Recent ETH Buying Draws Scrutiny

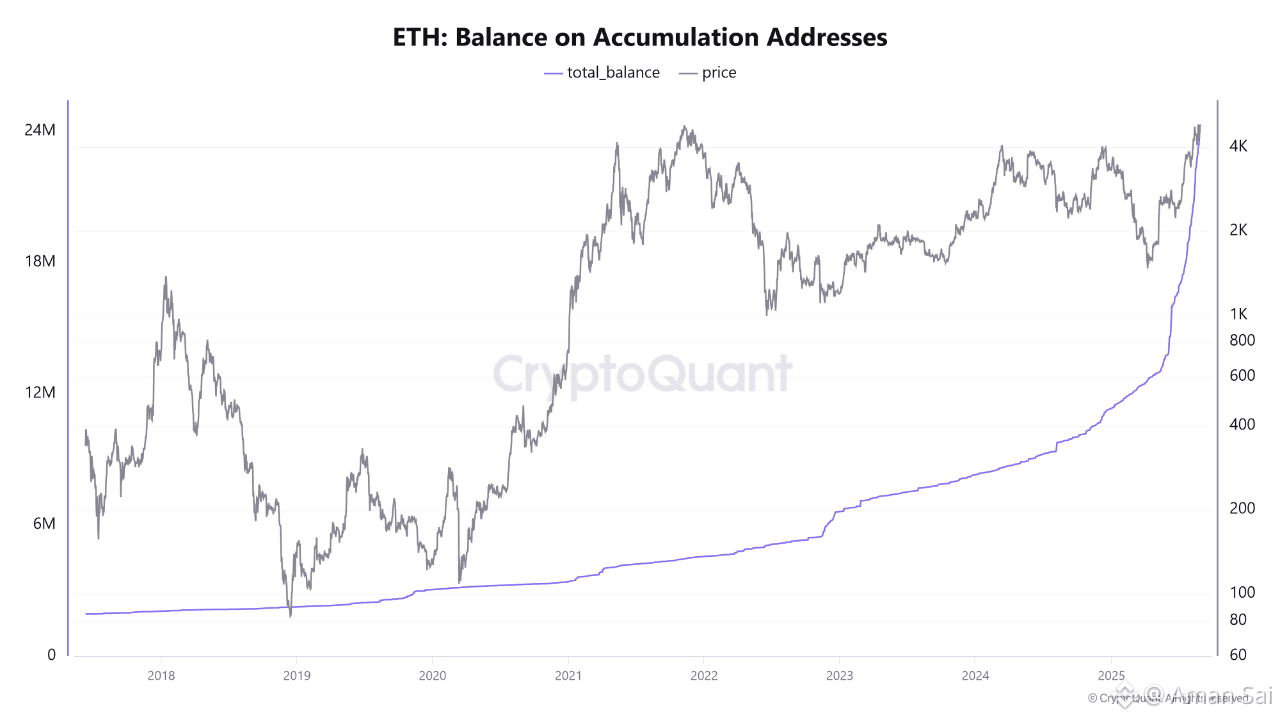

The company, chaired by Tom Lee, saw the value of its 4.24 million ether position fall to roughly $9.6 billion, down from nearly $14 billion at the market’s October highs, as selling pressure intensified across major digital assets.

Recent ETH Buying Draws Scrutiny

BitMine added over 40,000 ether as recently as last week, increasing its exposure just ahead of a sharp market slide. The timing has renewed scrutiny of corporate crypto treasury strategies, which can magnify both gains and losses during periods of thinning liquidity.

As ether prices slid, the firm’s balance sheet deteriorated rapidly, highlighting the risks associated with large, concentrated positions when market depth weakens and bids fade.

Liquidations Accelerate the Downturn

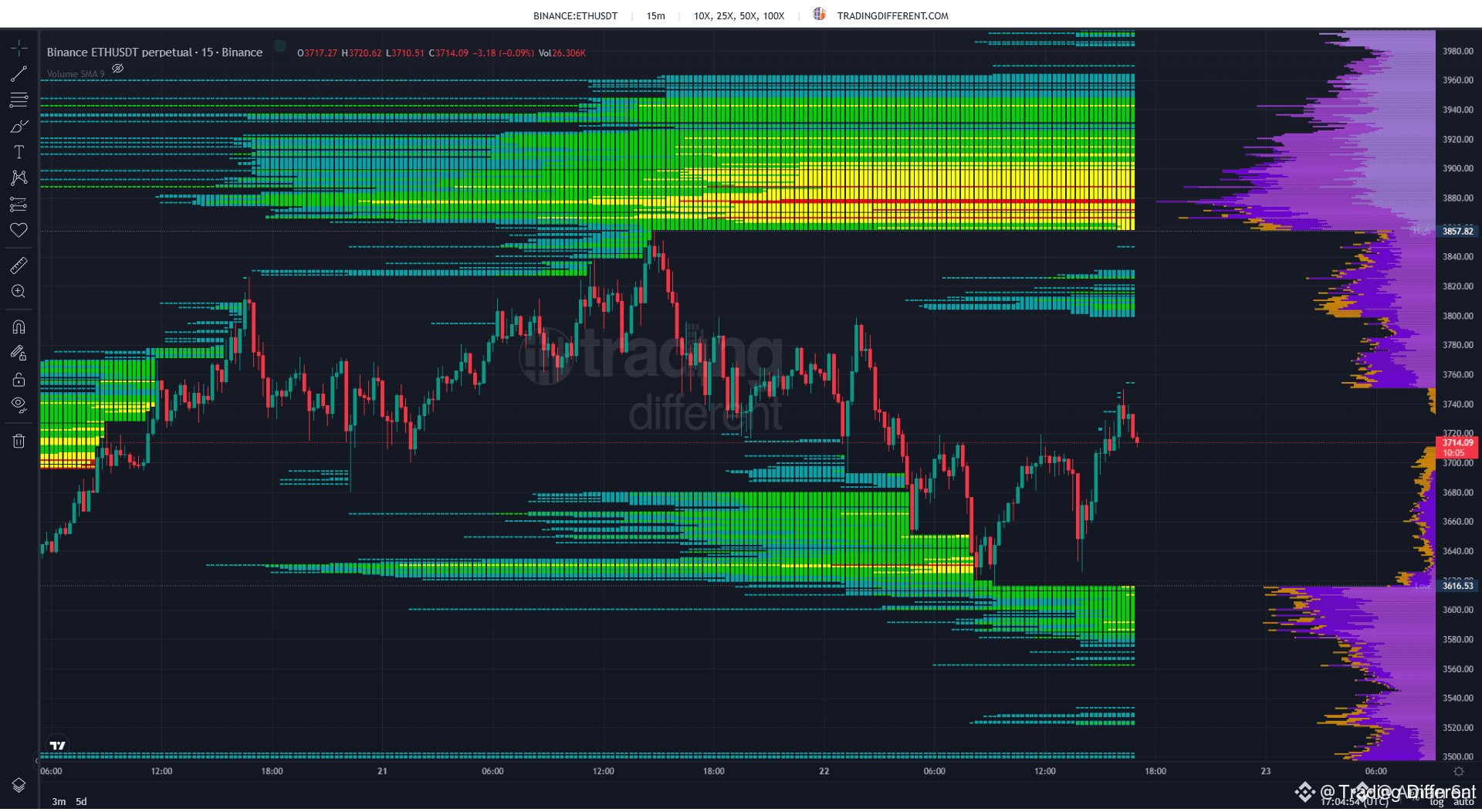

Ether dropped toward the $2,300 level on Saturday as forced selling rippled through derivatives markets. Liquidations picked up across major venues, adding momentum to the decline and compounding pressure on spot prices.

Ether dropped toward the $2,300 level on Saturday as forced selling rippled through derivatives markets. Liquidations picked up across major venues, adding momentum to the decline and compounding pressure on spot prices.

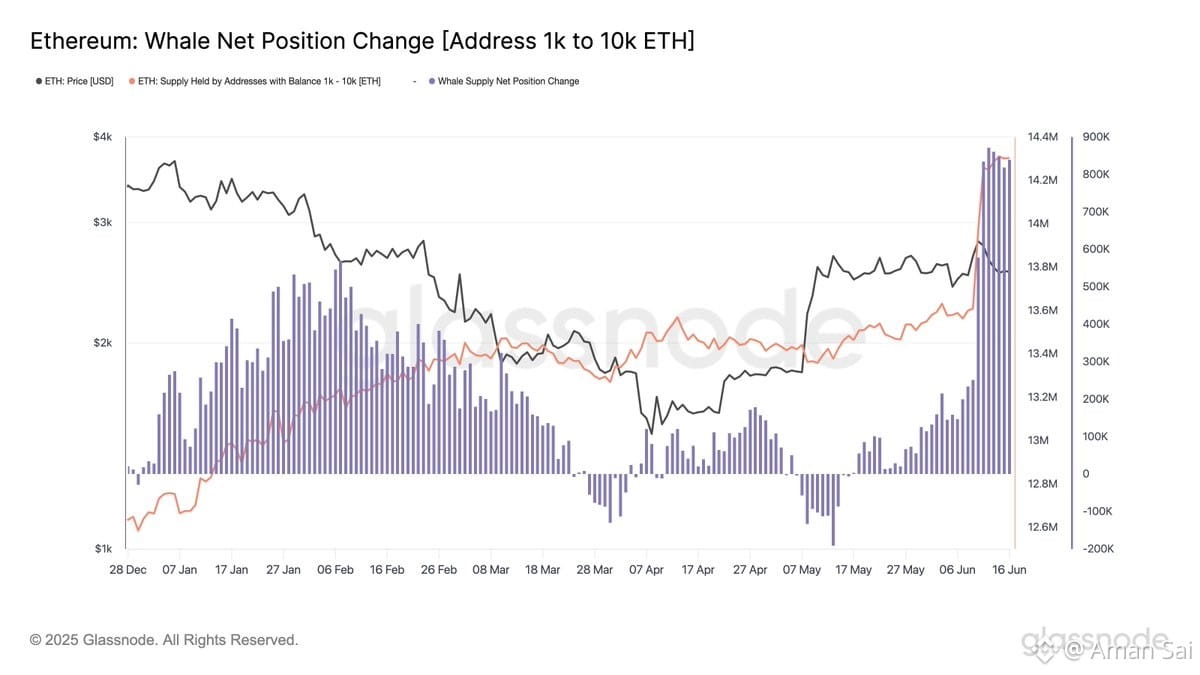

Analysts say this dynamic reflects a broader deleveraging phase, where leveraged exposure is being flushed out as prices fall , a process that often amplifies short-term volatility.

Staking Revenue Offers Limited Cushion

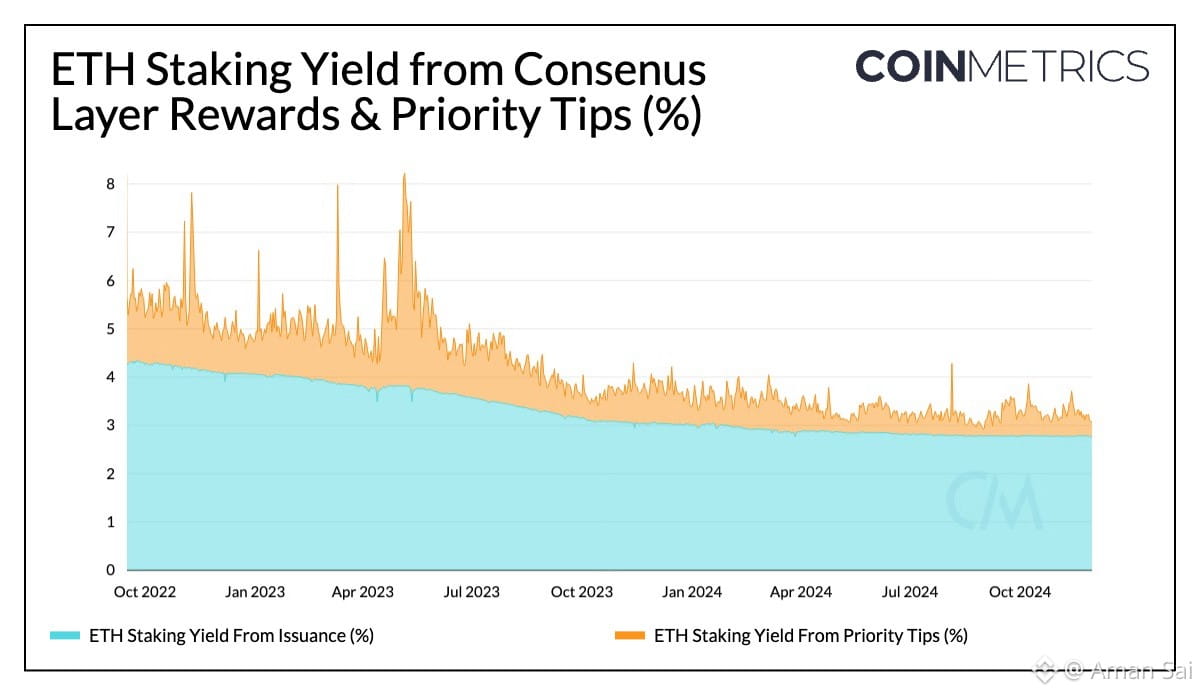

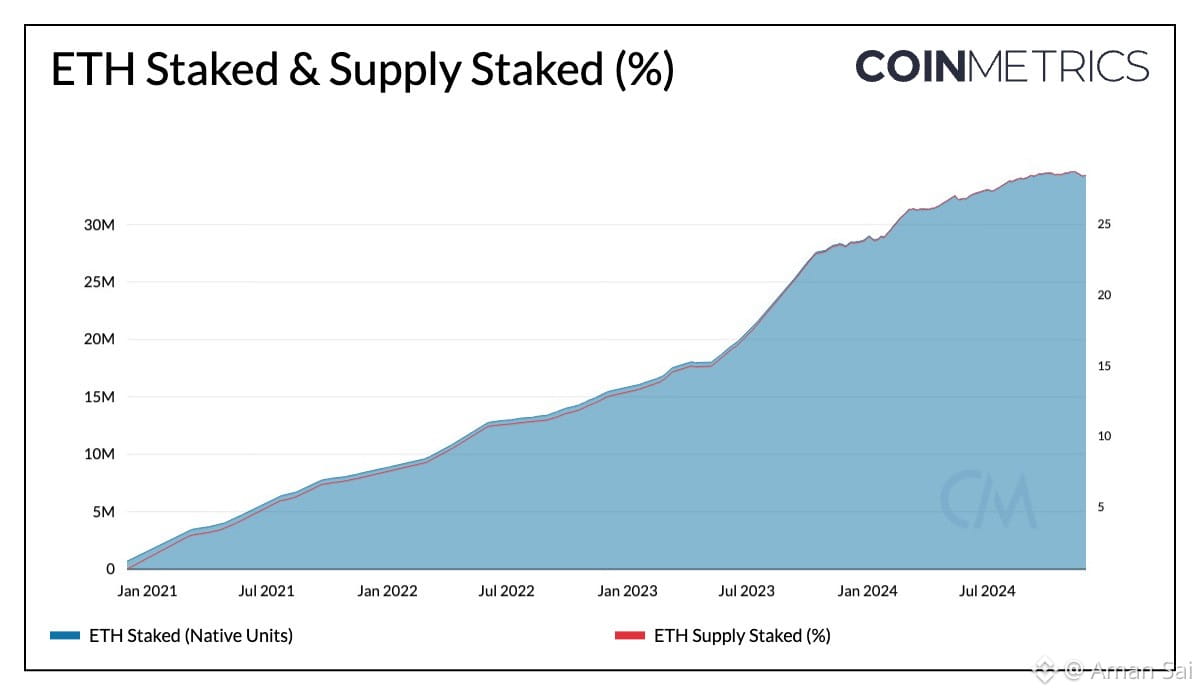

BitMine has said that a portion of its ether holdings is staked, generating estimated annual revenue of around $164 million. While this provides a steady income stream, the yield offers limited protection against rapid price declines during sharp market drawdowns.

BitMine has said that a portion of its ether holdings is staked, generating estimated annual revenue of around $164 million. While this provides a steady income stream, the yield offers limited protection against rapid price declines during sharp market drawdowns.

Network yields fluctuate with participation and demand, making staking income insufficient to offset multi-billion-dollar valuation swings in fast-moving markets.

A More Cautious Near-Term Outlook

Tom Lee has recently adopted a more cautious near-term stance, warning that crypto markets are still in the midst of deleveraging. While remaining constructive on longer-term fundamentals, he has cautioned that early 2026 could remain challenging before conditions stabilize.

Lee has pointed to October’s sharp selloff , which erased roughly $19 billion in market value , as a reset that forced excess positioning out of the system. The current decline, analysts say, reflects a continuation of that adjustment rather than a sudden fundamental breakdown.

Bottom Line

BitMine’s mounting paper losses underscore the risks of large corporate crypto treasuries in volatile markets. As ether prices slide and liquidity thins, aggressive accumulation strategies can quickly turn into balance-sheet liabilities. With deleveraging still underway, analysts expect choppy conditions to persist before the market finds firmer footing.s can quickly turn into balance-sheet liabilities. With deleveraging still underway, analysts expect choppy conditions to persist before the market finds firmer footing.