Comment your view after reading 🚀🚨🚨🚨

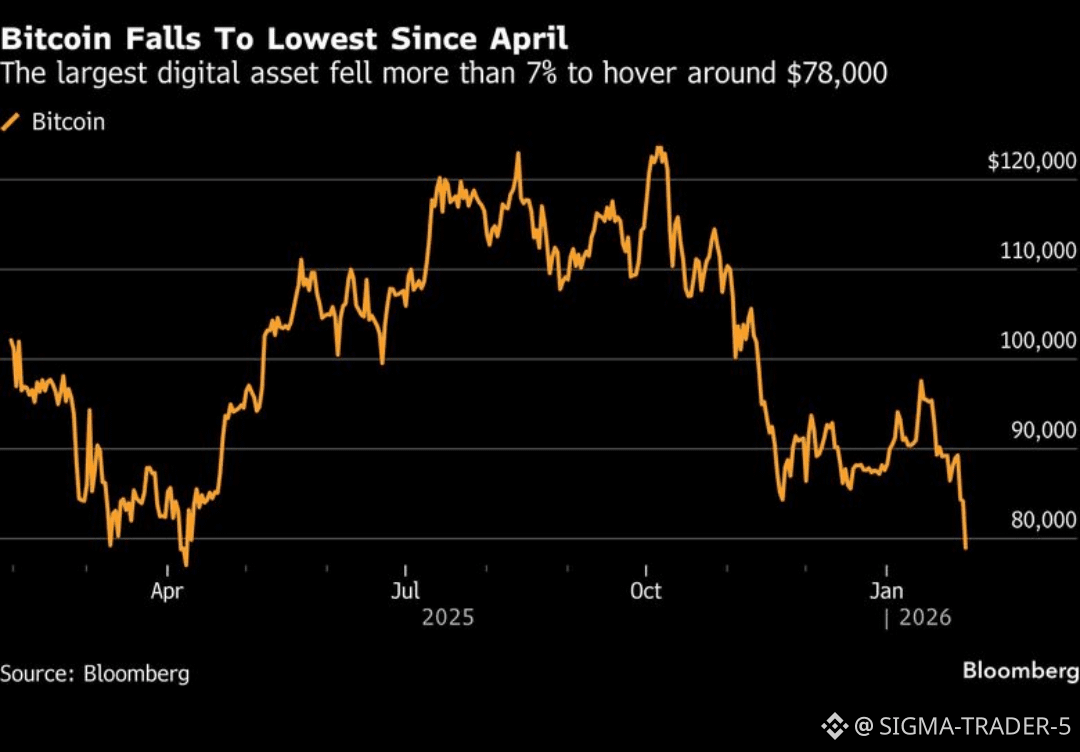

Bitcoin has experienced a sharp decline in early 2026, dropping below $80,000 for the first time since April 2025, with prices crashing to around $78,800 amid Federal Reserve leadership changes, geopolitical tensions, and heavy ETF outflows exceeding $1.1 billion weekly. From peaks near $126,000 in October 2025, BTC fell over 6% in a single day recently, breaking key support levels like $82,500 and signaling short-term bearish trends driven by risk aversion and liquidity concerns.

In stark contrast, gold started 2026 strongly, rising 1.8% to $4,387 per ounce after a 60% surge in 2025, fueled by a weaker dollar and expectations of lower interest rates. In India, MCX gold hovered near ₹1.60 lakh per 10 grams as of February 1, maintaining its safe-haven appeal amid global uncertainties

Key CausesMassive outflows from U.S. spot Bitcoin ETFs totaled over $1.1 billion in the week ending January 26, with five straight days of redemptions marking the heaviest since early 2025, as institutions rotated capital into surging precious metals like gold and silver. Geopolitical tensions escalated selling, including U.S.-China disputes over tariffs on rare earths and Greenland autonomy, reports of explosions in Iran, and a strengthening Japanese yen prompting global portfolio rebalan

President Trump's nomination of Kevin Warsh as Federal Reserve chair fueled fears of tighter monetary policy and reduced liquidity for speculative assets, amplifying risk-off sentiment. Over $1.68 billion in crypto liquidations—mostly long positions—created a cascading effect, with Hyperliquid alone seeing $598 million in forced closures amid overcrowded bullish bets.These factors erased January gains, dropping BTC 11% for the month to a low of $75,555 before stabilizing near $77,800-$78,000.