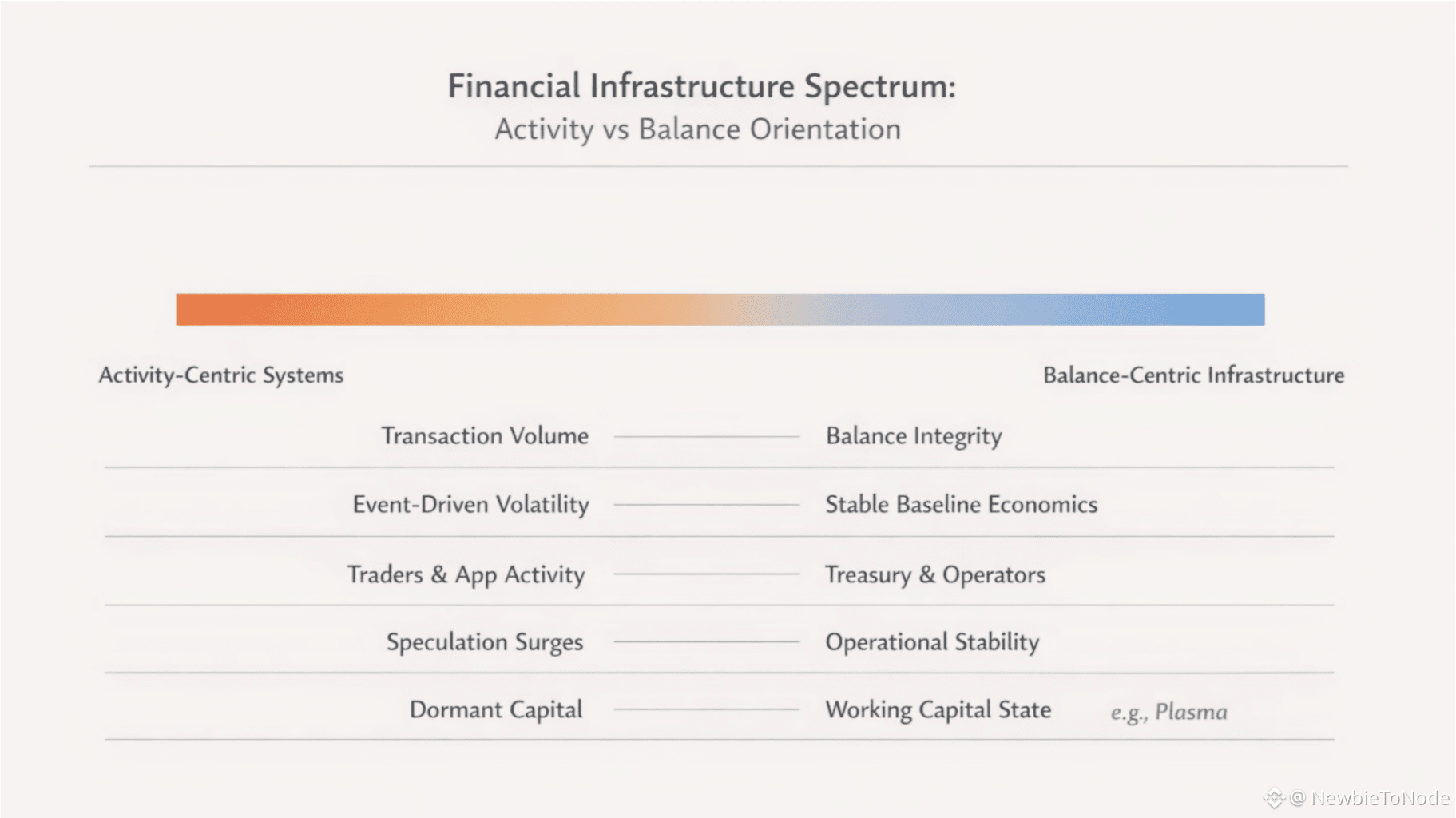

Crypto culture talks about motion all the time. Trading, staking, farming, routing, bridging, composability. Activity is treated as the proof that a system is alive. If assets are moving, value is being created. If nothing is happening, people assume nothing is working.

But most real money does not move.

It sits. In payroll accounts. In merchant balances. In treasury reserves. In settlement buffers. In working capital pools. Real financial systems are designed around this stillness. The core job of infrastructure is not to force money into constant motion. It is to keep balances safe, legible, and usable while they wait.

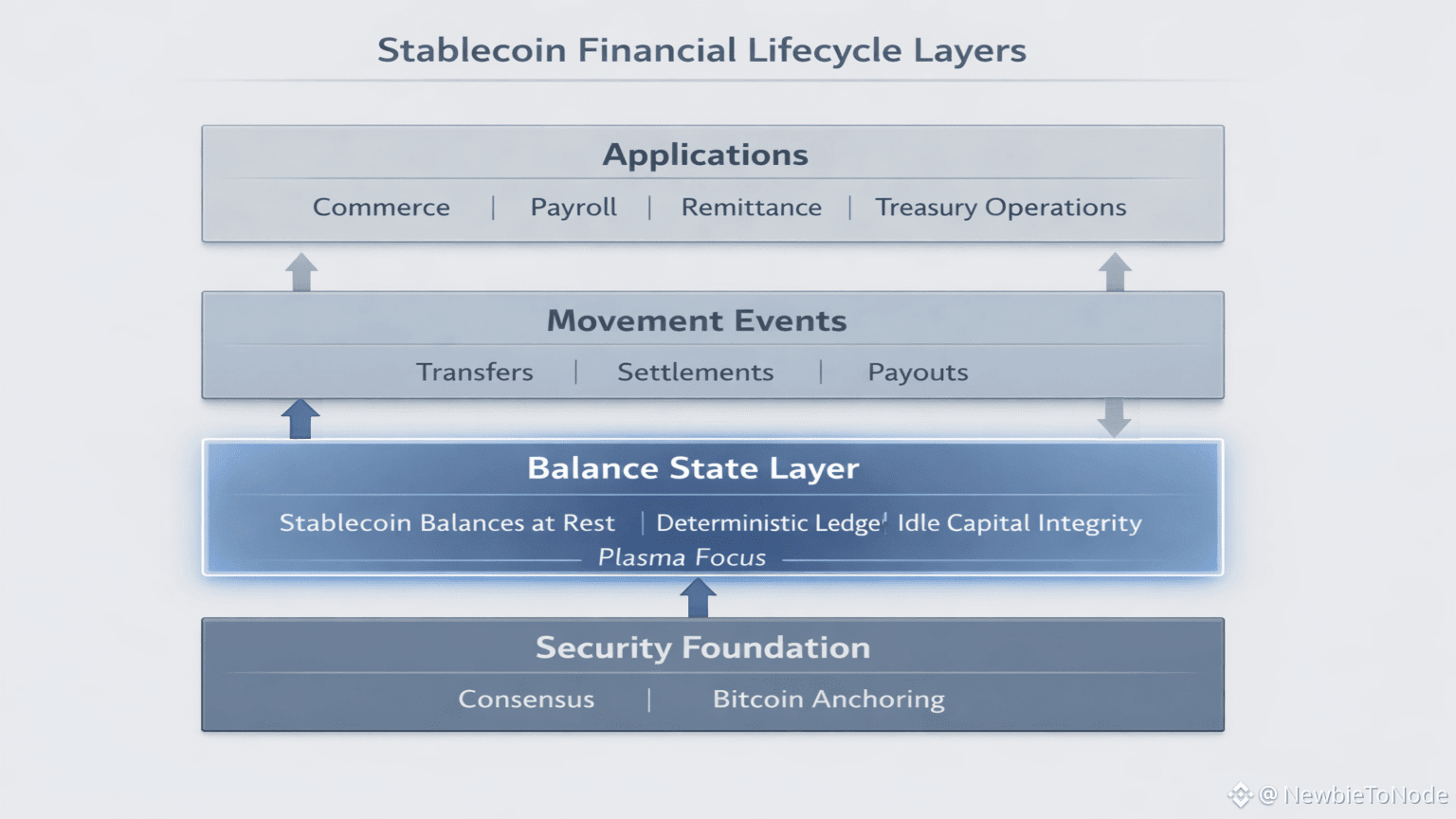

This is where Plasma makes sense from a completely different direction than most chains.

Instead of optimizing for nonstop activity, Plasma treats stablecoin balances as something that must remain reliable while idle. USDT on Plasma is not assumed to be in flight. It is assumed to be parked somewhere meaningful. A store of operating capital. A float for payments. A balance waiting for instruction from a business, not from a market.

That shift changes what performance even means.

On many networks, success is measured in throughput and transaction counts. On a settlement oriented system, success often looks like nothing unusual happening when nothing is happening. Costs do not drift. Access does not change. A balance visible yesterday behaves the same way today. Stability during inactivity becomes a feature, not an afterthought.

This logic is closer to banking infrastructure than to typical crypto platforms. Most money in banks is not constantly in transit. Systems are built so idle balances remain predictable, auditable, and ready. Movement is the exception. Stability is the baseline.

Plasma’s stablecoin first design fits that pattern. When USDT transfers are treated as core behavior, the surrounding environment begins to resemble financial plumbing rather than a marketplace. Zero fee transfers are not just about cheapness. They remove the mental overhead of maintaining gas balances just to hold funds. Doing nothing becomes safe.

Deterministic finality reinforces this model. Once a balance changes, its state is clear. But equally important, when a balance does not change, that state remains dependable. There is no sense that inactivity carries hidden risk because unrelated activity elsewhere on the network suddenly spikes.

That separation matters more than it sounds.

On general purpose chains, every workload shares the same environment. Speculative bursts, token launches, or trading waves can affect costs and conditions for basic transfers. Infrastructure behaves like a shared event space. On a settlement focused design, the goal is different. Routine financial use should not inherit volatility from unrelated behavior.

This changes adoption dynamics. Organizations are less interested in chains that promise constant novelty and more interested in rails that do not surprise them. If a balance behaves consistently across reporting cycles and across months, confidence builds. Infrastructure that supports stillness earns trust quietly.

There is also a behavioral dimension. Systems that constantly encourage movement create urgency and reaction. Systems that support stable balances encourage planning and structure. One favors speculation. The other favors operations.

Plasma clearly leans toward the second.

That does not mean activity disappears. Payments, payroll, settlements, and treasury flows still occur. But the baseline assumption is that money exists between events. Infrastructure is there to protect that interval, not just accelerate the moments of transfer.

This framing rarely gets attention because it sounds unexciting. But financial infrastructure is supposed to be unexciting. It should be dependable while idle and predictable when used.

If stablecoins are becoming working capital for the internet, most of their life will be spent not moving. A system designed for that reality looks different from one built for perpetual motion.

Seen through that lens, Plasma is not trying to make money more active. It is trying to make money more comfortable staying put until it is needed.

That is a different definition of performance. And it looks a lot like infrastructure growing up.