Executive Summary

Labs represents a fundamental bet on the commoditization of zero-knowledge proof generation through decentralized market coordination. The protocol operates a verifiable application (vApp) that connects proof requesters (applications needing ZK proofs) with proof suppliers (hardware operators) via an auction-based marketplace. With SP1 Hypercube achieving real-time Ethereum proving (93% of blocks under 12 seconds) and securing $2B+ TVL across major rollups, Succinct has transitioned from research to production-grade infrastructure. However, the proof market design introduces non-trivial centralization risks through capital-intensive all-pay auctions that may favor specialized hardware operators. Succinct

Investment Thesis: Succinct solves the structural problem of ZK infrastructure fragmentation by creating a unified proving layer. If Ethereum's scaling roadmap continues toward zk-based validation (10,000 TPS target), Succinct's architecture positions it as critical infrastructure. However, realization depends on overcoming auction-based centralization risks and achieving broader adoption beyond current rollup partnerships.

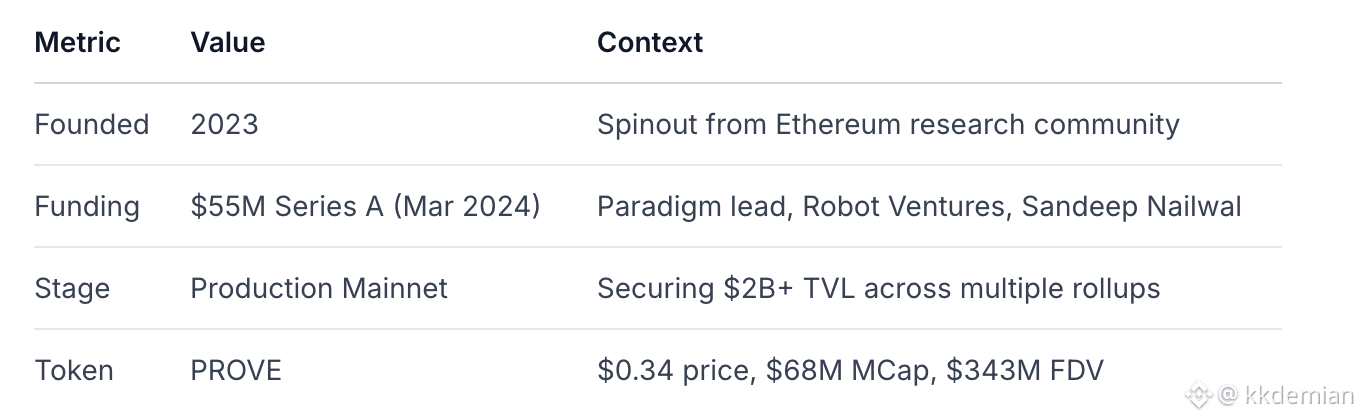

1. Project Overview & Strategic Positioning

Succinct Labs operates in the zero-knowledge infrastructure sector, specifically focused on decentralized proof coordination. The protocol's core vision is "programmable truth" - enabling any software to be cryptographically verified without trust assumptions. Whitepaper

Team Background: The team combines deep cryptographic expertise with practical systems engineering. CEO Uma Roy brings machine learning and algorithmic background (ex-Citadel Datathon winner), while CTO John Guibas has published at NeurIPS on efficient architectures. Head of Cryptography Tamir Hemo leads the SP1 Hypercube development with formal verification experience. Team

Strategic Positioning: Succinct operates as a horizontal infrastructure layer rather than vertical integration. This contrasts with rollup-native proving (Polygon zkEVM) or application-specific circuits, instead providing a general-purpose proving layer that can serve multiple applications simultaneously.

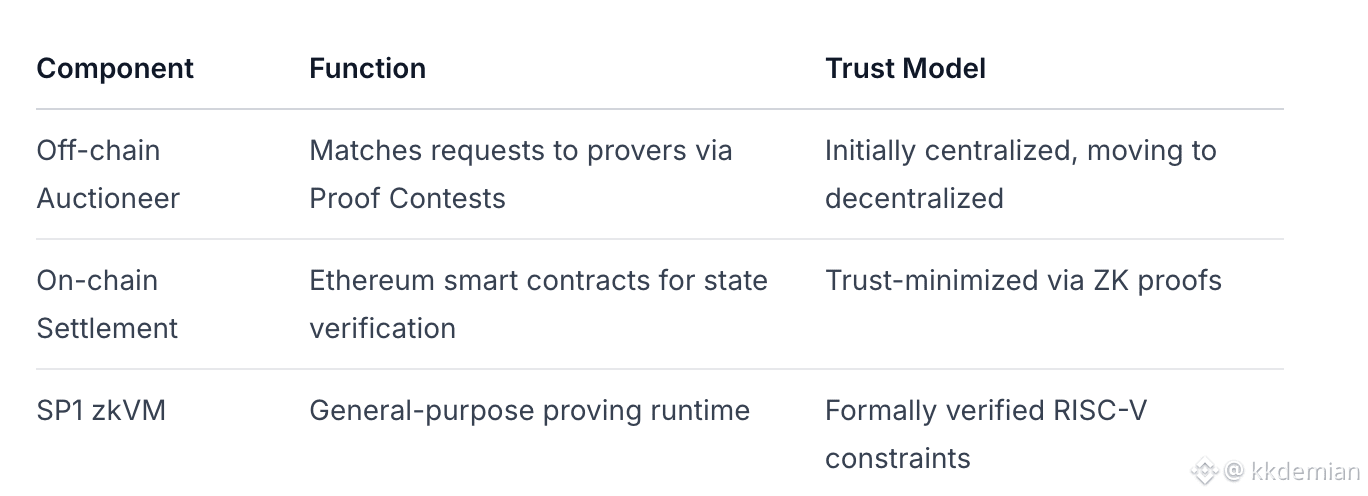

2. System Architecture: vApp Design

Succinct's architecture employs a novel verifiable application (vApp) pattern that separates execution from settlement, similar to L2 sequencer designs but optimized for proof generation. Architecture

Core Components:

The architecture provides real-time user experience (RPC-based requests) with cryptographic settlement guarantees (on-chain verification). This hybrid approach avoids blockchain throughput limitations while maintaining verifiability.

Key Innovation: The vApp design allows Succinct to process proof requests without blockchain latency while still enabling users to independently verify network state and withdraw funds directly from Ethereum if the auctioneer fails.

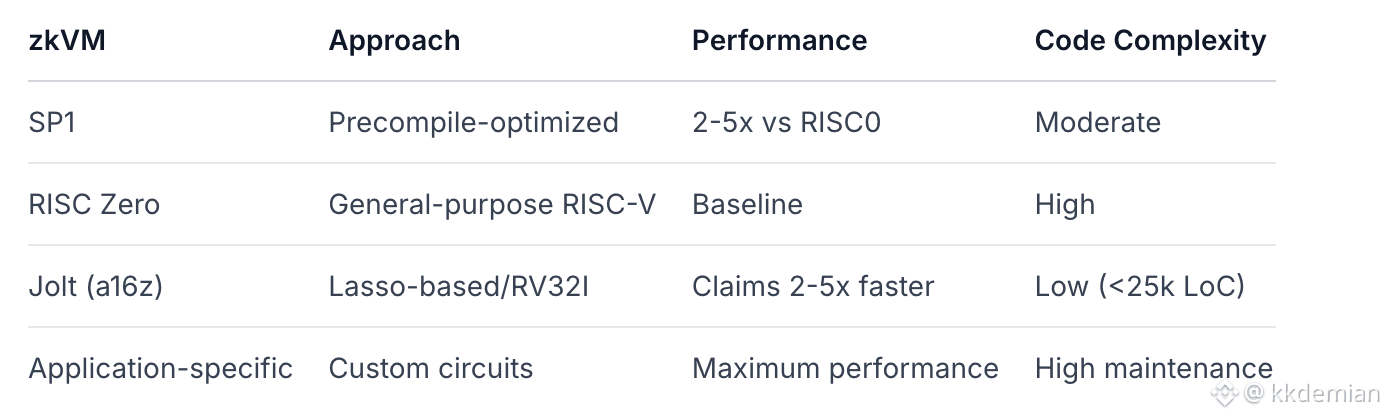

3. SP1 zkVM: Technical Differentiation

SP1 (Succinct Prover 1) is a RISC-V based zkVM that uses a precompile-centric architecture to achieve performance advantages over general-purpose zkVMs. SP1 Docs

Performance Benchmarks

SP1 demonstrates significant performance advantages through specialized optimization:

SP1 Hypercube Advancements (2026 Roadmap):

Multilinear polynomial system replacing univariate STARKs

Jagged PCS commitment scheme for "pay what you use"

Formal verification of all RISC-V constraints (with Nethermind)

Elimination of proximity gap conjectures - critical security advancement

Precompile Model: SP1's key differentiation is its flexible precompile system that accelerates specific operations (secp256k1, ed25519, sha256, keccak256) through hand-optimized circuits. This provides application-specific performance while maintaining general-purpose programmability.

Competitive Landscape

SP1 occupies a middle ground between general-purpose zkVMs (easier development) and application-specific circuits (maximum performance). The precompile system enables 5-10x cycle reduction for cryptographic operations common in blockchain workloads.

4. Proof Market Mechanism: Economics & Coordination

The Succinct Prover Network implements a novel market structure called Proof Contests - reverse all-pay auctions where provers compete for proof generation rights. Proof Contests

Auction Mechanics

Request Flow:

Requester submits program + inputs with max fee and deadline

Provers bid in reverse auction (lowest price wins)

Winning prover must complete proof before deadline

Payment split: Treasury (protocol fee), Stakers, Prover Owner

Pricing Structure:

Base Fee: Fixed cost per proof mode ($0.2 PROVE for compressed)

Auction Price: Market-determined bid per Prover Gas Unit (PGU)

Total Cost: Base Fee + (PGU × Auction Price)

PGU Innovation: Prover Gas Units represent a major advancement over simple cycle counts. PGU uses linear regression based on shard characteristics to accurately predict proving costs, accounting for the non-linear relationship between RISC-V cycles and actual proving time. PGU Docs

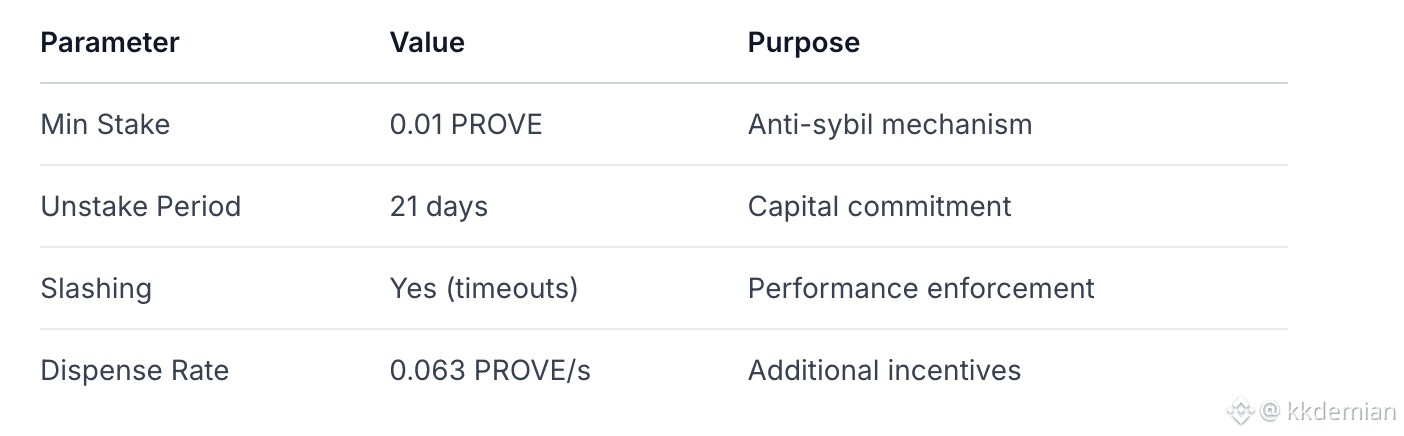

Staking Economics

Current Staking Landscape (Dune Analytics):

~16-20M PROVE total staked

Top staker: 19.87% concentration risk

23,038 unique claimers - broad distribution

Staking dashboard shows increasing security budget

The auction design creates natural competition that should drive proving costs toward marginal cost over time. However, the all-pay structure requires provers to bear bidding costs regardless of outcome, potentially favoring well-capitalized operators.

5. Protocol Economics & Token Mechanics

PROVE Token serves as the coordination mechanism and payment currency for the network. Tokenomics

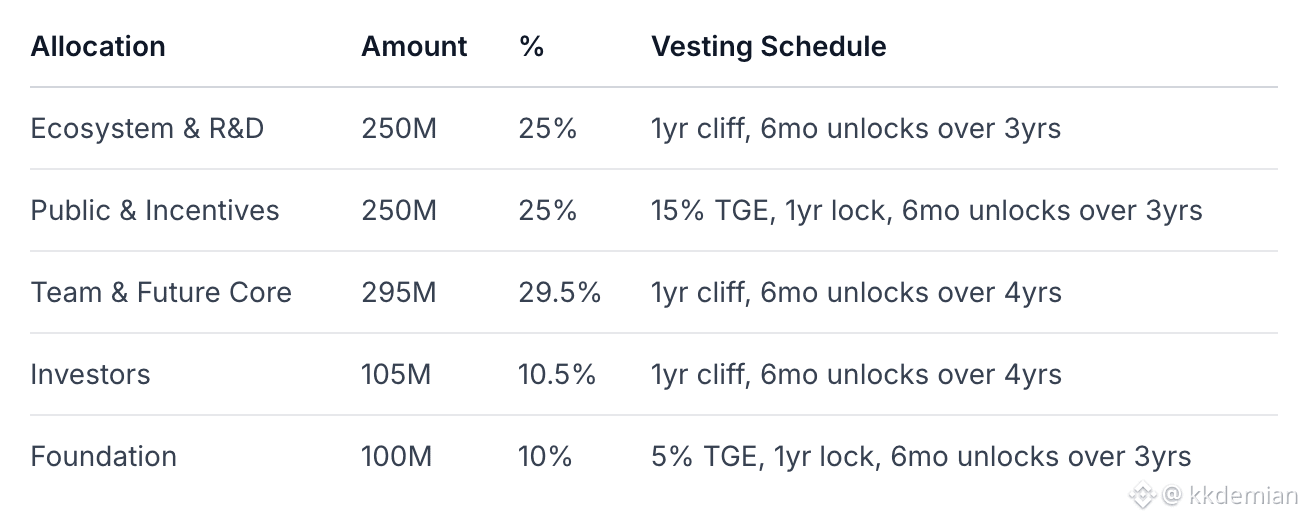

Token Distribution:

Fee Flows:

Requesters pay in PROVE for proofs

Protocol treasury receives 1% fee (adjustable)

Stakers earn prover rewards (set at prover deployment)

Prover owners receive remaining fees

The economic model aligns incentives around cost reduction - provers must continuously improve efficiency to compete in auctions, while the protocol captures value through treasury fees.

6. Risk Analysis

Technical Risks

Cryptographic Implementation: Despite formal verification, novel proof systems carry implementation risk

Liveness Dependencies: Single-prover assignment creates latency risk if provers fail

Hardware Moats: Specialized hardware (FPGAs, ASICs) may centralize proving power

Economic Risks

Auction Centralization: All-pay auctions may favor capital-rich provers (Critique)

Staking Concentration: Top staker controls 19.87% of stake - governance risk

PROVE Volatility: Token-based payments expose users to price volatility

Governance Risks

Current Control: Security Council manages key parameters

Transition Path: Roadmap to permissionless proving not fully detailed

Upgrade Mechanisms: vApp architecture requires careful upgrade coordination

Mitigating Factors: Slashing mechanisms discourage malicious behavior, and the ability to withdraw funds directly from Ethereum reduces auctioneer dependency. The proving pool system allows smaller operators to participate collectively.

7. Adoption & Ecosystem Integration

Succinct has achieved significant early adoption across multiple ecosystem segments: Partners

Rollups & L2s:

Mantle: $2B+ TVL secured with OP Succinct

Celo: First L2 with OP Succinct Lite mainnet

Arbitrum: 1-year exclusive partnership with Tandem studio

Infrastructure:

Celestia: Blobstream migration to Succinct Prover Network

Across Protocol: v4 bridge powered by Succinct

Hyperliquid: USDC bridging via HyperEVM

Emerging Use Cases:

Automata: ZK proofs for software supply chain (Proof of Build)

Primus Labs: Proof of Reserves for institutions

C2PA: Content authenticity standards with ZK verification

Network Metrics (from Dune dashboards):

Cumulative proofs: Data incomplete in available sources

Active provers: Number not publicly disclosed

PGU volume: Growing but specific metrics limited

The diversity of integrations demonstrates Succinct's general-purpose capability, though rollup infrastructure remains the primary use case.

8. Strategic Trajectory & 2026 Roadmap

Succinct's 2026 trajectory focuses on making the protocol "systemically critical" through several key initiatives: Roadmap

Technical Milestones:

SP1 Hypercube Mainnet: Real-time Ethereum proving (<12s for 93% of blocks)

Hardware Diversification: FPGA acceleration (20x vs CPU with AntChain)

Formal Verification Completion: Full RISC-V constraint verification

Ecosystem Growth:

Ethereum L1 Integration: Enabling zk-based validation for base layer

Additional Precompiles: Expanding optimized operations (secp256r1, RSA)

Cross-chain Expansion: Beyond Ethereum to other ecosystems

Economic Evolution:

Permissionless Proving: Reducing barrier to prover participation

Fee Market Optimization: Dynamic base fee adjustment

Governance Transition: Moving toward community control

The successful implementation of these milestones would position Succinct as critical infrastructure for Ethereum's scaling roadmap, particularly if the transition to zk-based L1 validation accelerates.

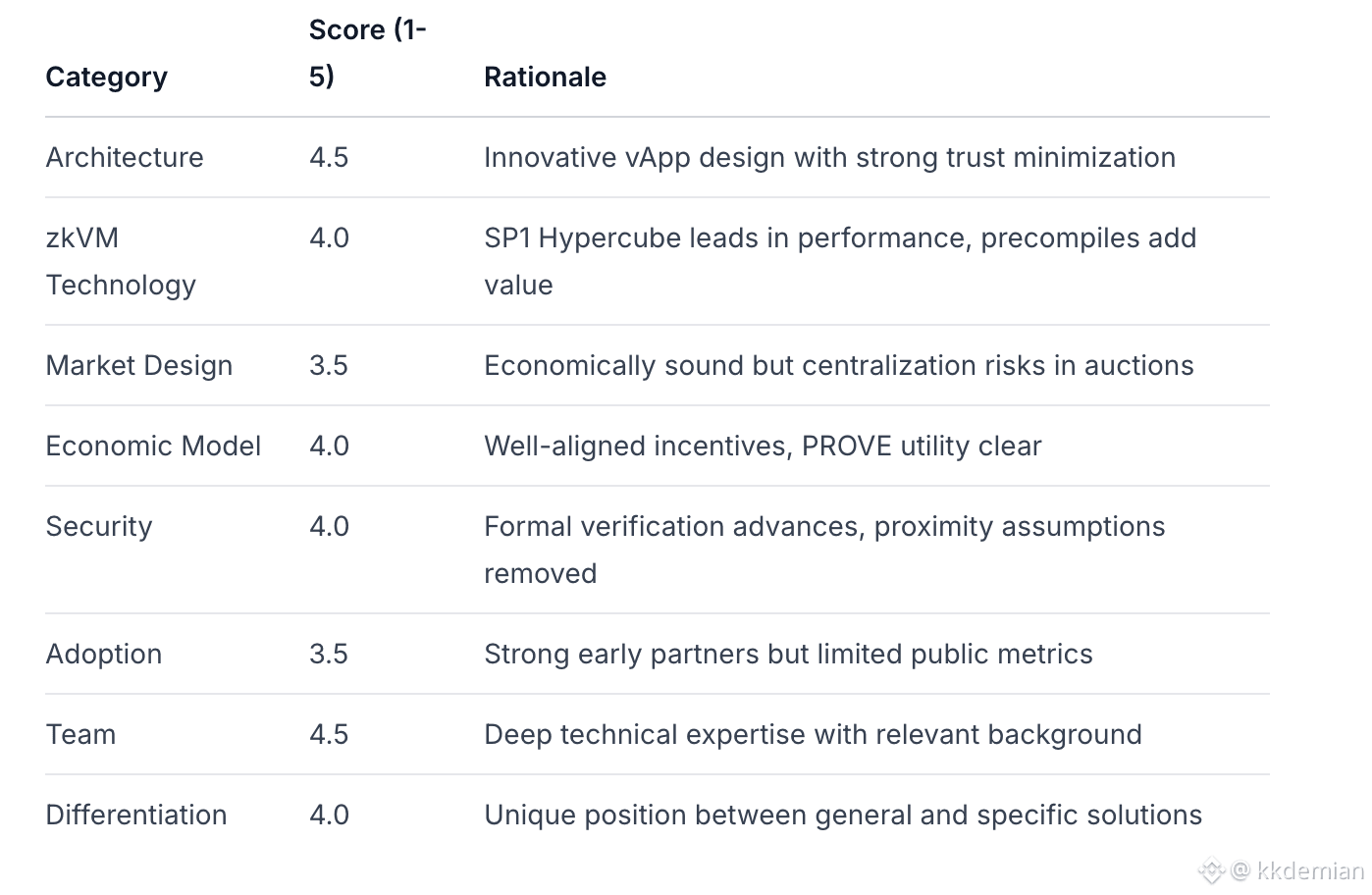

9. Investment Assessment

Based on comprehensive analysis across multiple dimensions:

Overall Score: 4.0/5.0

Final Investment Verdict

SUCCINCT REPRESENTS A HIGH-CONVICTION INFRASTRUCTURE INVESTMENT for tier-1 crypto funds with a 3-5 year horizon. The protocol solves fundamental fragmentation in ZK proving infrastructure and aligns with Ethereum's scaling trajectory. However, investors should monitor:

Auction Centralization: Whether proof contests maintain sufficient decentralization

Adoption Metrics: Movement beyond current partners to broader ecosystem

Execution Risk: Delivery of 2026 technical milestones, particularly L1 integration

Recommendation: INVEST with position sizing reflecting the high-reward/high-risk profile. Succinct's technical differentiation and ecosystem positioning justify investment, but the proof market design requires careful observation for centralization tendencies.

The fundamental thesis remains compelling: as ZK proof generation becomes commoditized, coordination layers like Succinct will capture disproportionate value by enabling efficient market formation between proof supply and demand.