Everyone’s pointing fingers at different things —

🌍 geopolitics, 🏦 the Fed, 📉 macro headlines…

But when you actually look at on-chain data + derivatives flows, the answer is much clearer 👇

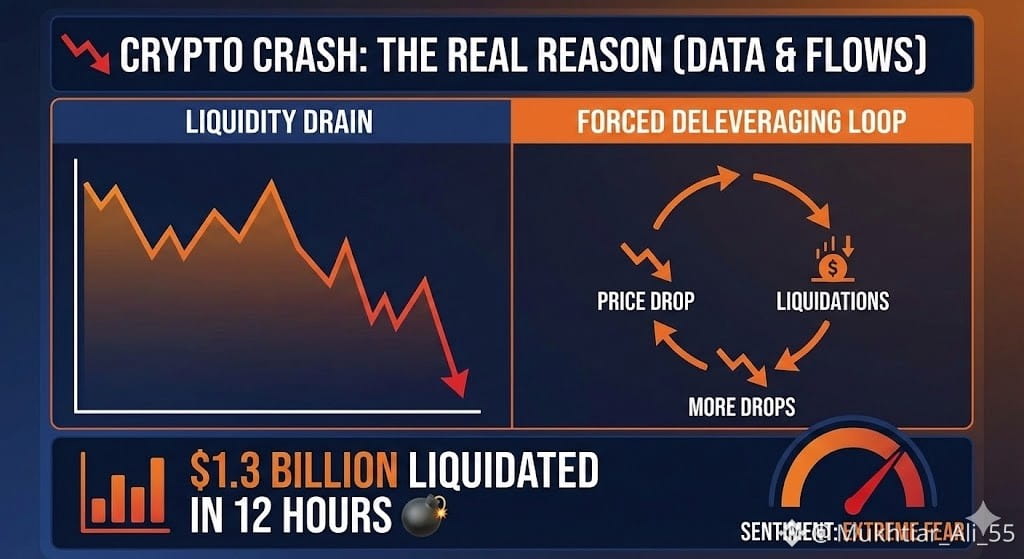

🧠 This Is a LIQUIDITY Problem — Not a Narrative Problem

❓ Why is Bitcoin below $79,000?

👉 Because liquidity disappeared at the worst possible time.

⏱️ In the last 12 hours, the market absorbed THREE major liquidation waves, totaling around $1.3 BILLION 💥💣

🚫 This was not organic selling.

⚠️ This was forced deleveraging.

⚠️ High Leverage + Thin Liquidity = Price Air Pockets

Crypto liquidity has been uneven and fragile lately 🌊

But leverage stayed dangerously high 📈

That combination creates price air pockets 💨

🔻 One push down → liquidations trigger

🔻 Liquidations push price lower

🔻 Lower price triggers MORE liquidations

🔁 A brutal feedback loop

This is why moves feel sudden, violent, and exaggerated ⚡😵

🐑 Sentiment Is POURING Fuel on the Fire

Crypto is an emotion-driven market ❤️🔥

Right now, sentiment is flipping fast:

😄 Extreme bullishness

⬇️

😨 Extreme bearishness

When positioning gets crowded on one side, even small moves explode 💣

📌 Price doesn’t move on opinions

📊 It moves on positioning + liquidity

📊 What This REALLY Means for Traders

🚫 This is NOT a “crypto is dead” moment

🔄 This is a liquidity reset

What’s happening:

🧨 Excess leverage getting flushed

🐑 Weak hands forced out

📈 Volatility expanding

These environments reward traders who:

🧘♂️ Stay patient

🛡️ Manage risk properly

🎯 Exploit emotional overreactions

🎯 Final Take

❌ Not about Iran

❌ Not about headlines

❌ Not about fear narratives

This move is about:

💧 Liquidity gaps

🧨 Overleveraged positions

🐑 Herd psychology

📌 Extreme emotion creates opportunity — if you know how to read it.

Stay sharp. 🔍💪

#Market_Update #MarketCrashAlert