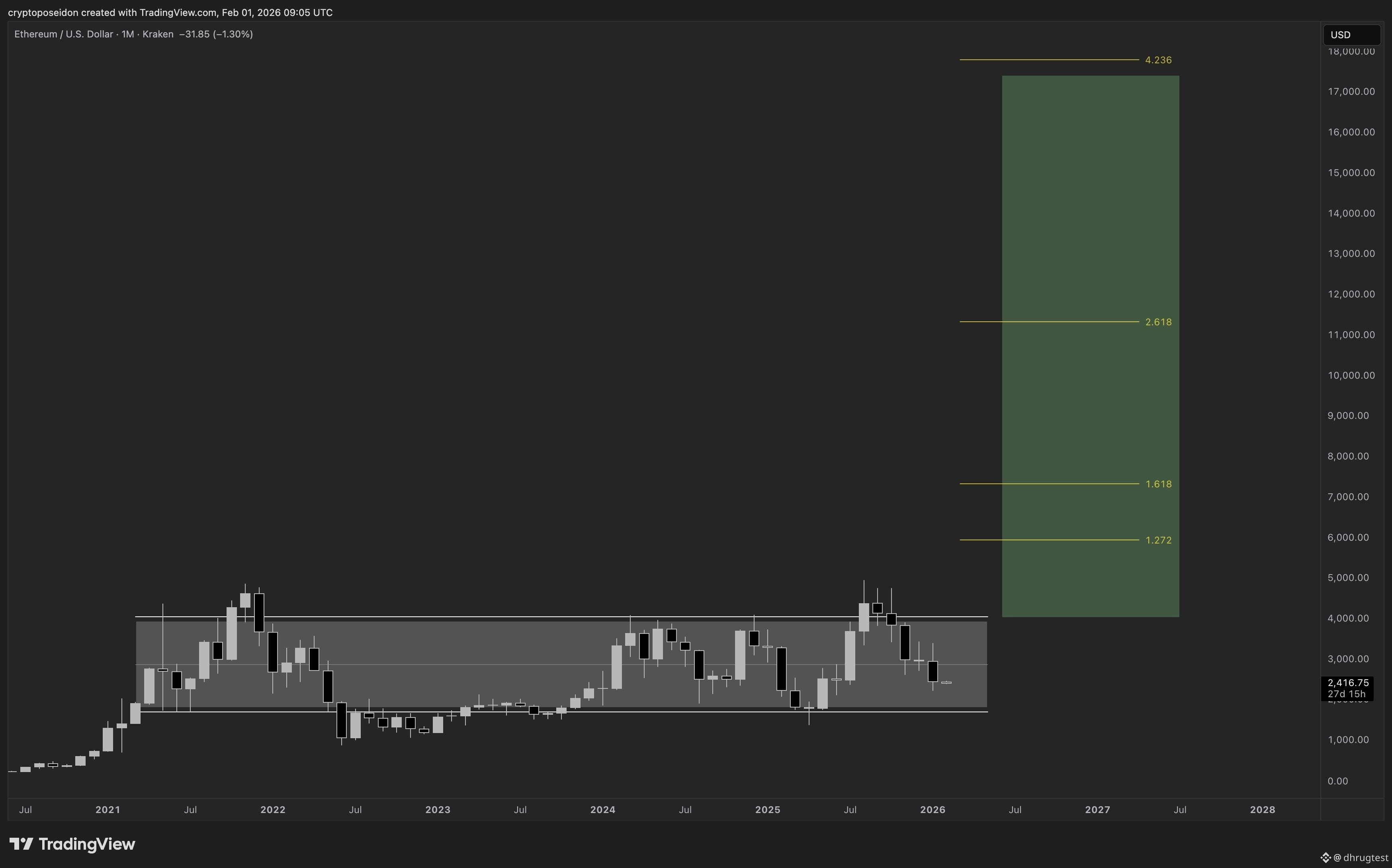

$ETH is currently trading around the $2,300 level, placing it in a consolidation phase after months of volatility across the broader crypto market. Price action suggests ETH is building a base rather than trending aggressively in either direction.

For now, Ethereum appears comfortable moving between $2,100 and $2,500. This range reflects market indecision buyers are stepping in on dips, while sellers continue to cap upside momentum. Such sideways movement often precedes a larger directional move.A decisive break above the $2,500 resistance could shift sentiment quickly. If volume confirms the move, ETH may target the $3,400 region, which aligns with previous high-liquidity zones. In a broader market recovery, extended upside levels around $3,500, $3,900, and even $4,400 become realistic over time.On the downside, Ethereum is not immune to macro pressure or sudden market shocks. If volatility increases, a pullback toward $1,930 remains a valid scenario. This level would likely act as a major support zone, where long-term buyers may look to re-enter.

Ethereum’s current structure favors patience. The market is waiting for a catalyst whether macro, ETF flows, or network-driven developments to define the next trend. Until then, ETH remains range-bound, with both upside expansion and downside risk clearly defined.