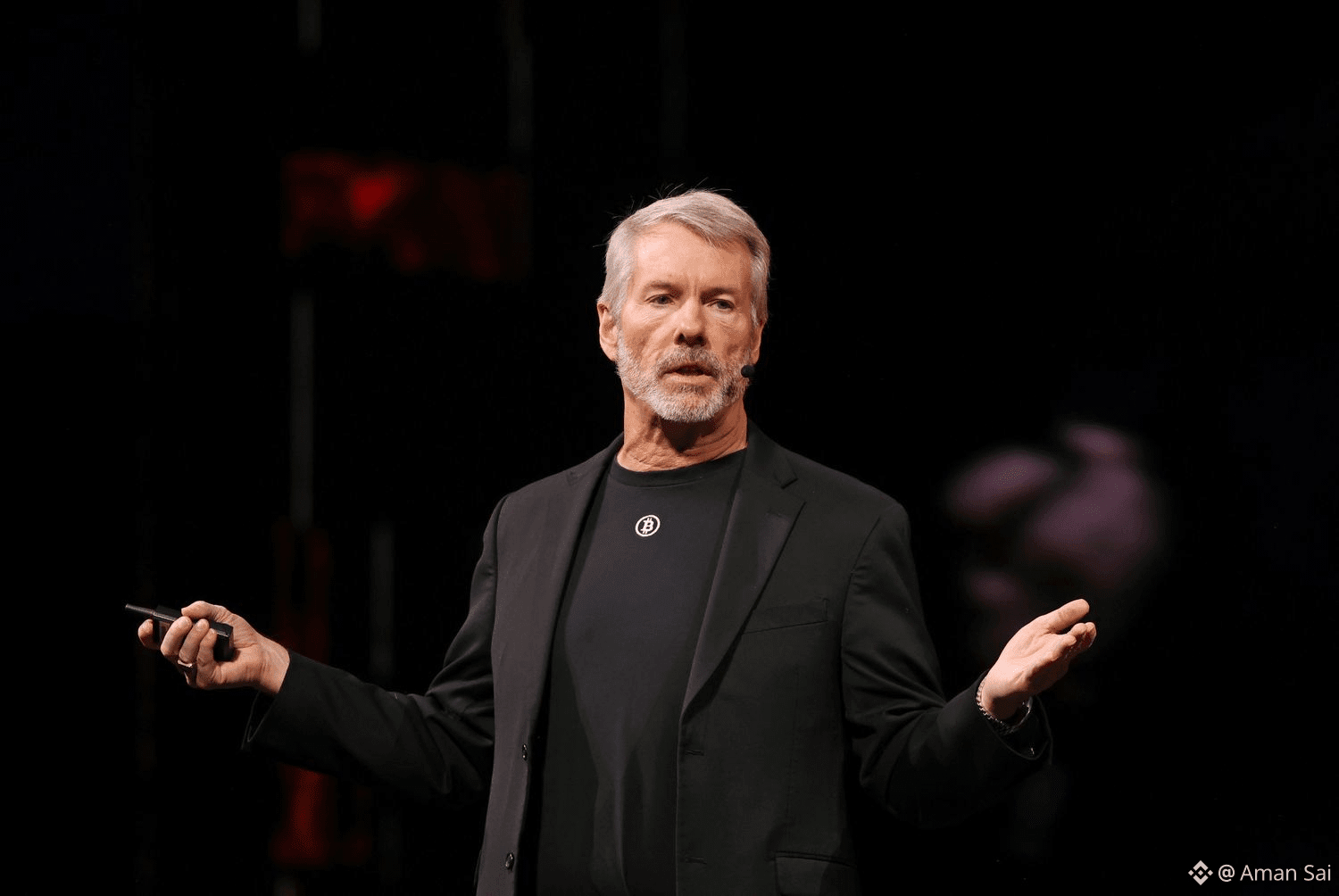

Michael Saylor has once again hinted that Strategy, the world’s largest publicly traded corporate holder of bitcoin, may have added more BTC to its balance sheet following the latest market downturn.

Bitcoin slid sharply over the weekend, trading near $78,000, as broader risk sentiment weakened across global markets. Despite the pullback, Saylor posted a familiar message on X early Sunday: “More Orange.”

A Familiar Signal to the Market

For long-time observers, Saylor’s cryptic “orange” posts are rarely random. Over the past several months, he has consistently used weekend references to orange dots as a teaser ahead of official announcements confirming fresh bitcoin purchases, typically released on Mondays.

This latest post suggests Strategy likely accumulated more bitcoin during the recent selloff, continuing its long-standing strategy of buying BTC during periods of price weakness.

Funding Constraints Could Limit the Buy

However, unlike earlier accumulation phases, Strategy’s capacity to execute a large purchase now appears constrained:

Common stock under pressure: Strategy’s shares fell around 6% over the past week, closing below $150 per share, reducing the company’s ability to raise capital through at-the-market (ATM) equity sales.

Preferred stock below par: The company’s perpetual preferred stock, STRC, traded below its $100 par value throughout the week. This prevented Strategy from issuing new preferred shares via the ATM program tied to that instrument.

Dividend hike to support pricing: To help lift STRC’s price, the company recently increased the dividend rate, signaling efforts to restore access to that funding channel.

Taken together, these factors suggest that while Strategy likely bought bitcoin, the size of the purchase may have been modest compared to past acquisitions.

Strategy’s Growing Bitcoin War Chest

Even with near-term capital constraints, Strategy’s bitcoin holdings remain massive. Since the start of the year, the company has acquired roughly 40,000 BTC, bringing its total holdings to approximately 712,647 BTC , by far the largest stash held by any publicly listed firm.

This aggressive accumulation reflects Saylor’s unwavering conviction that bitcoin is a superior long-term store of value and a core treasury asset, regardless of short-term volatility.

Market Context

At the time of writing, bitcoin is trading around $78,000, down significantly from recent highs. Investors remain cautious amid tighter liquidity conditions, equity market weakness, and ongoing macroeconomic uncertainty.

Closing Thoughts

Michael Saylor’s latest signal reinforces a consistent message: Strategy continues to buy bitcoin into market weakness. While funding limitations may cap the size of any new purchase, the firm’s long-term thesis remains unchanged , bitcoin accumulation remains central to Strategy’s corporate strategy, even during turbulent market conditions.