The longest minute in payments is the one after you expected to be done.

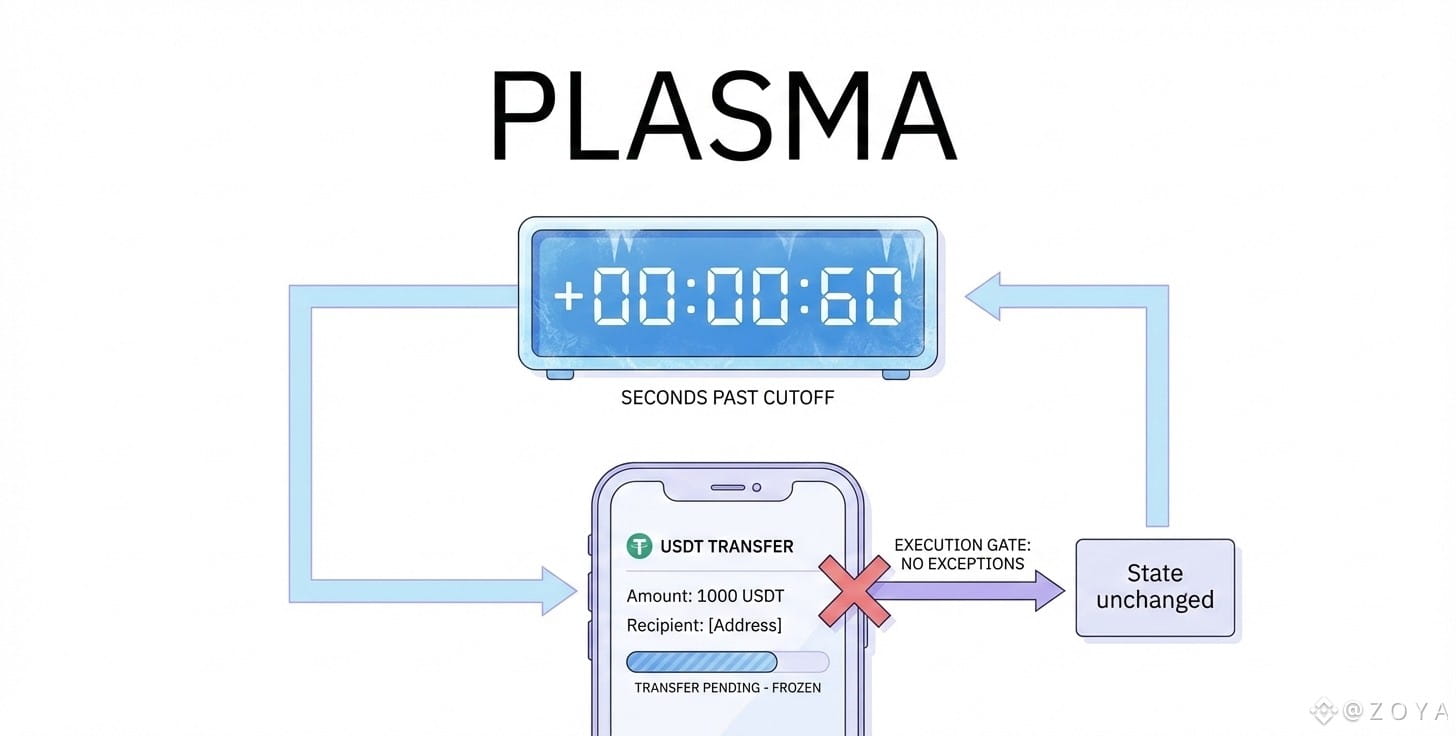

A USDT transfer is sent. The wallet updates. No error appears. The chain continues finalizing. Yet nobody moves. The sender assumes completion. The receiver waits. Ops doesn’t escalate because nothing is technically wrong.

So the minute stretches.

That minute doesn’t register as downtime. It registers as hesitation. A quiet delay where responsibility floats without landing anywhere. No one owns it, but everyone feels it.

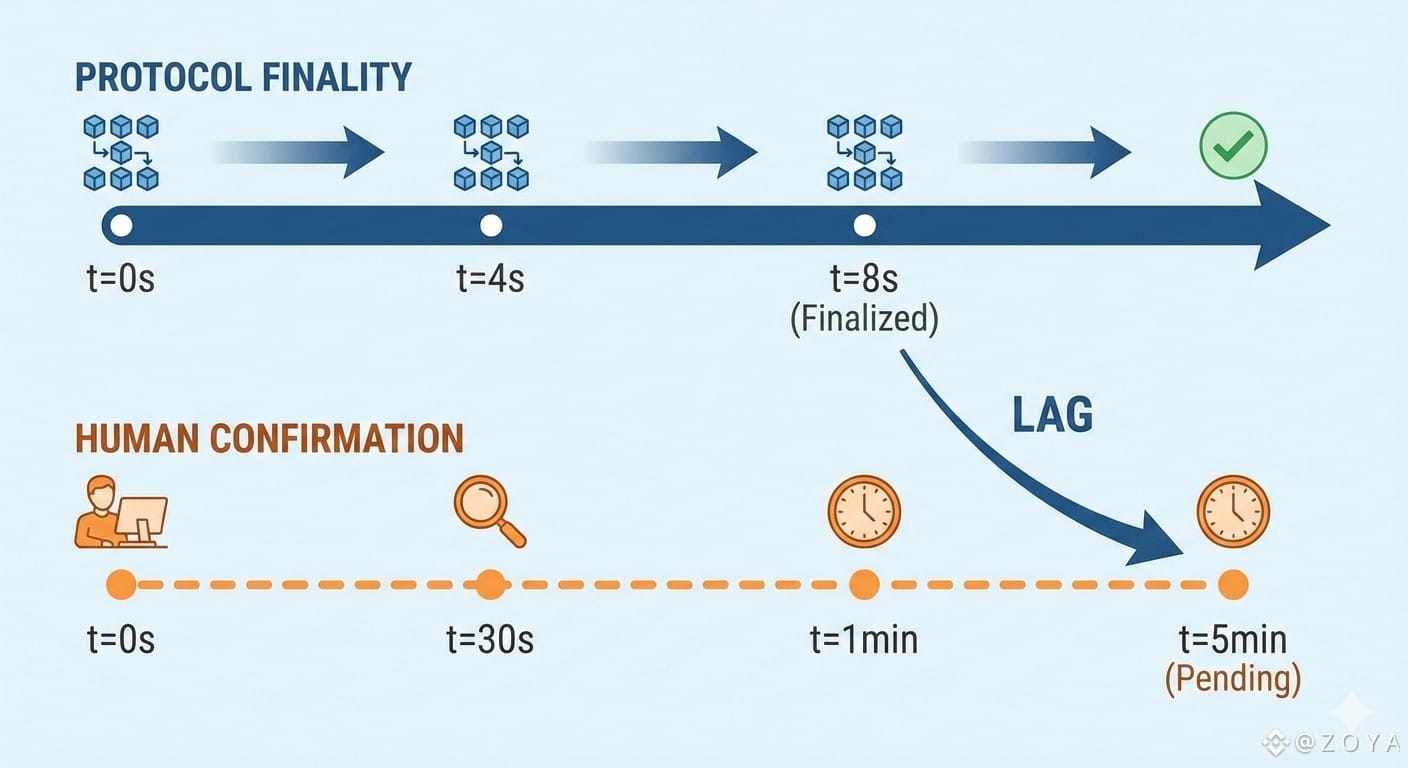

This is not a throughput problem. PlasmaBFT is doing its job. Blocks are final. Ordering is clean. The friction shows up later, when humans need a signal strong enough to let them stop waiting.

Gasless USDT flows make this sharper. When users don’t manage gas, they also don’t manage expectation. Pressing send feels terminal. Any delay afterward feels like the system broke a promise it never explicitly made.

So behavior shifts.

Receivers delay booking. Senders disengage too early. Ops keeps an eye on a transfer that should already be forgotten. The payment becomes something to monitor instead of something to use.

That’s where cost accumulates.

Not as loss.

As attention.

Attention shows up as extra checks. Extra messages. Extra notes in systems that shouldn’t need commentary. Over time, these small delays stack into habit. People learn to wait “just in case,” even when the system is functioning correctly.

This is how velocity erodes without anyone noticing.

Plasma’s design appears focused on collapsing that minute. Sub-second finality isn’t positioned as speed for charts. It’s a way to reduce the time window where humans feel justified in hovering.

Shorten that window and behavior changes automatically. Fewer follow-ups. Fewer retries. Fewer internal pings asking whether it’s safe to move on.

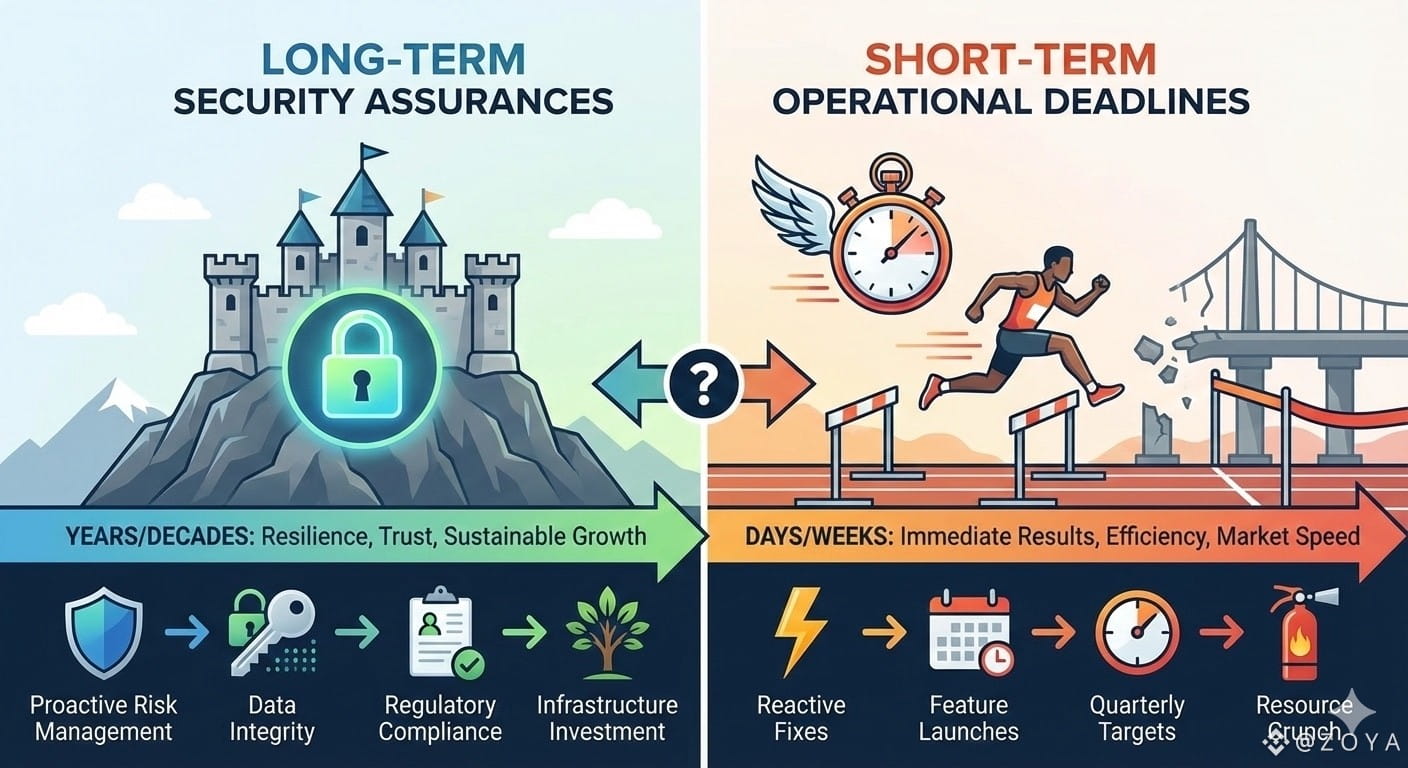

Bitcoin anchoring exists beyond this moment. It answers a different question entirely. Whether value should live here over years. That matters for institutions deciding where to settle long-term. It doesn’t help someone staring at a clock during reconciliation.

Those clocks don’t negotiate.

What clears a stablecoin payment isn’t cryptographic certainty alone. It’s a signal that arrives early enough and plainly enough that no one feels the need to wait one more minute.

The first time a routine USDT transfer makes someone hesitate past their cutoff, the system hasn’t failed. But it has quietly taxed the workflow.

Plasma’s real test isn’t whether payments complete.

It’s whether they complete fast enough that humans stop counting time.

Because in settlement, waiting one more minute

is where trust quietly gets spent.