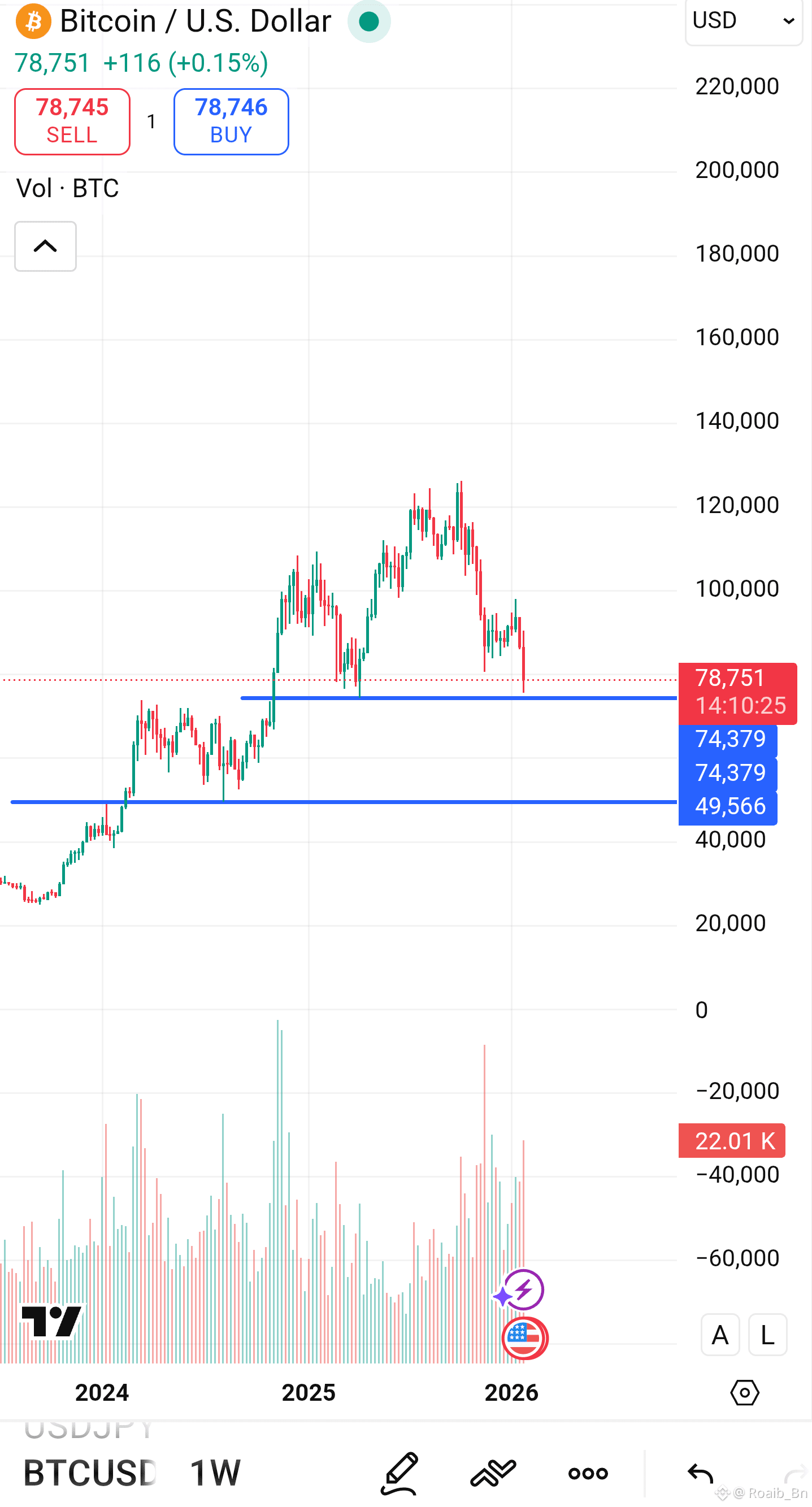

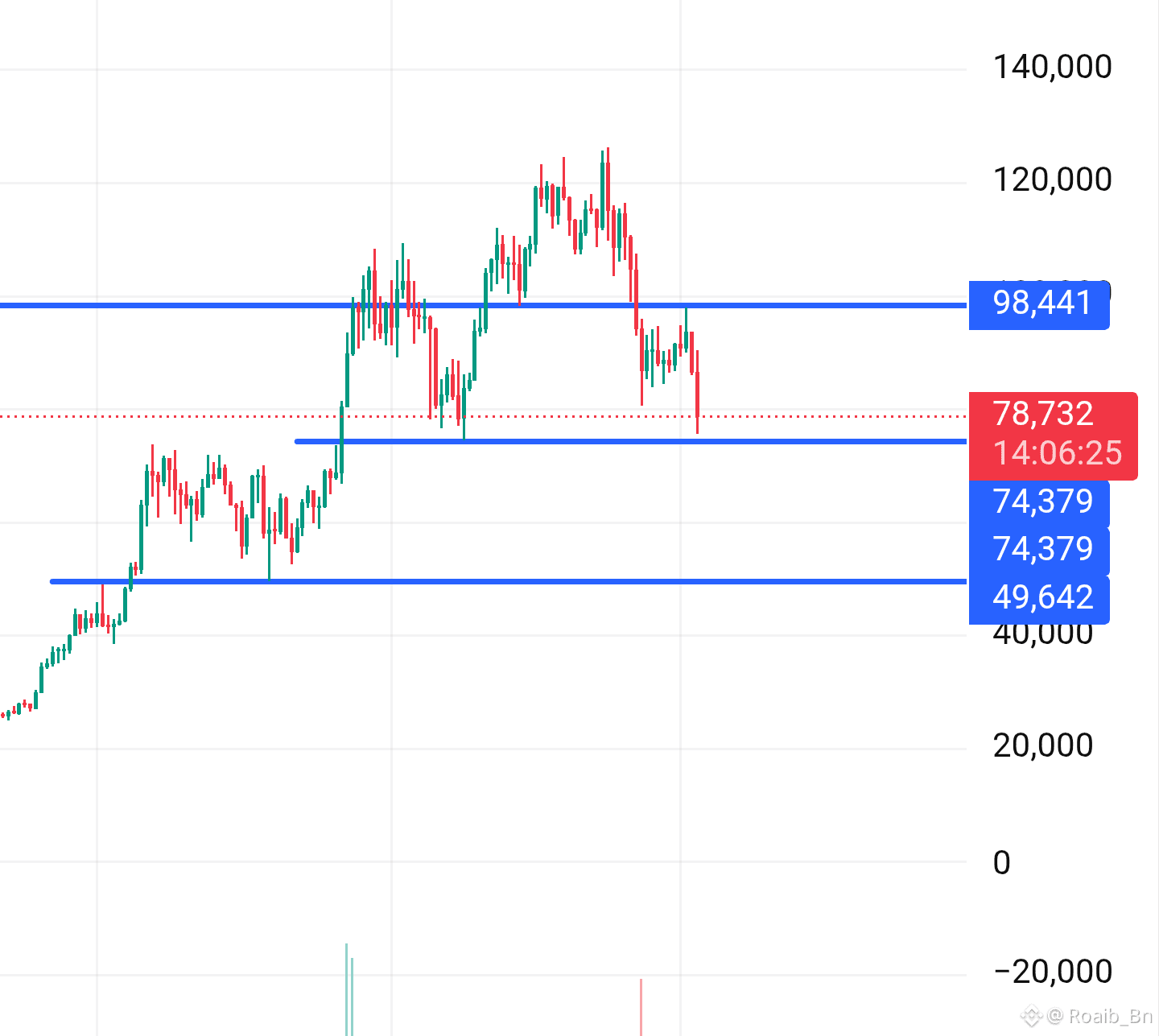

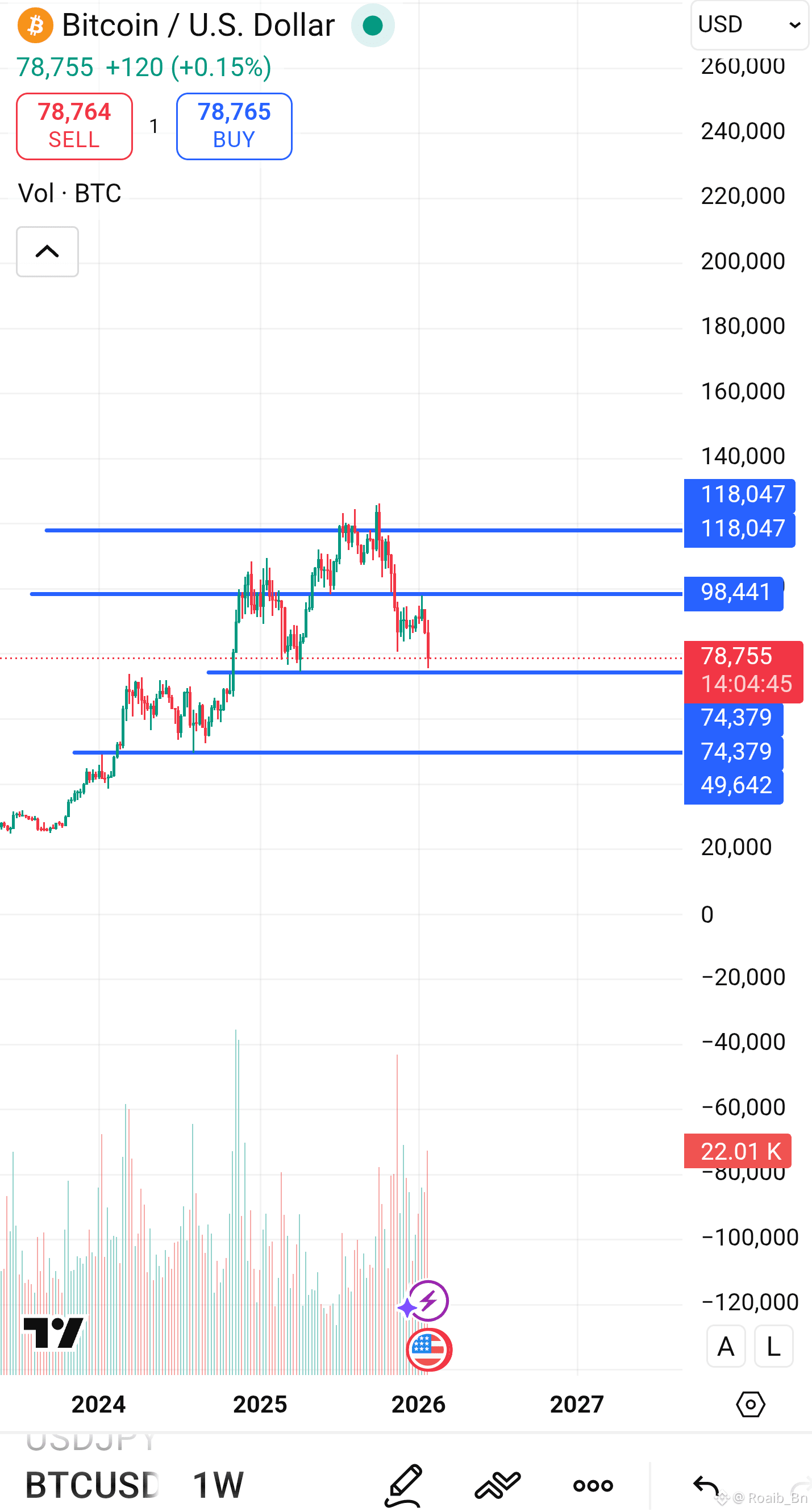

Bitcoin is currently trading around the $78K zone after experiencing a strong rally followed by a noticeable pullback. The weekly chart shows that BTC is now testing an important previous support-turned-demand area, making this a critical decision point for the market.

📊 Market Structure Overview

Over the past year, Bitcoin moved through three major phases:

Strong Uptrend – Price surged aggressively, forming higher highs and higher lows.

Distribution Phase Near the Top – Volatility increased as BTC struggled to maintain momentum above the $100K+ region.

Corrective Pullback – Price retraced sharply and is now sitting near a key support zone around $74K–$75K.

This zone previously acted as resistance before the breakout, and markets often retest these areas before the next major move.

🔵 Key Levels to Watch

Major Support Zone

$74,000 – $75,000

Price is currently reacting here

This level previously triggered a strong bullish breakout

Buyers may step in again if confidence returns

Lower Support

$49,000 – $50,000

If the current support fails, this becomes the next major historical demand zone

A move here would signal a deeper market correction

Resistance Levels

$90,000 – $100,000

First major recovery barrier

Previously acted as a consolidation and rejection area

$115,000 – $120,000

Prior peak region

A break above this would likely restart a strong bullish expansion

📈 Bullish Scenario

If BTC holds above the $74K support and volume increases:

Buyers could push price back toward $90K

A break above $100K may open the path toward new highs

This would suggest the current move is just a healthy correction in a larger bull cycle

Momentum confirmation signs:

Strong weekly close above $82K–$85K

Increasing green volume

Higher lows forming on lower timeframes

📉 Bearish Scenario

If BTC loses the $74K support with strong selling volume:

Price may drop toward $60K as an intermediate reaction level

Major downside target sits near $50K demand zone

That would shift the structure from bullish correction to deeper macro retracement

Bearish confirmation signs:

Weekly close below $74K

Rising red volume

Weak bounces with lower highs

🎯 Possible Trade Planning (Educational Example)

Bullish Idea (Support Bounce)

Entry: $75K–$78K zone

Stop Loss: Below $72K

Targets: $90K → $100K → $115K

Bearish Idea (Support Breakdown)

Entry: Confirmed weekly close below $74K

Stop Loss: Above $80K

Targets: $60K → $50K

Volume Insight

Recent spikes in volume show strong activity during the drop, meaning both profit-taking and new positioning are happening. The next big move will likely come with another volume expansion, not low-volume drifting.

Bitcoin is sitting at a make or-break level. This area often decides whether the market continues the broader bull trend or enters a deeper correction phase. Patience is key —confirmation matters more than prediction.

This is a high-volatility zone where fakeouts are common. Risk management is more important than being right.

Disclaimer: This is not financial advice. Always Do Your Own Research (DYOR) before making any trading decisions.

#CZAMAonBinanceSquare #USPPIJump #BitcoinETFWatch #USGovShutdown #WhoIsNextFedChair