Money doesn’t just live in wallets. It lives in shoulders held too tight, in messages checked too often, in the small panic that creeps in when a payment says “pending” for too long. It lives in the silence between “I sent it” and “did you get it?” For most of the world, money is not abstract. It is rent, food, medicine, dignity. It is time, and time is never neutral.

Plasma exists because too many systems forgot that.

For years, blockchains spoke about freedom in technical terms while everyday people kept dealing with friction that felt quietly cruel. Fees that changed without warning. Assets that swung wildly while salaries stayed the same. Payments that technically worked but emotionally failed. Plasma doesn’t try to impress you with cleverness. It tries to do something far more difficult: it tries to respect you.

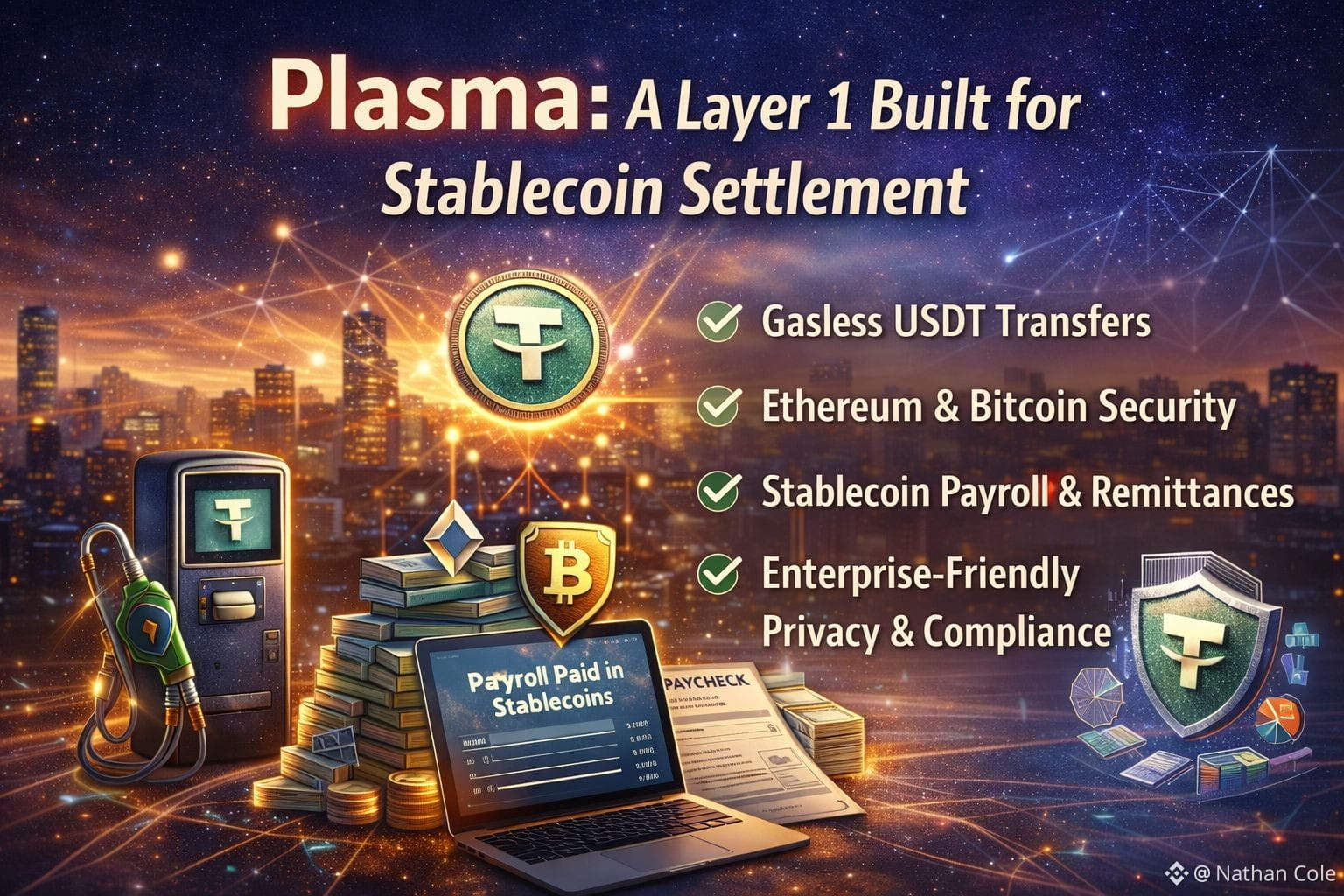

At its core, Plasma is a Layer 1 blockchain built for settlement, not spectacle. It doesn’t assume people want to gamble just to move money. It assumes they want certainty. It assumes they want to send something today and know—really know—that it has arrived. That assumption changes everything.

Most chains were built around volatility and later adapted for stablecoins. Plasma does the opposite. It begins with the quiet truth that stablecoins are already money for millions of people. Not “crypto money.” Just money. Salaries paid in stablecoins. Rent paid in stablecoins. Families supported across borders by stablecoins. Plasma looks at that reality and says: then the chain itself should behave accordingly.

Underneath, it runs a fully Ethereum-compatible execution layer using Reth. That matters not because it’s clever, but because it avoids asking developers and users to start over. Familiar tools, familiar contracts, familiar expectations. There’s a kindness in that choice. It doesn’t demand loyalty; it offers continuity. It respects the time people have already invested in learning how this world works.

But familiarity alone is not comfort. Comfort comes from finality. From knowing something is done. Plasma’s consensus system, PlasmaBFT, is designed for sub-second finality, which sounds technical until you realize what it actually means: no waiting, no refreshing, no lingering doubt. The payment doesn’t hover in limbo. It completes. Your nervous system can relax.

Then there’s the part that hits closest to home for many people: fees. On most blockchains, sending stablecoins still requires holding a volatile asset just to pay gas. This forces people into risk they never asked for. Plasma removes that burden. Gas can be paid in stablecoins. In some cases, users don’t see gas at all. They send USDT, and that’s it. No second asset. No mental overhead. No explaining to a new user why “money” needs another kind of money to move.

This is not a UX trick. It’s an emotional correction. It tells users, especially those in high-adoption regions, that the system was built with them in mind. That their reality wasn’t treated as an edge case.

Security, too, is treated as something more than math. Plasma anchors its security to Bitcoin, not because Bitcoin is trendy, but because it is neutral. Because it has survived pressure, politics, and cycles without bending easily. In a world where payment rails are often shaped by whoever holds the most power, anchoring to Bitcoin is a quiet statement: no single actor should get to decide who money belongs to.

At the same time, Plasma does not reject institutions. It doesn’t posture as anti-bank or anti-regulation. It understands that payrolls, treasuries, and payment processors need reliability and clarity to operate at scale. So it builds with that reality in mind, offering predictable fees, confidentiality where appropriate, and structures that can support compliance without surrendering the soul of the system. That balance is fragile. It requires humility. It requires admitting that the future of money will not be won by ideology alone.

The people Plasma is built for are not chasing narratives. They are trying to make things work. A merchant who needs margins to survive. A worker who needs their pay to arrive on time. A family waiting on a remittance that decides whether the month will be calm or terrifying. For them, speed is not a luxury. Predictability is not a bonus. It is emotional safety.

There are risks, of course. Making stablecoins frictionless invites attention. From regulators. From governments. From institutions that have historically controlled the flow of money. Plasma does not pretend those tensions don’t exist. It steps into them with the belief that usable, humane infrastructure is worth defending. That doing nothing because the world is complicated only preserves systems that already fail too many people.

What makes Plasma feel different is that it doesn’t want to be exciting forever. It wants to disappear. It wants to become boring in the way electricity is boring. You don’t celebrate it when it works. You just live.

If Plasma succeeds, nobody will write poems about it. They will just stop worrying as much. Payments will arrive when they’re supposed to. Fees will make sense. Money will behave like money instead of a puzzle you have to solve every time you use it.

And maybe that’s the most radical thing of all.

Not shouting about the future.

Just quietly making life easier.