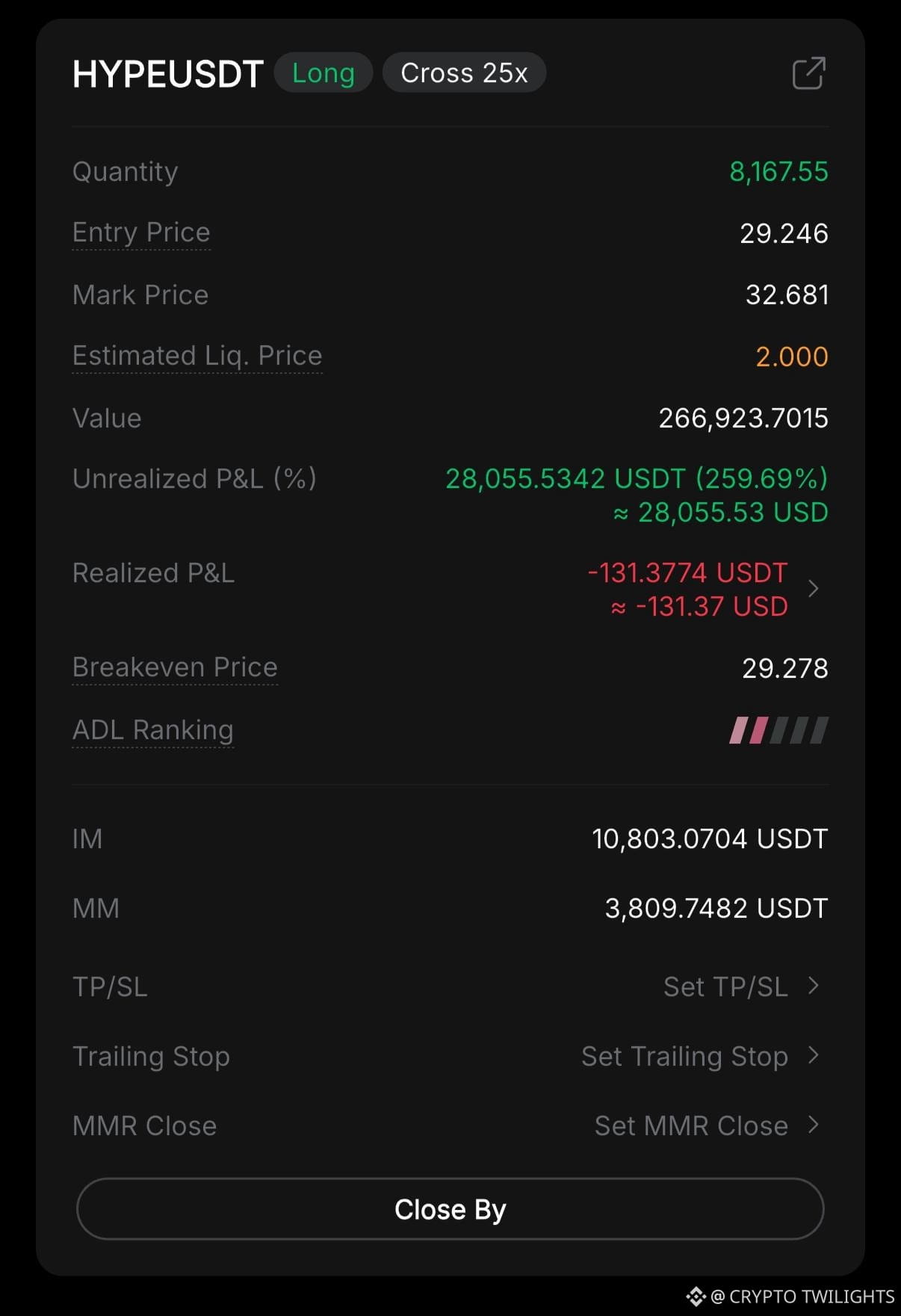

---$HYPE

One Trade. One Decision. One Lesson in Discipline.

This position is not about luck.

It’s not about catching a random pump.

And it’s definitely not about overconfidence.

This trade represents something far more important: patience, structure, and execution.

When the entry was taken, the market wasn’t loud. There was no hype. No excitement. Just a clear level, a clear idea, and a plan that made sense. The price didn’t move immediately in favor — and that’s where most traders fail. They panic, they doubt, they interfere.

I didn’t.

I let the trade breathe.

Trading is not about predicting every candle. It’s about positioning yourself where the risk is defined and the reward is asymmetric. Once that’s done, your job is simple but difficult: do nothing.

Look closely at this position.

The entry was precise.

The leverage was controlled.

The liquidation was far away — not because of hope, but because of calculation.

This is what most people don’t understand about leverage. Leverage is not dangerous by default. Poor structure and emotional sizing are dangerous. When risk is managed, leverage becomes a tool — not a weapon against your account.

Another important detail: unrealized profit means nothing without discipline. Anyone can hold green numbers. Very few can protect them without becoming greedy. The moment profit grows, emotions grow faster. Ego whispers: “Hold more. Take more. You’re right.”

That’s the moment traders give back weeks of work.

Professional thinking is different.

You don’t fall in love with profit.

You don’t argue with the market.

You stay flexible.

This trade also highlights something most people ignore: time in the trade matters more than frequency of trades. One well-structured position can outperform ten rushed entries. Overtrading is usually a symptom of impatience, not skill.

And patience is a skill.

There were moments price pulled back. There were moments volatility spiked. But the plan didn’t change — because the reason for the trade didn’t change. That’s the difference between reacting and executing.

Losses will come. That’s part of the game. But trades like this don’t come from avoiding losses — they come from accepting them before entering. Risk is paid upfront. Clarity comes later.

If you’re still chasing signals, tips, or shortcuts, you’ll miss the real edge. The edge is not the entry button. The edge is how you think when nothing is happening… and when everything is happening at once.

This position is simply the result of:

Waiting instead of forcing

Planning instead of guessing

Holding instead of panicking

Thinking instead of hoping

No trade defines a trader.

But habits do.

And this trade reflects a habit I trust.

Stay sharp. Stay patient. Stay disciplined.

The market always rewards those who respect it.