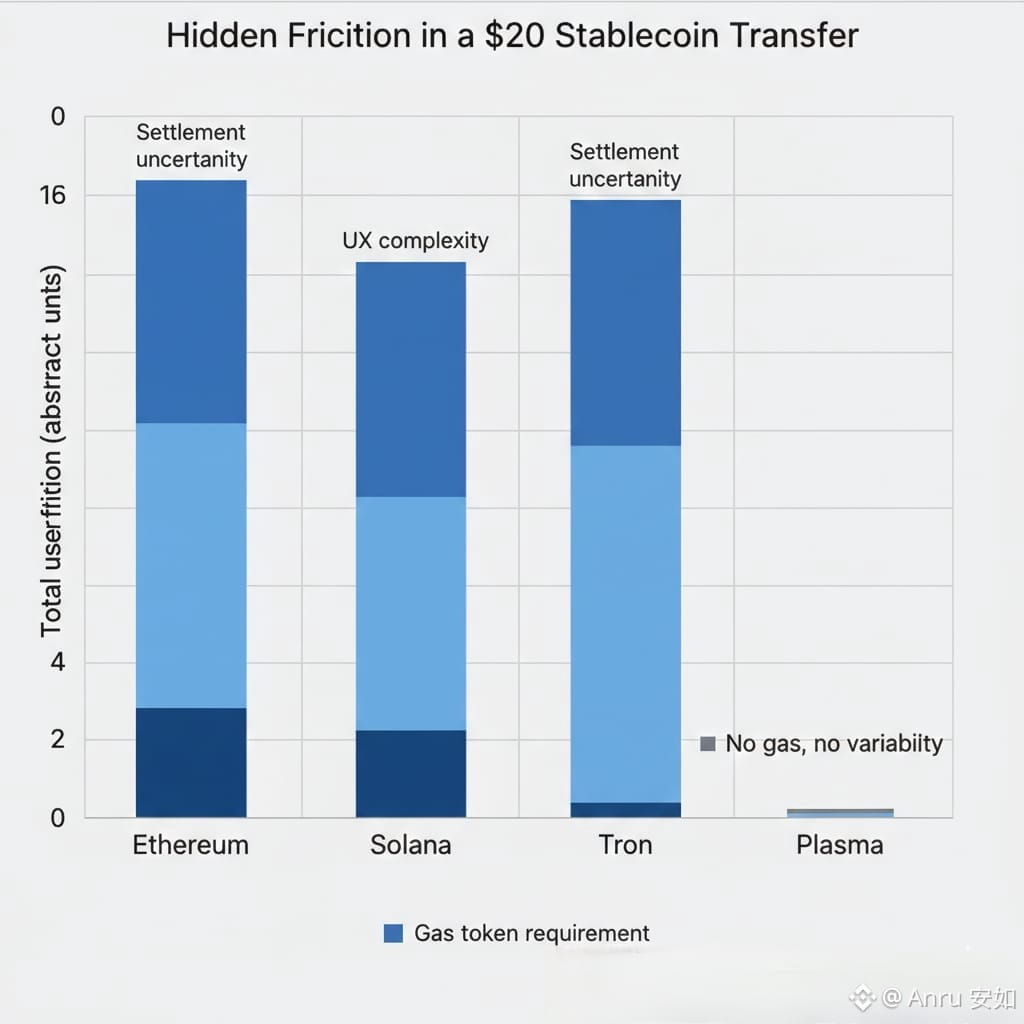

Majority of blockchains attempt to be all things, payments, DeFi, NFTs games, identity, even a world computer. Plasma takes a sharper focus. It begins with the fact that the stablecoins such as the USDT already serve as the dollar of the internet. Time to save, send and settle across boundaries, and yet the infrastructure is still cumbersome. You tend to incur an extra gas payment, charges are higher at peak times, and sending money is like a developer console.

Majority of blockchains attempt to be all things, payments, DeFi, NFTs games, identity, even a world computer. Plasma takes a sharper focus. It begins with the fact that the stablecoins such as the USDT already serve as the dollar of the internet. Time to save, send and settle across boundaries, and yet the infrastructure is still cumbersome. You tend to incur an extra gas payment, charges are higher at peak times, and sending money is like a developer console.

Plasma is a Layer-1 constructed to deal with the pain in question. It is stable-coin infrastructure to make global and high volume payments, and it is entirely EVM-compatible to allow developers to continue using the tools familiar to them.

The thesis: Cryptocurrency hype is not guaranteed to the users of stable coins.

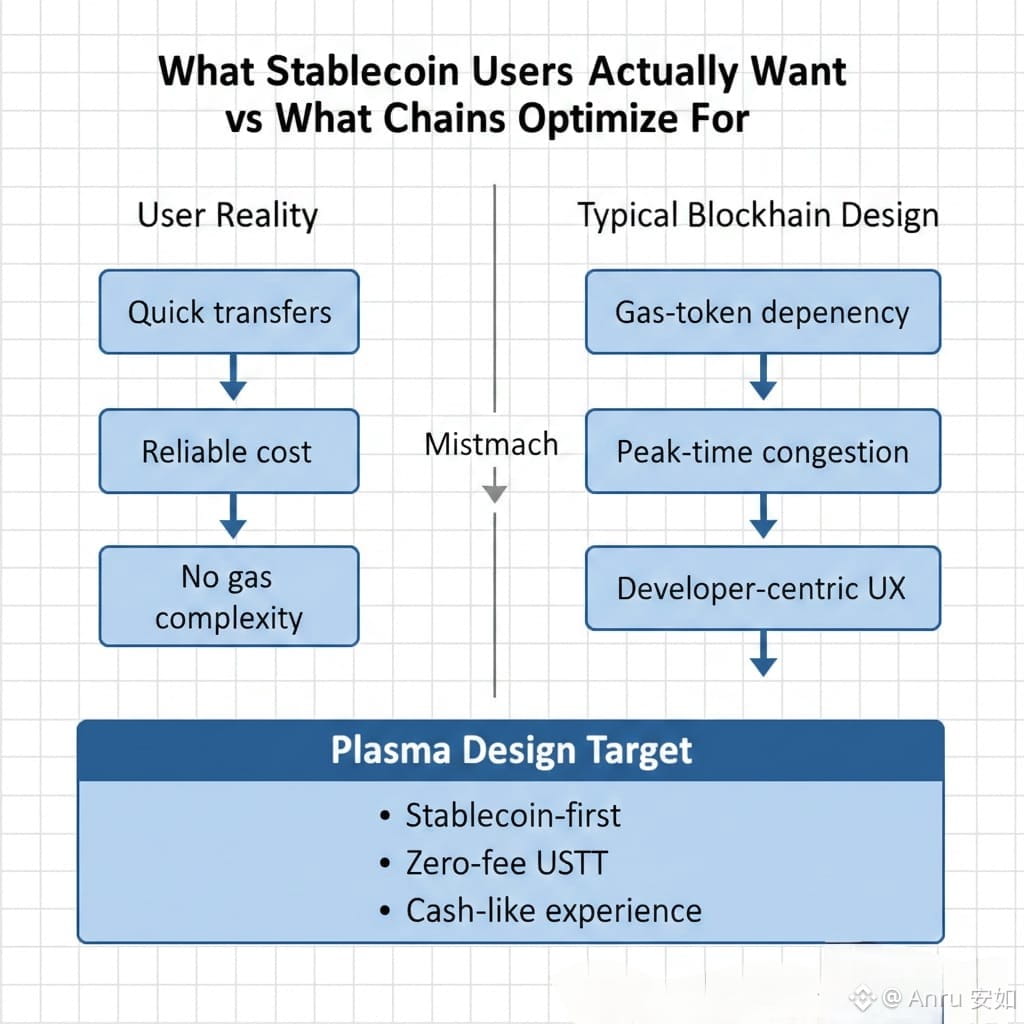

Individuals do not jump out of bed in need of gas tokens. They desire three things; quick transfers, reliable cost, and money free of drama. The usage of stable-coins is already enormous since it has price stability and is global, yet most networks are not yet optimized to use stable-coins in the first place.

The basic concept of plasma has it that in the case that stable-coins are becoming common internet money, the chain underneath them must handle transfers of stable-coins as first-class, not as an experiment in the token slot. This is the reason Plasma advocates a design of a stable coin-native instead of a generic trade-off.

Free transfer of USDT is not a marketing gimmick, but rather a matter of design.

In the title of Plasma, the pledge of a series of no-fee USDT transfers embedded within the chain is contained. The point isn’t just “cheaper.” It’s eliminating a mental tax. Stable-coins seem like non-transparent applications rather than money when the user needs to have ETH, TRX, or SOL on standby “just in case.

This is important because, as explained in the documentation of Plasma, fee friction prevents the adoption of stable-coins, particularly in small or frequent transactions. Elimination of fees makes wallets avoid the complexity of gas-tokens and enables micro-payments, and commerce flows to be realistic.

The longer term is to ensure that stable-coins will be perceived as a utility rather than an investment product. Normal payments will result in natural growth in usage, a dull but more sustainable growth over time.

The compatibility between EVM and payments to programmable money reduces the gap between payment and programmable money.

Payments alone aren’t enough. A stable-coin rail will be powerful in the case of being programmable. That is why Plasma embraces complete EVM support: it attracts the biggest developer ecosystem and provides the available apps with a smooth way into deployment.

The economic future of the stable-coin economy does not look like a version of send USDT. It consists of payroll which is divided into savings, merchant tools which are settled immediately, subscriptions which enforce money back and global marketplaces which escrow money with simple rules. Stable-coin movement becomes programmable money whilst still being compatible with EVM, without compelling developers to reinvent the wheel.

It is the story of trust and not vibes that is anchored to Bitcoin.

It is simple to pitch speed, but difficult to trust.

The security model with which Plasma reiterates the connection to Bitcoin is a so-called trust-reduced Bitcoin bridge that allows the use of BTC in smart contracts. Bitcoin secures the chain of permanence and neutrality.

The purpose of Plasma can be stated as follows: take the battle-proven brand of Bitcoin and create a chain of payments that users will experience as something contemporary, fast, and easy to develop. Details are arguable, but the fundamental logic is straightforward: in case stable-coins are going to be taken seriously as money, we require to have the best settlement and security narratives.

XPL: it is not simply gas, but a payments economy coordination tool.

XPL is the native token of plasma, the network token of transaction and validator rewards such as the base assets of other chains.

A base token plays a vexed part in a stable-coin-first world. The users desire to exist in the stable-coins, however the network requires incentives, security payments and governance systems. XPL serves that purpose: that is maintaining the stable-coin rail plausible instead of causing a price frenzy.

This is the reason why it is possible to have zero fee stable-coin transfers and utility of tokens. Plasma is not asserting that the network is free to use, but insists that the charge load does not befall a person sending his or her relatives 20. Security and infrastructure costs are managed with the help of the validator economics, network design and monetizing non-core activity.

Actual adoption cries are much more than slogans.

One method to rank infrastructure projects is based on who is early integrating. Custody and settlement partners have less appreciation of retail hype and more of reliability. Cobo, one of the largest providers of digital-asset custodians, announced an integration, which put Plasma and its lifetime stable-coin transfer cost 0 in the spotlight and made it a stable-coin payment chain, referring to USDT0 in the statement.

Take this as an actual indicator Plasma is playing to win the game of plumbing layer. Adoption of plumbing layers is usually initiated by institutions, custodians and payment-style workflows, and then made apparent to the end users.

The most important question is whether Plasma is able to make stablecoins transparent.

This is how Plasma Will reposition itself as a pro. It is not intended to persuade the world to open a new chain, rather it conceals the chain behind a basic user experience: open a wallet, transfer digital dollars, that is all.

The educational content created by Plasma focuses on usefulness and rapidity: almost instant confirmations, a coin-first approach, and the transfer of the USDT fees.

Provided the success, Plasma will not appear as the other successful stories in crypto. It will resemble down-to-earth money on the run. This is why the opportunity is important: the majority of international payments remain slow, expensive, and limited to the region. The global issue has already been dealt with by stablecoins. The easy part is addressed by plasma.

What could then go wrong and why that still does not kill the thesis.

Critical educational article should provide the risks in the open.

To start with, a stablecoin-first strategy is also one that is stablecoin-dependent. Should regulation, issuer policy or market structure change around USDT, a chain constructed around it will need to change rapidly. In plasma, a more inclusive stablecoin strategy is involved, although USDT still comes first.

Second, the free transfers cause a sustainability concern. Although users may not pay anything, someone will have to pay spam protection and incentives to validate. The solution provided by Plasma will be based on the idea of architecture and token economics, yet the balance over time will be tried in real network settings, rather than on blog posts.

Third, competition is real. USDT transfers are dominated today by Tron and other fast chains and L2s continue to be enhanced. The plasma bets on specialization to be superior over generalization as the market becomes established.

All these risks do not eliminate the main concept they only increase the standards. That is healthy. Money rails is not a meme, it is infrastructure and has to qualify as infrastructure.

Why Plasma is worth the attention of the builders and serious users.

Plasma is interesting in that it tries to enable stablecoins to behave as a real internet-layer of payment. It has such features as stablecoin-First contracts, a fee-free transfer of USDT, programmability using EVM, a security story associated with the credibility of Bitcoin.

Novelty is not the true value but focus. Attention in crypto is scarce and it is generally stronger than newness.