Introduction and why the chart alone is an incomplete diagnosis

A persistent downtrend after a token launch usually triggers a simple conclusion: the launch was mispriced, the product was not ready, or incentives were misaligned. That conclusion can be directionally correct, but it is not yet an analysis. A research grade read separates three layers.

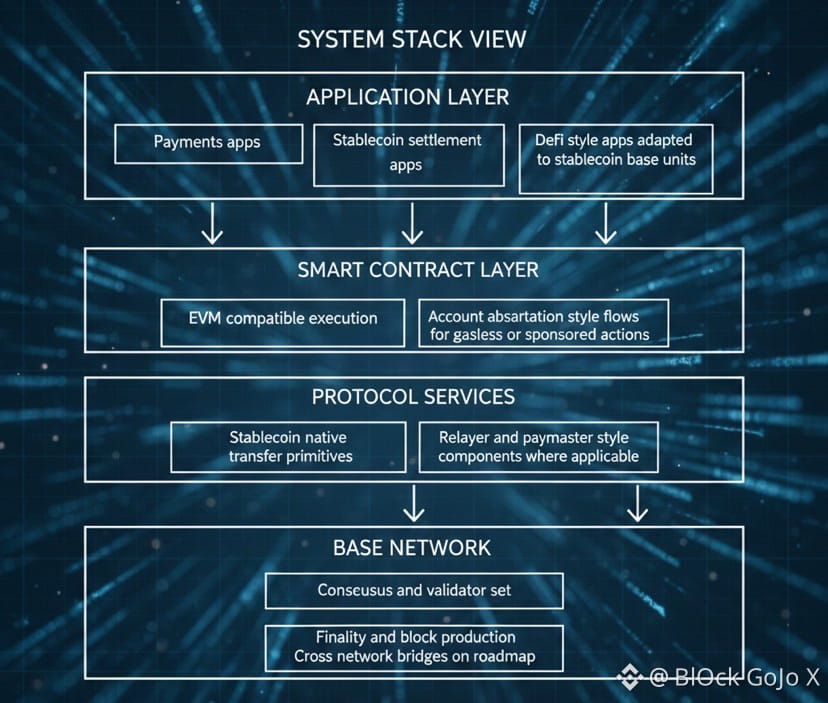

First layer is market structure. Early liquidity is thin relative to supply that can reach exchanges, so marginal selling pressure can dominate for months. Second layer is execution reality. Mainnet beta often means core functionality exists, but reliability, tooling, and integrations lag. Third layer is economic design. If the token is not required for the primary user action, demand must come from security, staking, or governance, which can be slow to materialize.

Plasma has been positioned as a stablecoin focused network, and the available public documentation and network data show a clear emphasis on stablecoin native mechanics and EVM compatibility, alongside a staged rollout of validator and staking architecture.The question is whether that product direction is converting into adoption and durable value capture faster than supply and incentive driven selling.

1. Launch timeline and what it implies for market behavior

A key anchor is timing. Plasma’s mainnet beta and token generation event have been reported as occurring on September 25, 2025. From a market microstructure perspective, that places the asset in the typical post TGE window where price discovery is dominated by:

1. early participants taking profit or rotating

2. liquidity providers adjusting risk

3. unlock schedules becoming a focal point for expectations

4. narratives resetting from announcement to delivery

Price aggregators currently show the asset trading far below its peak and near its historical lows, which is consistent with heavy post launch repricing rather than a single event collapse.This matters because a long decline can be driven by supply and positioning even if product metrics improve. The reverse is also true: a temporary bounce can happen with weak fundamentals.

2. Technical foundations: what exists today and what is still being built

A practical way to evaluate a network is to map what is explicitly documented, what is observable on chain, and what is implied by roadmap language.

2.1 Execution environment and compatibility

The documentation positions Plasma as EVM compatible, which lowers developer switching costs by allowing familiar tooling and smart contract patterns.EVM compatibility is not itself a differentiator in 2026. Its value depends on performance, fee model, and integration depth with stablecoin payment flows.

2.2 Stablecoin native mechanics

The docs emphasize stablecoin oriented design choices and a gas model aimed at stablecoin usage, including mechanisms that can support gas abstraction patterns.For adoption, this is the central thesis: if stablecoin transfers can be made cheap, predictable, and operationally simple for apps and wallets, the network can target real payments and settlement use cases rather than purely speculative activity.

2.3 Consensus, staking, and decentralization trajectory

Public commentary and update notes point to staking and committee formation as active development areas rather than fully settled.That is a double edged signal. It suggests the team is still iterating on security and governance, but it also means the strongest value capture narrative for the token, often staking tied, may not be fully online yet.

3. Ecosystem updates: what to look for beyond announcements

Ecosystem progress is often over stated via partnership lists and marketing. A stricter approach uses three filters:

Filter one: composable infrastructure shipped

Filter two: independent app teams building and deploying

Filter three: user activity that does not depend on short term incentives

The network explorer shows a large cumulative transaction count and a current throughput reading, which indicates the chain is being used at scale in raw transaction terms.But transaction volume alone is insufficient, because it can be driven by internal operations, automated flows, or short lived farming behavior. What strengthens the signal is persistence over multiple weeks, distribution across addresses, and growing contract variety. Those require deeper on chain analysis than a single dashboard snapshot, but the baseline is that activity exists and is not negligible.

A second ecosystem angle is bridge functionality. Update summaries reference a planned or progressing bridge activation into a Bitcoin anchored asset flow, which would matter for liquidity and collateral diversity.The key is not the announcement, it is whether the bridge becomes a reliable liquidity rail used by third party apps and market makers.

4. Adoption signals: what counts as real usage in a stablecoin first network

If Plasma is optimized for stablecoin movement, then the strongest adoption evidence usually appears as:

1. consistent stablecoin transfer volume

2. repeated usage from the same cohorts, meaning retention

3. wallet and payment integration count increasing

4. merchant or payroll or settlement like patterns, meaning predictable intervals and ticket sizes

Without naming external providers, you can still track these patterns by observing:

Address clustering and repeat behavior

Share of transactions that are simple transfers versus contract interactions

Gas sponsorship usage frequency if it is visible on chain

Block time stability and failure rate in peak periods

The explorer indicates very fast block cadence around one second and a multi month transaction history, which supports the claim that the network is optimized for high frequency settlement.If this performance is stable under load, it supports payment oriented use cases. If it degrades or requires centralized intervention, adoption will stall.

5. Developer trends: the make or break factor after a down only chart

Price can fall for a long time while a developer base grows. But a developer base rarely grows if documentation, tooling, and reliability lag. For a new EVM compatible chain, the most relevant developer indicators are:

Time to first contract deployment

Availability and stability of RPC endpoints

Clarity of fee and gas abstraction model

Indexing and explorer tooling quality

Presence of grants or structured onboarding

The docs provide structured sections for getting started, bridging, explorer access, and tokenomics, which suggests the project is investing in developer experience.The remaining question is whether independent teams are committing to mainnet deployments. That can be assessed by tracking new verified contracts, unique deployers, and sustained contract calls over time.

In many ecosystems, the early phase is dominated by internal teams and affiliated builders. A healthier signal is when unrelated teams choose the network because the stablecoin first primitives reduce cost and friction for their product.

6. Economic design: supply, distribution, and where token demand can come from

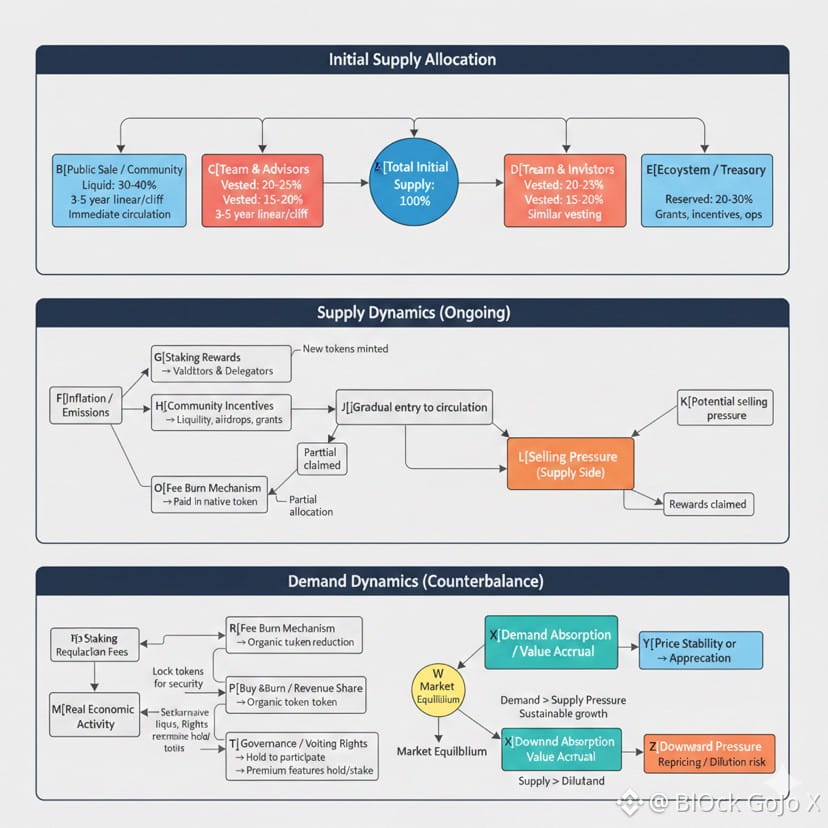

A downtrend following launch often correlates with an economic design where supply unlocks are visible and demand is not yet structural.

6.1 Distribution and categories

The tokenomics documentation breaks out allocations including ecosystem and growth, team, investors, a public sale, and validator network elements.The most important point for market behavior is not the category labels but the release mechanisms: cliffs, linear vesting, and any inflation schedule.

6.2 Unlock schedule and expectation management

Third party unlock trackers report scheduled releases and characterize the supply as effectively infinite due to inflation design, alongside specific upcoming unlock dates. If market participants anchor on recurring supply additions, it can create reflexive sell pressure regardless of product progress. The only sustainable counterweights are:

Staking demand tied to security and yield

Fee capture that accrues to token holders

Governance rights that matter for real revenue decisions

Collateral demand inside DeFi or payment rails

6.3 The core value capture question

For a stablecoin focused chain, it is possible that the end user never needs the token for ordinary transfers if fees are abstracted away or paid in stablecoin. That improves UX but weakens direct token demand. In that case, the token must earn its place through network security, validator participation, and possibly protocol revenue distribution or utility in specialized functions. The project’s own documentation highlights validator network and inflation schedule, which implies staking economics are intended to be a major pillar.

7. Challenges that plausibly explain a prolonged decline

A grounded explanation should list hypotheses and the specific observations that would confirm or refute each one.

7.1 Early valuation overshot realistic adoption pace

If the initial fully diluted expectations assumed rapid payment integration, then slower integration would force repricing. Confirmation would be modest growth in unique active addresses and limited diversity of contracts even as transactions are high.

7.2 Supply overhang and unlock anticipation

If unlock dates are frequent and sizeable relative to organic buy pressure, price can drift lower. Confirmation would be repeated sell offs around expected release windows and weak recoveries afterward.

7.3 Token demand decoupled from end user activity

If stablecoin gas abstraction reduces token touch points, adoption can rise without token demand rising. Confirmation would be rising transaction counts without corresponding on chain fee demand paid in the token, depending on the fee model. The docs explicitly discuss stablecoin oriented design, so this is a real possibility.

7.4 Security and decentralization still in progress

If staking and committee formation are not fully mature, some investors discount long term security. Confirmation would be ongoing protocol changes to validator selection and staking rules, and limited validator diversity.

8. Future outlook: a disciplined way to form a view

A non hype outlook should be conditional. Here is a structured path.

8.1 Near term checkpoints

Network stability under load as block time and throughput remain consistent.

Clear, auditable progress on staking and validator decentralization.

Evidence that transaction growth is user driven, not internal looping.

8.2 Medium term checkpoints

Bridge functionality that produces durable liquidity, not one time inflows.

Developer growth shown by increasing independent deployments and contract call diversity.

Economic alignment where token holding is rational for validators and long horizon participants, not only for speculators.

8.3 What would change the price narrative

The simplest way to describe a turnaround without hype is: sustained demand must exceed predictable supply additions. Demand can come from staking participation, protocol revenue, or collateral utility. Supply additions come from unlocks and inflation.

If Plasma succeeds at being a stablecoin settlement layer, the network can become useful even if the token underperforms. For token holders, usefulness is not enough. Value capture must be explicit and defensible.

9. Practical watchlist for ongoing monitoring

To keep the analysis grounded, track a small set of measurable items monthly.

Network activity

Total transactions and daily average throughput.

Unique active addresses and retention cohorts, requires deeper explorer queries.

Developer activity

Number of unique deployers

New contract deployments and sustained call counts

RPC reliability incidents if public status pages exist in the docs navigation

Economics

Upcoming unlock dates and category source

Staking participation rate once live

Inflation schedule impact on circulating supply

Closing assessment

The prolonged decline since launch is not automatically proof that the project is structurally broken, but it does raise the bar for evidence. The public materials show a coherent technical direction centered on stablecoin native UX and EVM accessibility, while on chain telemetry indicates meaningful transaction volume and fast block production.The weak point, from a token holder perspective, is whether token value capture is strong enough to offset unlock and inflation expectations, especially if end user flows minimize token touch.

A rigorous stance is therefore conditional. If staking, validator decentralization, and real payments integrations mature on a clear timeline, the network can justify a re rating. If those items remain perpetually in progress while supply continues to expand, the downtrend can persist even with growing on chain activity.