it comes to the token, I deliberately avoid thinking about it in speculative terms. Its relevance is in how it supports usage, aligns participants, and sustains the network’s operation. Ideally, most users never need to think about it at all. In my experience, the best infrastructure fades from view as it becomes more useful. The token’s role should be to make the system function smoothly, not to demand attention.

Stepping back, Plasma represents a broader shift in how blockchain infrastructure can be designed for everyday use. Instead of celebrating complexity, it treats complexity as something to be managed quietly. Instead of trying to be everything, it commits to doing one thing well. That approach may not excite people who are looking for novelty, but it resonates with anyone who has built or relied on real systems before. Infrastructure that works is rarely loud. It earns trust by being predictable, legible, and boring in the best sense of the word. If Plasma continues to prioritize those qualities, it points toward a future where blockchains feel less like experiments and more like dependable tools woven into daily financial life.