We often talk about blockchain scaling through sharding or parallel execution, but the real bottleneck, the quiet anchor point for every transaction, is consensus. It is the protocol that decides what happened and in what order, and its design dictates a chain's speed, security, and finality. The journey from the classical Practical Byzantine Fault Tolerance, PBFT, of the 1990s to the modern variants powering today's chains is a story of refining trade offs. My review of the technical landscape shows that PLASMA's implementation, dubbed PlasmaBFT, does not just pick a side in this evolution, it attempts to merge paths, combining a high performance BFT core with a Bitcoin anchored security fallback. This creates a distinct profile for its stated goal, becoming a neutral settlement layer for stablecoins.

Classic PBFT, introduced by Castro and Liskov, was a breakthrough for synchronous systems. It provided a way for a known set of replicas to agree on an order of operations even if some were malicious. The mechanics are methodical, pre prepare, prepare, commit phases with all to all communication. It works, but it scales poorly, the message complexity is O(n^2) as the validator set grows. What struck me when revisiting the original paper is how this model implicitly assumed a closed, permissioned environment. It was a solution for data centers, not for a global, permissionless blockchain where participants join and leave. Later adaptations like Tendermint, used by Cosmos, and HotStuff, adapted by Diem and later Sui, Aptos, sought to solve this. They streamlined communication, often moving to linear or reduced message complexity. Tendermint introduced a locking mechanism to ensure safety under asynchrony, while HotStuff's pipelined view changes aimed for better performance under a rotating leader. PlasmaBFT sits in this modern lineage. According to PLASMA's technical documentation, it achieves sub second finality by optimizing this consensus family's hot path, but its architectural choice to be fully EVM compatible using Reth execution means it inherits a vast developer toolkit from day one.

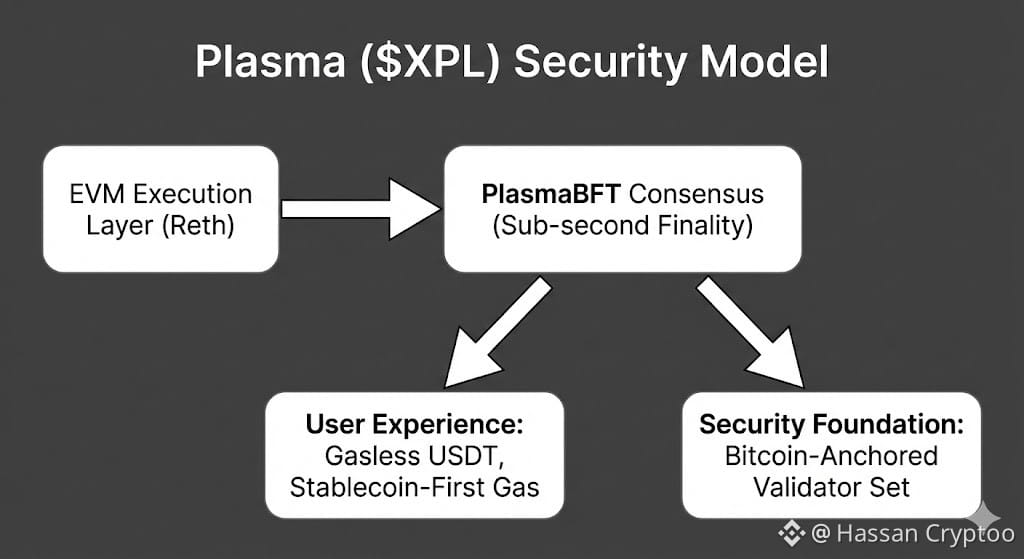

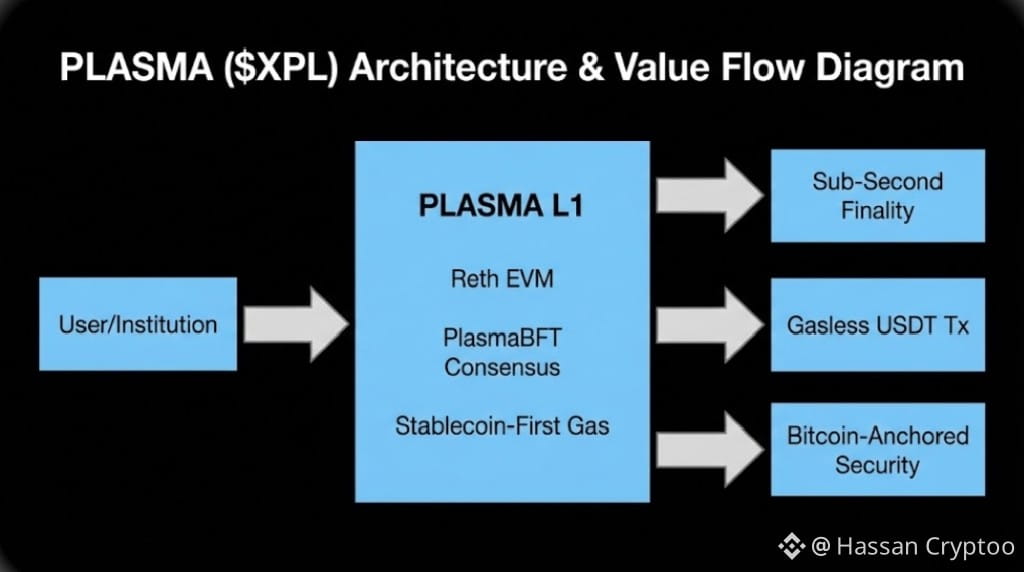

The distinctive layer, the part that moves beyond pure protocol mechanics, is PLASMA's security model. The chain operates with its own set of validators running PlasmaBFT for daily performance. However, checkpoint states are periodically committed to Bitcoin. This is not a two way bridge, it is a one way notarization. The whitepaper details a two phase process where a Plasma block's Merkle root is embedded into a Bitcoin transaction. This achieves what the team calls "Bitcoin anchored security." If the Plasma chain were to suffer a catastrophic consensus failure or a malicious takeover, users could leverage the Bitcoin recorded state to exit honestly. It is a clever hedge. You get the speed and low cost of a modern BFT chain for execution, but the ultimate settlement guarantee, the backstop, rests on Bitcoin's immutable ledger. This design philosophy aims for neutrality and censorship resistance, positioning the chain not as a competitor to Bitcoin but as a complementary settlement highway that periodically ties its truth to the most secure blockchain.

This architecture directly services PLASMA's primary use case, stablecoin transactions. Features like gasless USDT transfers and stablecoin first gas, where fees are paid in the stablecoin you are transacting with, are not afterthoughts, they are systemic requirements enabled by a fast, final consensus layer. When finality is sub second and costs are predictable, the chain behaves more like a financial network than a typical smart contract platform. It is targeting the mundane but colossal flow of value, not the speculative edge of DeFi. Analyzing the XPL token on CoinMarketCap and Binance Spot as of today shows a market focused on this utility. The token facilitates network security and governance within this streamlined ecosystem. Its value is tied to the throughput and adoption of stablecoin settlement, a metric fundamentally different from chains competing for generalized TVL.

So, where does PlasmaBFT land in the BFT family tree. It is an evolved branch. It adopts the performance optimizations of its contemporary siblings, the quick finality, the linear communication where possible. But it reintroduces a form of external security austerity through Bitcoin anchoring, a concept more familiar from older merge mining or sidechain designs. This synthesis is its answer to the blockchain trilemma for its specific niche. It does not promise unbounded decentralization for consensus itself, it promises efficient, final consensus that is periodically audited and secured by the most decentralized network in existence. For stablecoins, where transaction finality and auditability are paramount, this trade off is not just logical, it is pragmatic. The evolution of consensus is not always a straight line toward one ideal. Sometimes, it is about a strategic convergence, and PlasmaBFT appears to be an experiment in exactly that.

By Hassan Cryptoo