In the world of crypto, optionality is often treated as an unquestionable benefit. More features. More composability. More choices. More ways to route, stake, bridge, wrap, unwrap, and optimize. Flexibility is seen as progress, and systems that don’t accommodate everything are frequently labeled as restrictive.

This logic works well in environments designed for experimentation. However, it doesn’t hold up when the system is expected to handle money. Money behaves differently from software. It is not a tool for exploration—it is repetitive. It flows through established, daily paths: payroll, settlements, treasury transfers, remittances. In these scenarios, optionality doesn't feel like empowerment—it feels like a risk.

Each added choice introduces uncertainty. Every alternative execution path is another point of potential failure. When value is speculative, this risk may be tolerable. But when that value represents payroll, invoices, or reserves, the stakes are different.

Many blockchains prioritize optionality because that’s what early users wanted. Traders want flexibility. Developers crave expressiveness. Protocol designers prefer to avoid early commitments. Over time, these priorities create systems that excel at adapting but struggle to deliver consistency.

Stablecoins reveal this flaw more sharply than any other asset class. While they are already used as money, they still function within ecosystems designed for optional behavior. Fees vary based on unrelated activities. Finality is dependent on network conditions. Users face decisions around speed, cost, and certainty every time they transfer value. Traditional payment systems don’t have this problem because their settlement infrastructure is designed to eliminate these choices.

Plasma takes a different approach. Instead of maximizing optionality, it intentionally limits it. This isn’t because optionality is inherently bad, but because it comes at a cost. Predictable systems require discipline—saying no to edge cases, absorbing complexity at the protocol level instead of burdening users with it. This tradeoff is often unpopular but becomes crucial when money is involved.

Take gasless stablecoin transfers, for example. By removing the dependency on native tokens, a whole category of decisions is eliminated for users. There’s no need to worry about exposure, balance wallets, or time transactions around price fluctuations. Value moves without hesitation. This isn’t just a user experience shortcut—it’s a reduction in systemic risk.

Finality follows a similar principle. In flexible systems, finality is something users must interpret and understand. In payment systems, finality is assumed. Plasma guarantees finality rather than estimating it, reducing uncertainty instead of expanding it.

Even Plasma’s choice of compatible execution environments reflects this philosophy. Using familiar systems reduces unpredictability. Developers know how these systems fail, recover, and perform under pressure. The novelty may be sacrificed, but stability is prioritized.

Anchoring security to Bitcoin further enforces this restraint. It restricts how much the system can adapt to internal pressures or external shifts. This lack of flexibility is often criticized in fast-moving markets, but in the realm of financial infrastructure, it’s usually seen as an advantage.

The core message is not that optionality is inherently bad. The issue is that optionality has a price—and that cost is often borne by users who never requested it.

As stablecoins become more integrated into real-world economies, infrastructure will be increasingly evaluated by what it removes rather than what it enables. Fewer decisions. Fewer surprises. Fewer assumptions.

Plasma is moving in that direction. By narrowing its focus and accepting constraints, it views money movement as something that should be routine, reliable, and predictable.

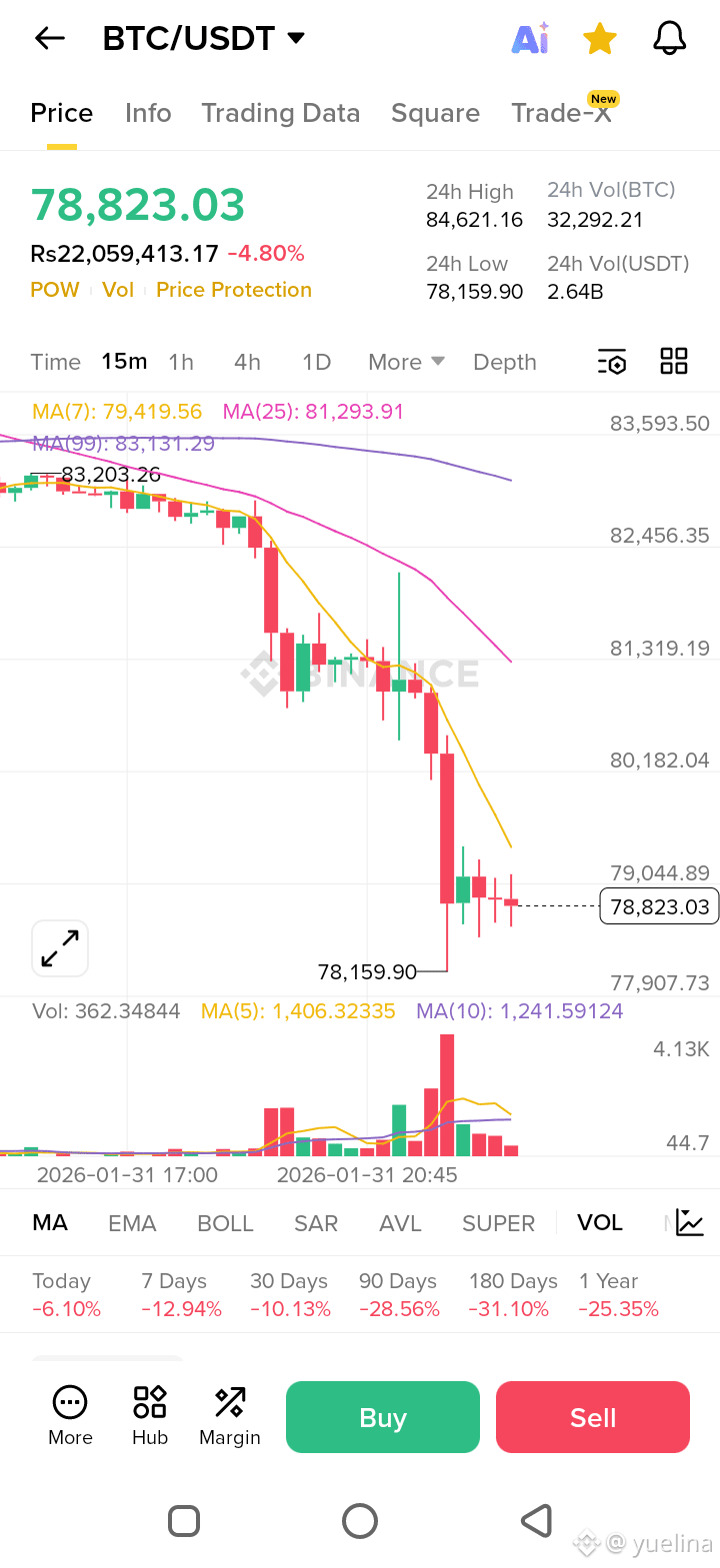

In finance, systems that perform consistently tend to outlast those that promise endless possibilities.Btc crashed