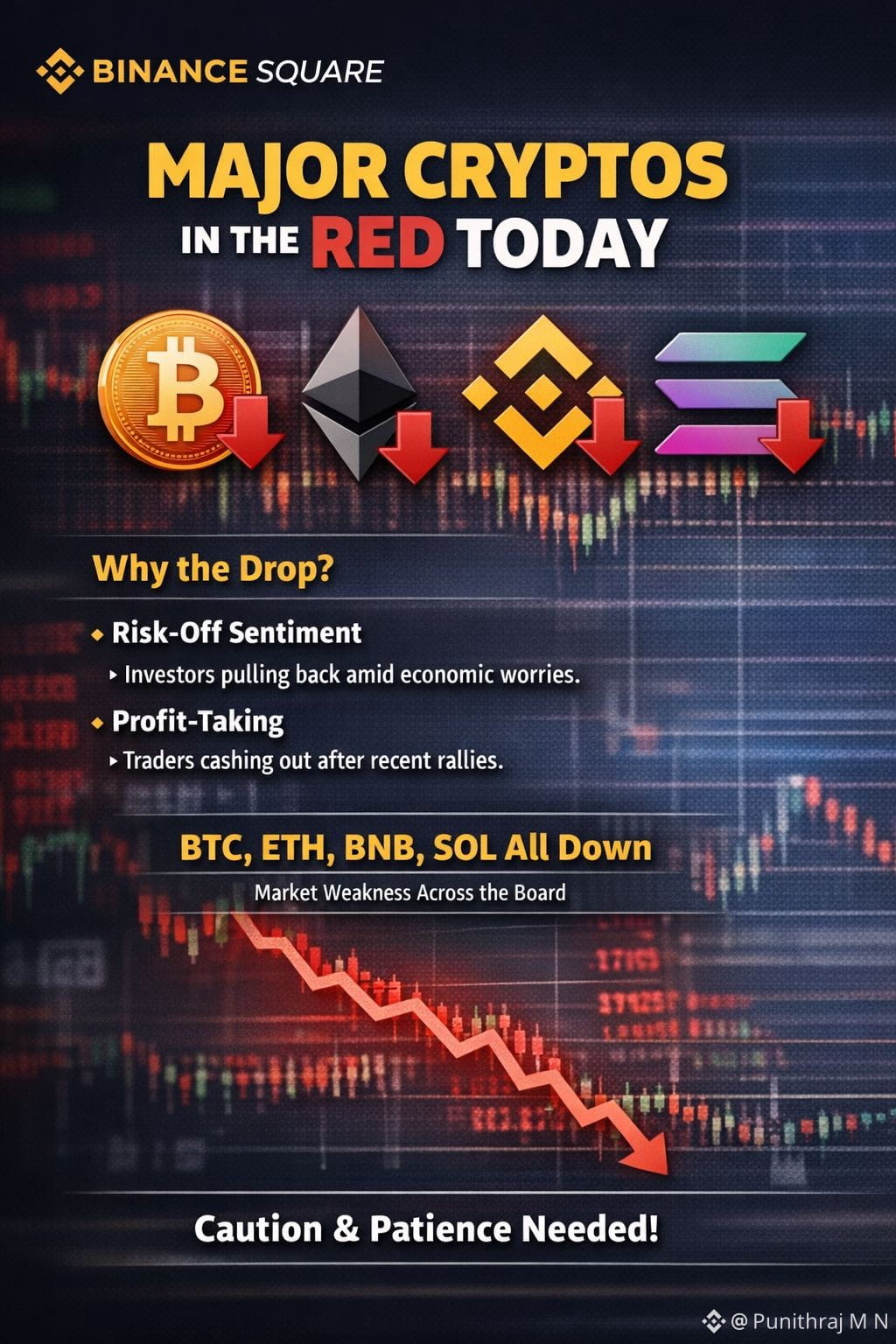

Today, the cryptocurrency market experienced a broad pullback.$BTC ,$BNB , $BNB , and Solana (SOL)all saw notable declines, reminding investors how volatile even major tokens can be.

📊 Market Snapshot:

BTC: Dropped below key support levels, reflecting broader risk-off sentiment.

ETH & BNB: Declined alongside BTC, showing how tightly altcoins move with Bitcoin.

SOL: Followed the downward trend, underlining that no token is isolated from market swings.

Overall sentiment: Trading volume is down, and market capitalization across crypto is shrinking as investors pause and rethink positions.

Why the Drop?

Macro Uncertainty & Risk-Off Behavior: Global economic concerns, including speculation over interest rate adjustments and liquidity tightening, have investors seeking safety in less volatile assets.

Profit-Taking After Recent Rallies: Many traders are locking in gains after a strong run-up in the past weeks, leading to short-term selling pressure.

Liquidity Pressure: Outflows from staking products, ETFs, and institutional portfolios have reduced upward momentum in the market.

What It Means for Investors:

The pullback is not a signal of long-term failure, but it tests patience.

Small investors should consider batch buying rather than going all-in, as timing the bottom is always risky.

Watch key support levels for BTC and ETH — these are often guides for market sentiment.

Bottom Line:

The crypto market is volatile, and today’s drop shows the importance of risk management, patience, and following fundamentals rather than short-term hype. While BTC, ETH, BNB, and SOL are all down, this could also present opportunities for strategic investors who understand the market cycle.