Everyone speaks about real-world assets as the inevitable future of Web3 — tokenized stocks, bonds, funds, and financial instruments living on chain. But there’s a question institutions quietly ask before they even consider entering this space: what kind of blockchain would actually make us feel safe?

Many RWA projects look impressive on the surface. Strong branding, confident promises, polished platforms. Yet when you examine how they handle regulation, privacy, and long-term operational demands, the foundations often feel temporary. Institutions do not care about slogans. They care about privacy, compliance, auditability, and reliable settlement. And this is where most blockchains fall apart.

The core conflict blocking institutional adoption is simple: privacy and compliance appear to oppose each other. Financial institutions must protect trading strategies, positions, and counterparties because this information is commercially sensitive. At the same time, regulators require transparency, audit trails, and proof that rules are followed. Public blockchains expose too much. Private chains sacrifice decentralization. Neither option satisfies both sides.

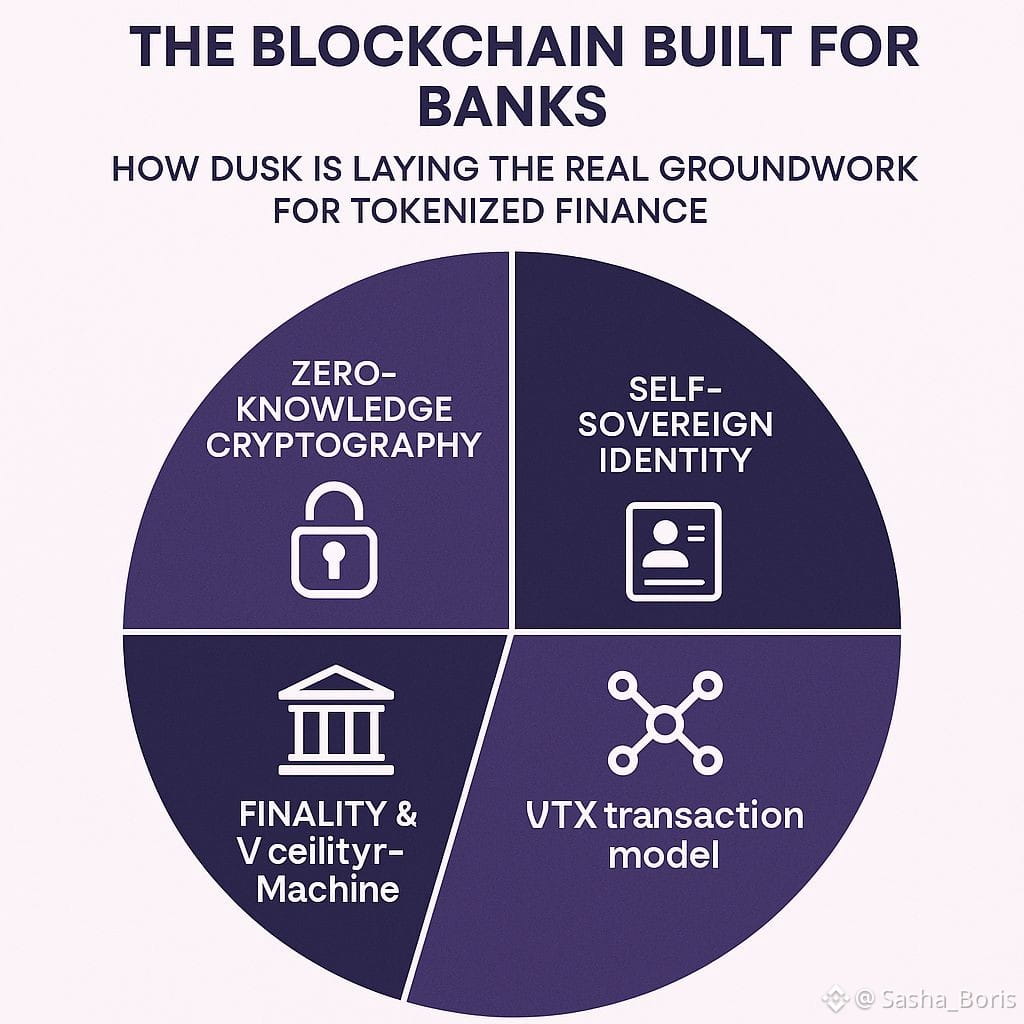

Dusk approaches this problem from a different angle by embedding zero-knowledge cryptography directly into the foundation of the network. Instead of treating privacy as an added feature, it makes cryptographic proof the primary method of verification. Transactions are validated based on mathematical correctness rather than exposed data. This allows participants to prove they meet the rules without revealing sensitive information.

A major part of this design is Dusk’s custom virtual machine, built specifically for financial logic. Unlike general-purpose environments where complex compliance rules become difficult to manage, this system focuses on verifying proofs rather than inspecting user data. The network checks whether conditions are satisfied, not who you are or what details you hold. Privacy remains intact while compliance is enforced by design.

Dusk’s Phoenix transaction model further advances this idea. It blends the privacy strengths of UTXO systems with the flexibility of smart contracts. Observers can see that value moves across the network, but they cannot trace which specific participants are involved. The chain verifies that everything is valid without exposing transaction relationships. This makes it suitable for financial settlements where confidentiality is essential but correctness must still be provable.

Identity and compliance are handled through Citadel, a self-sovereign identity system where users keep their credentials on their own devices. Instead of repeatedly submitting documents to platforms, participants generate zero-knowledge proofs that confirm they meet requirements. Institutions and regulators can verify compliance without ever accessing private personal data. It is a model that aligns strongly with modern data-protection expectations while still satisfying regulatory oversight.

Dusk is also built with settlement finality in mind rather than chasing extreme transaction speeds. Financial markets value certainty over raw throughput. Validators actively verify proofs as part of consensus, ensuring that every confirmed transaction is cryptographically sound and irreversible. This focus on stability and correctness over marketing metrics reflects an understanding of how traditional finance actually operates.

What makes Dusk particularly relevant now is timing. The RWA conversation is no longer theoretical. Institutions are actively exploring blockchain infrastructure, and regulatory clarity is increasing across major jurisdictions. Weak architectures are being filtered out. Systems that cannot balance privacy with compliance simply cannot support tokenized securities or regulated assets at scale.

The challenge ahead for Dusk is ecosystem growth. Even the strongest infrastructure needs developers, applications, liquidity, and adoption to demonstrate its full potential. Technology alone does not create a market. But if real-world assets are going to define the next era of blockchain, the networks designed specifically for financial requirements will be the ones that matter most.

Dusk is not built for daily excitement or speculative hype. It is engineered for long-term financial use, where trust, privacy, and compliance are non-negotiable. If tokenized finance is to move from narrative to reality, this kind of foundation is what institutions have been waiting for.