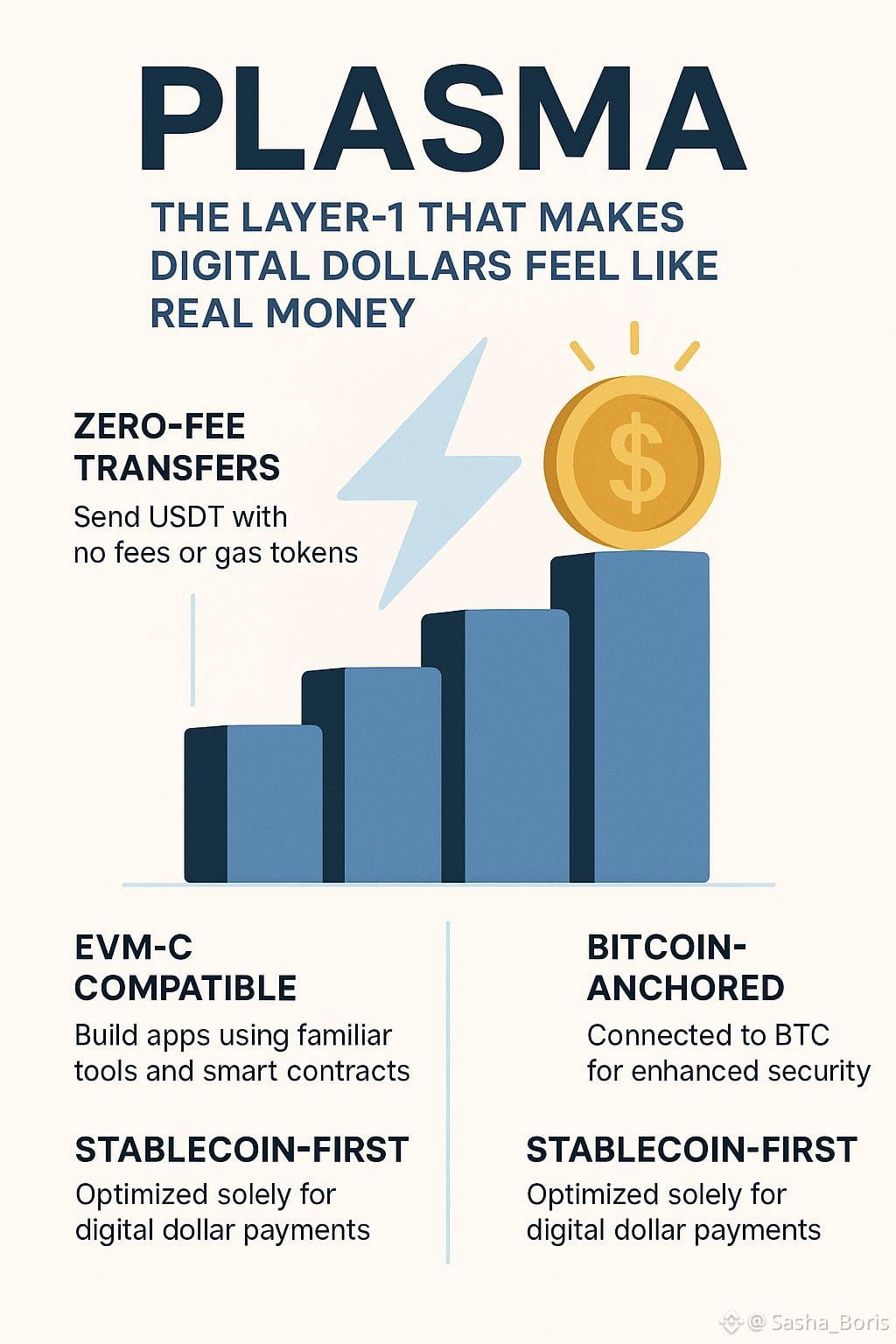

Most blockchains try to be everything at once — payments, DeFi, NFTs, games, identity — and the result is often complexity that ordinary users don’t enjoy. Plasma takes the opposite path. It is a purpose-built Layer-1 designed around one clear mission: make stablecoins work like real internet money instead of feeling like a technical crypto tool.

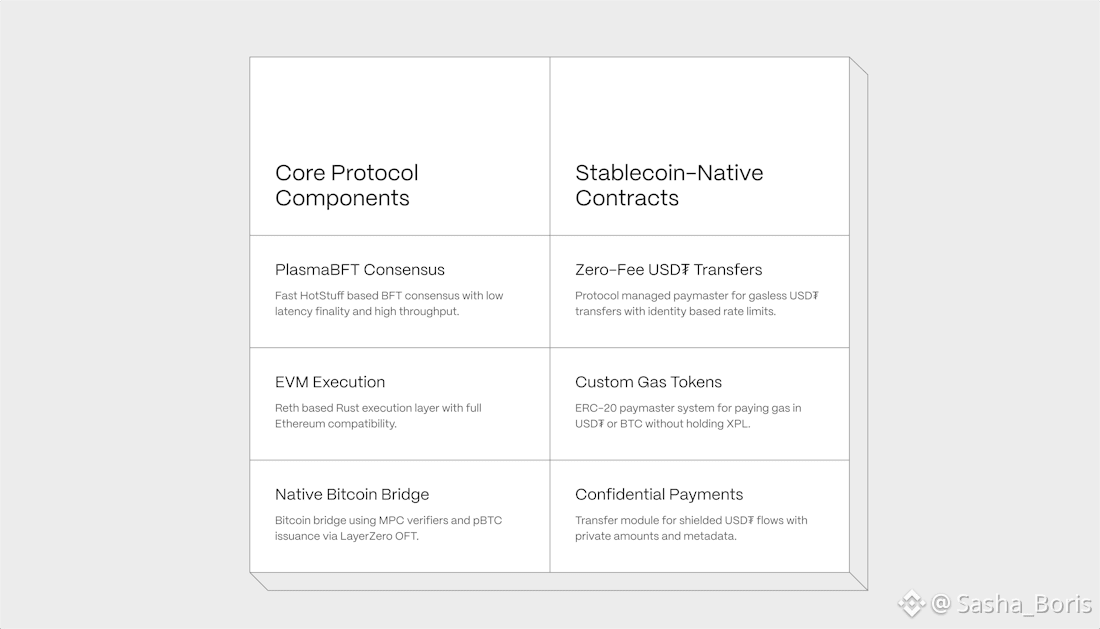

Plasma treats stablecoins as first-class citizens rather than just another token on the network. This design choice appears in its most talked-about feature: zero-fee USDT transfers at the protocol level. Users don’t need to hold gas tokens or worry about fluctuating fees just to send digital dollars. The goal is to remove mental friction so that micro-payments, remittances, and everyday transactions feel simple and predictable.

At the same time, Plasma keeps the developer experience familiar by remaining fully EVM compatible. Builders can continue using common tools while creating payment-centric applications such as automated payroll systems, instant merchant settlement tools, subscription logic with refund rules, and marketplaces with built-in escrow. This allows programmable money without forcing developers to relearn everything.

Security and settlement credibility are also central to Plasma’s design. The network introduces a trust-reduced bridge to Bitcoin, allowing BTC to be used within smart contracts. By anchoring part of its trust model to Bitcoin’s security, Plasma combines a modern payment chain with one of the most established security foundations in crypto.

Plasma launched with real liquidity and ecosystem integrations rather than an empty network, signaling that the focus is on practical transaction flow rather than hype. This matters because real payment infrastructure tends to attract custodians, processors, and enterprise use before retail users even notice.

Infrastructure providers and custodians have shown early interest in Plasma’s stablecoin-first approach, particularly the concept of zero-fee payment rails. These integrations are important signals because institutional players evaluate reliability, compliance, and usability before sentiment or marketing narratives.

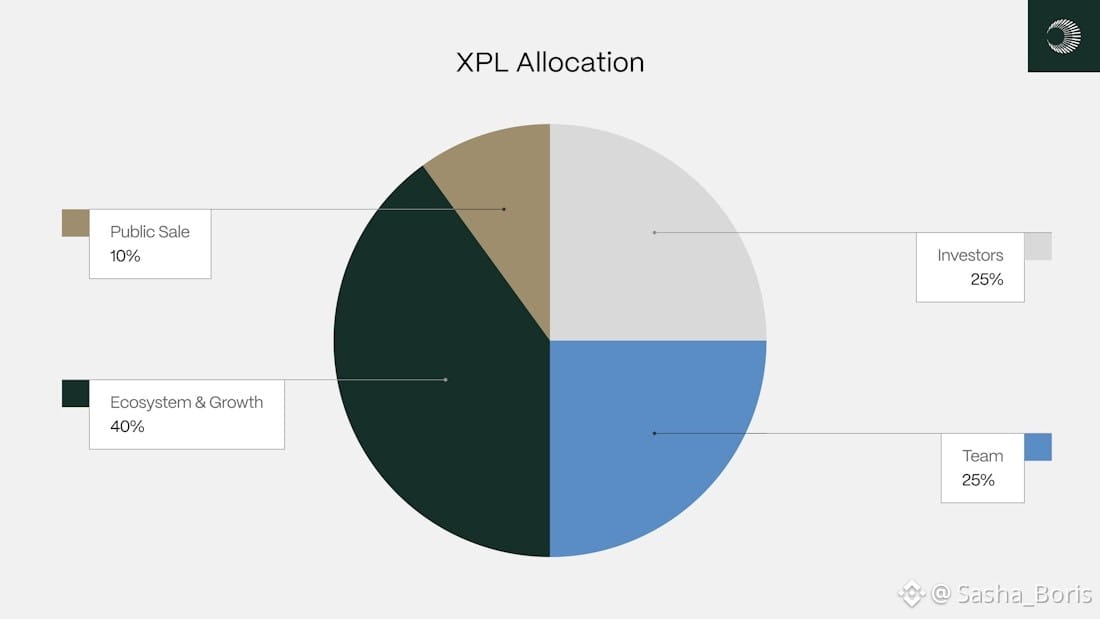

The role of XPL, Plasma’s native token, is to coordinate validators, secure the network, and handle governance without forcing everyday users to manage gas complexity. The economic design shifts operational costs away from someone sending a small stablecoin payment and into the broader network structure, keeping user experience simple.

Plasma’s focused approach also comes with challenges. It depends heavily on the continued relevance of stablecoins and favorable regulatory conditions. A fee-free model must prove sustainable under high usage, and competition from established high-volume chains and Layer-2 solutions is strong. Long-term success will require developers, liquidity, and real applications to validate the model.

Still, Plasma stands out because it focuses on a single problem: making stablecoins behave like normal money. Fast transfers, predictable costs, EVM compatibility, and a Bitcoin-anchored trust narrative are not about novelty — they are about focus. In a space where attention is limited and noise is everywhere, focus can be a powerful advantage.