We are past the point where a new blockchain can succeed by just offering cheaper blockspace or faster transactions. The narrative has shifted, especially with AI demands. The real question is no longer about hypothetical technical specs, but about what actually works today. What does a chain do when an AI agent needs to remember, reason, and act autonomously. My review of Vanar Chain suggests its answer is not a roadmap promise it is a set of live products already handling these tasks. This moves the conversation from marketing to mechanics.

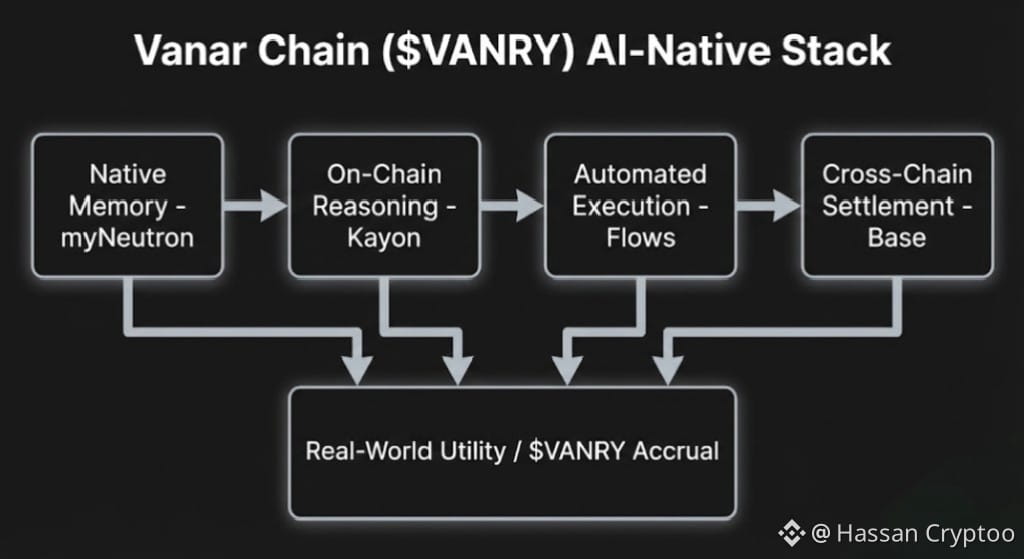

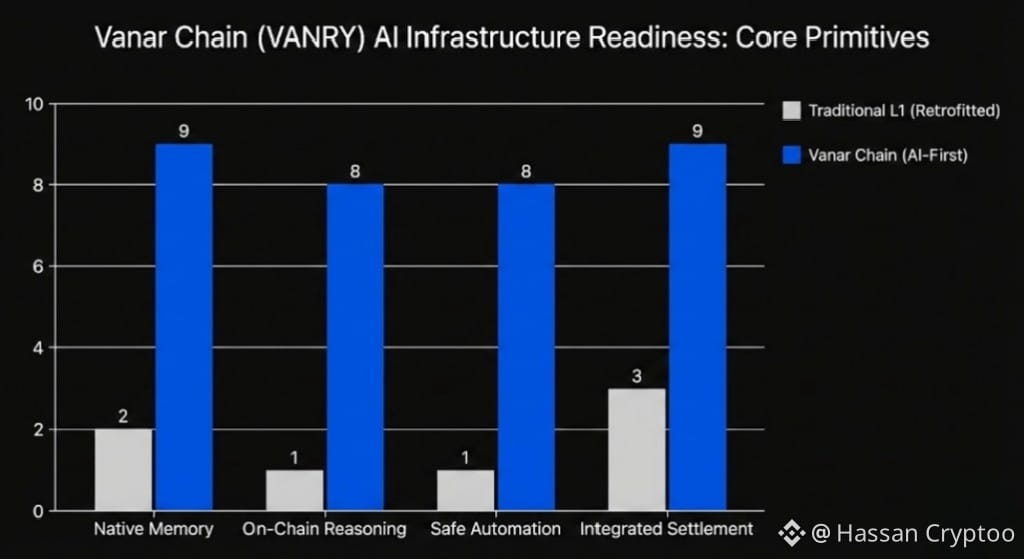

Vanar calls itself an AI first L1. That term gets used everywhere now, often to describe a chain that has simply added an AI tooling SDK to its existing structure. In my view, that is AI added, not AI first. The distinction is operational. An AI first infrastructure is designed with the assumption that non human, intelligent agents will be primary users. Their needs native memory, verifiable reasoning, secure automation, and seamless settlement are not afterthoughts. They are the foundation. Scanning Vanar ecosystem, you find products built on this foundation, myNeutron, Kayon, and Flows. They are not demos, they are functional applications that, when examined, clarify what "AI ready" truly means.

Take myNeutron. It is described as a decentralized memory protocol. For an AI, memory is not just storage, it is context. Traditional blockchains are stateless by design, which is efficient for simple transfers but crippling for an agent that must learn from past interactions. myNeutron attempts to solve this by giving AI agents a persistent, on chain state they can write to and recall from. This is not a feature bolted onto a smart contract. It is a core primitive, suggesting the underlying chain architecture was considered with this write read cycle as a frequent operation. Without this, an AI agent on chain is essentially starting from zero every time it interacts, which is not useful.

Then there is Kayon, focused on on chain reasoning and explainability. Anyone who has used a large language model knows the "black box" problem you get an output, but the logical steps are opaque. In financial or automated environments, that is unacceptable. Kayon premise is to make an AI reasoning traceable and verifiable on chain. This tackles a massive barrier to trust and compliance. If an AI makes a decision to execute a trade or sign a contract, being able to audit its logical pathway is non negotiable for enterprise adoption. Kayon existence indicates Vanar stack includes layers for generating and validating these proof of reasoning logs, which is a deeply specialized need.

Automation is handled by Flows. It is a platform for creating and managing automated on chain workflows. Again, this speaks directly to an AI agent future. An intelligent agent does not want to manually approve every single step, it needs to define a set of rules and let the system execute them securely. Flows provides the framework for this, connecting different actions and conditions. The product demonstrates that automation is treated as a native capability, not something requiring a patchwork of external tools. When you look at these three products together memory, reasoning, automation they form a coherent stack. One product addresses an AI need for history, another for transparent logic, and a third for autonomous action. This triangulation is what makes Vanar "AI first" claim more tangible than most.

The recent expansion to Base, an Ethereum L2, is a critical piece. AI agents cannot be confined to a single chain. They need to access liquidity, data, and users across ecosystems. By being natively available on Base, Vanar infrastructure is positioned where users already are. This cross chain availability is not just about business development, it is a technical requirement for scalable AI utility. An agent using myNeutron for memory should be able to act on that memory wherever the relevant opportunity or data exists. This move significantly broadens the potential utility surface for $VANRY beyond its own native chain.

Speaking of $VANRY, its role ties these products back to the chain economic layer. The token is described as powering the chain. Operationally, this translates to transaction costs on platforms like myNeutron, Kayon, and Flows being processed using $VANRY. A rise in the user base for these artificial intelligence-focused applications should, in turn, drive greater demand for the token, as it is necessary to power their fundamental transactions. This represents a value accrual model rooted in practical use within a focused, rapidly expanding sector, not purely speculative trends. Reviewing the current price action, $VANRY is moving inside a specific range. Trading volume behavior hints at gathering near foundational price zones, indicating a market that is still weighing this utility proposition against wider cryptocurrency sector trends.

This brings us to a fundamental point. The crypto space is littered with chains that launched with a vision but no proof of product market fit. Vanar differentiator is that it is attempting to prove fit concurrently with infrastructure development. myNeutron, Kayon, and Flows are the proof of concept, running live. They validate the infrastructure design by showing it can support the applications it was built for. The emphasis on developers and tangible implementations within the team's established sectors entertainment, gaming, and brands forms a more convincing story than a standalone technical document.

Ultimately, the vision for an AI era blockchain will not be won by the chain with the highest theoretical TPS. It will be won by the chain that proves it can best host the intelligent agents and applications that define the next computing paradigm. Vanar approach of building and launching its own flagship products its own "killer apps" is a bold strategy. It does not just sell the blockspace, it demonstrates exactly what that blockspace is for. Whether this leads to dominance is uncertain, but it provides a concrete, technical basis for evaluation that goes far beyond hype. The products are the proof.

by Hassan Cryptoo