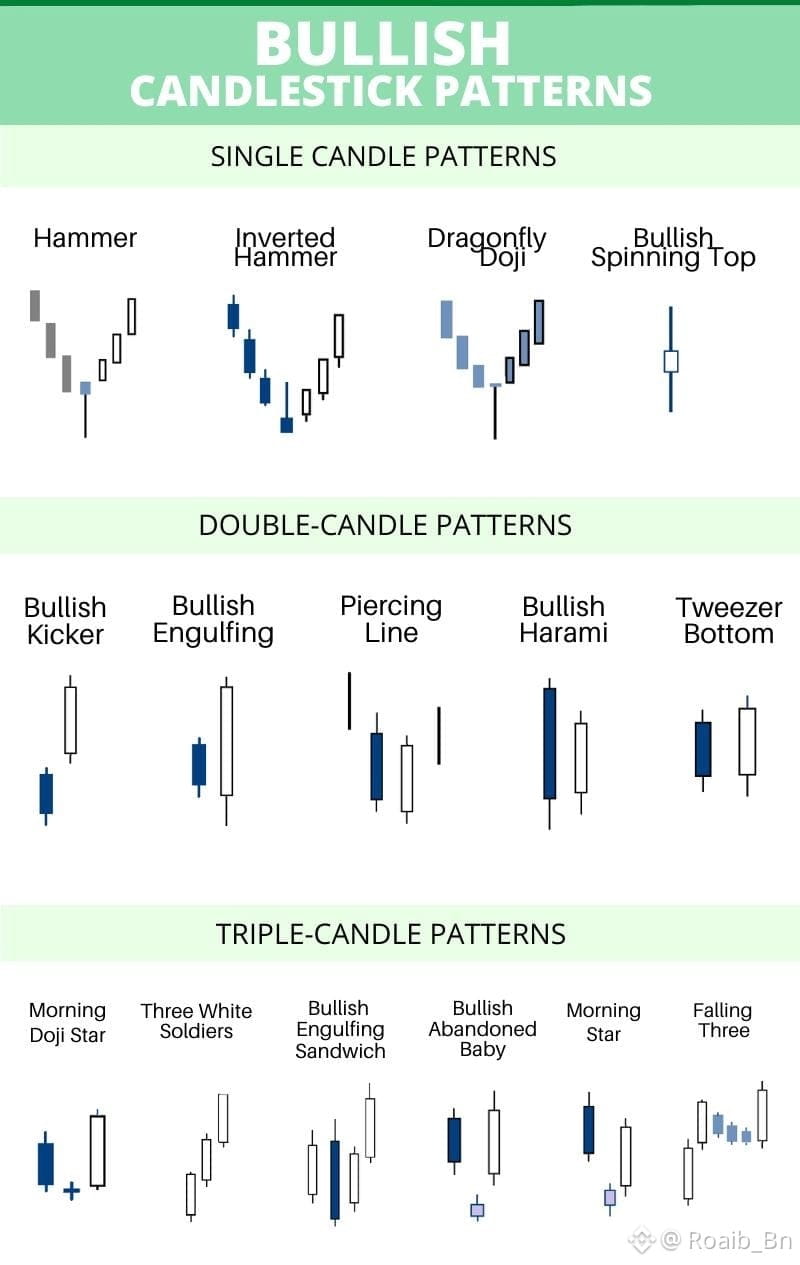

1. Single Candle Bullish Patterns

Single-candle patterns form using only one candle and usually appear near market bottoms.

Hammer

The Hammer has a small body and a long lower wick. It signals strong buying pressure after sellers pushed the price down. When it appears after a downtrend, it often indicates a potential reversal.

Inverted Hammer

This pattern has a small body with a long upper wick. It suggests that buyers attempted to push prices higher and may succeed in reversing the trend.

Dragonfly Doji

The Dragonfly Doji shows equal open and close prices with a long lower shadow. It reflects rejection of lower prices and indicates bullish strength.

Bullish Spinning Top

This candle has a small body and long upper and lower shadows. It signals market indecision but can turn bullish when confirmed by the next candle.

2. Double Candle Bullish Patterns

Double-candle patterns use two candles to confirm trend reversal signals.

Bullish Kicker

This strong reversal pattern occurs when a bullish candle gaps above a bearish candle. It indicates aggressive buying interest.

Bullish Engulfing

A large bullish candle completely engulfs the previous bearish candle. This is one of the most reliable bullish reversal signals.

Piercing Line

In this pattern, a bullish candle closes above the midpoint of the previous bearish candle. It shows buyers stepping back into the market.

Bullish Harami

A small bullish candle forms inside the body of a previous large bearish candle. It suggests weakening selling pressure.

Tweezer Bottom

This pattern forms when two candles share the same low price level, indicating strong support and possible trend reversal.

3. Triple Candle Bullish Patterns

Triple-candle patterns provide stronger confirmation because they involve multiple price actions.

Morning Doji Star

This pattern consists of a bearish candle, a Doji, and a bullish candle. It signals the transition from selling to buying pressure.

Three White Soldiers

Three consecutive bullish candles with higher closes indicate strong upward momentum and trend continuation.

Bullish Engulfing Sandwich

This formation involves a bearish candle between two bullish candles. It highlights a strong shift in market sentiment.

Bullish Abandoned Baby

A rare but powerful reversal pattern formed by a Doji that gaps between a bearish and bullish candle.

Morning Star

Similar to the Morning Doji Star but with a small-bodied middle candle. It signals a reliable bullish reversal.

Here is the candles image 👇

If you found this helpful then please follow like and comment on it thanks 👍

#WhenWillBTCRebound #PreciousMetalsTurbulence #MarketCorrection #CZAMAonBinanceSquare #USPPIJump