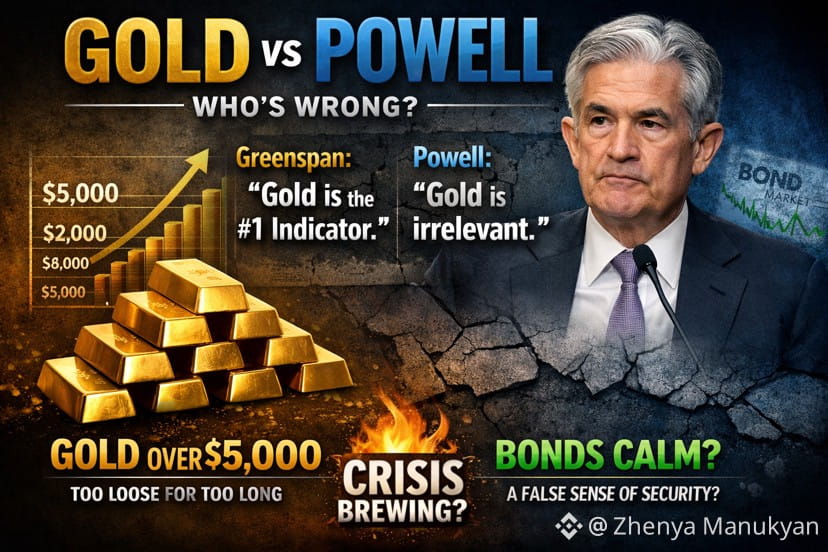

Jerome Powell says gold is irrelevant to monetary policy and that the Fed doesn’t “get spun up” over asset prices.

But gold is a monetary metal.

When Alan Greenspan was Fed Chair, he said gold was the most important indicator he watched. Even without a gold standard, he used gold to judge whether policy was too loose or too tight. Rising gold meant rates were too low. Falling gold meant policy was too tight.

Today, gold is above $4890 — over 10× higher than in Greenspan’s era. That’s the market screaming that monetary policy has been too loose for too long.

Powell argues that if there were a real loss of confidence, the bond market would show it. But loss of confidence appears first in the most sensitive markets — gold and silver — just like subprime cracked before the broader mortgage market in 2007.

Gold has been warning the Fed from $2,000 → $3,000 → $4,000 → $5,000. Instead of tightening, the Fed loosened.

Powell says gold is “contained.”

History says that’s how every crisis starts.