XRP came under sharp pressure on Jan 31, sliding nearly 7% to around $1.75, after a broader, bitcoin-led selloff triggered heavy long liquidations across the derivatives market. The move was driven by positioning and leverage , not token-specific news , highlighting how fragile price action can become once key technical levels fail.

What happened?

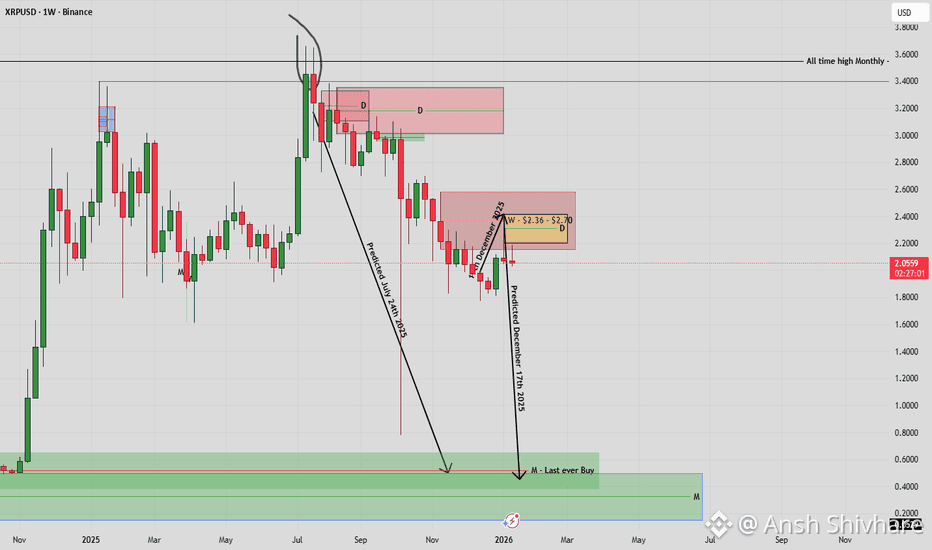

The selloff accelerated after XRP lost the $1.79 support, a level that had previously held multiple pullbacks. Once broken, stop losses and forced liquidations cascaded rapidly, pushing price to an intraday low near $1.74.

Derivatives data showed over $70 million in XRP futures liquidations, overwhelmingly from long positions. This suggests the market was heavily crowded on the bullish side, amplifying downside once selling began.

Broader market context

XRP’s decline mirrored weakness across the wider crypto market, with bitcoin leading risk-off moves. High-beta tokens like XRP tend to react more aggressively during such periods, especially when leverage is elevated.

Importantly, there was no negative XRP-specific catalyst. The move was purely structural , a reminder that in leveraged markets, price often moves due to positioning rather than news.

Technical breakdown: support flips to resistance

From a technical standpoint, the breakdown below $1.79 was decisive:

XRP fell from $1.88 → $1.75

Volume surged during the drop, signaling forced selling

A weak bounce stalled below $1.76, with fading volume

Former support at $1.79–$1.82 has now flipped into resistance

This behavior points to stabilization, not reversal, at least in the short term.

What traders are watching next

Traders now see $1.74–$1.75 as the immediate “line in the sand”:

✅ If $1.74 holds: XRP may consolidate as liquidation pressure fades, but bulls must reclaim $1.79–$1.82 to neutralize downside risk.

❌ If $1.74 breaks: downside opens toward $1.72 and $1.70, where momentum could accelerate again.

Until leverage resets and bitcoin stabilizes, XRP remains liquidation-sensitive, with technical levels , not headlines , driving price action.