Money has always been a story about time. How long it takes to arrive. How long it takes to trust. How long it takes to feel real. For centuries, finance has been built around delay clearing periods, settlement windows, reconciliation cycles that stretch hours into days, days into weeks. Even in the digital age, where messages travel at the speed of light, money still crawls behind them. Plasma exists because that gap has started to feel unacceptable.

Plasma does not begin with ideology. It begins with an observation that borders on uncomfortable honesty: most real economic activity on blockchains today already runs on stablecoins. Dollars, not volatile assets, move payrolls, remittances, merchant payments, treasury balances, and institutional flows. Yet the infrastructure carrying those dollars was never designed for them. Stablecoins were bolted onto general-purpose chains as guests, forced to pay fees in foreign tokens, navigate congestion meant for speculative traffic, and accept settlement uncertainty that makes accountants nervous. Plasma is what happens when someone asks a simple question and refuses to look away from the answer. What if the blockchain were designed around the dollar from the start?

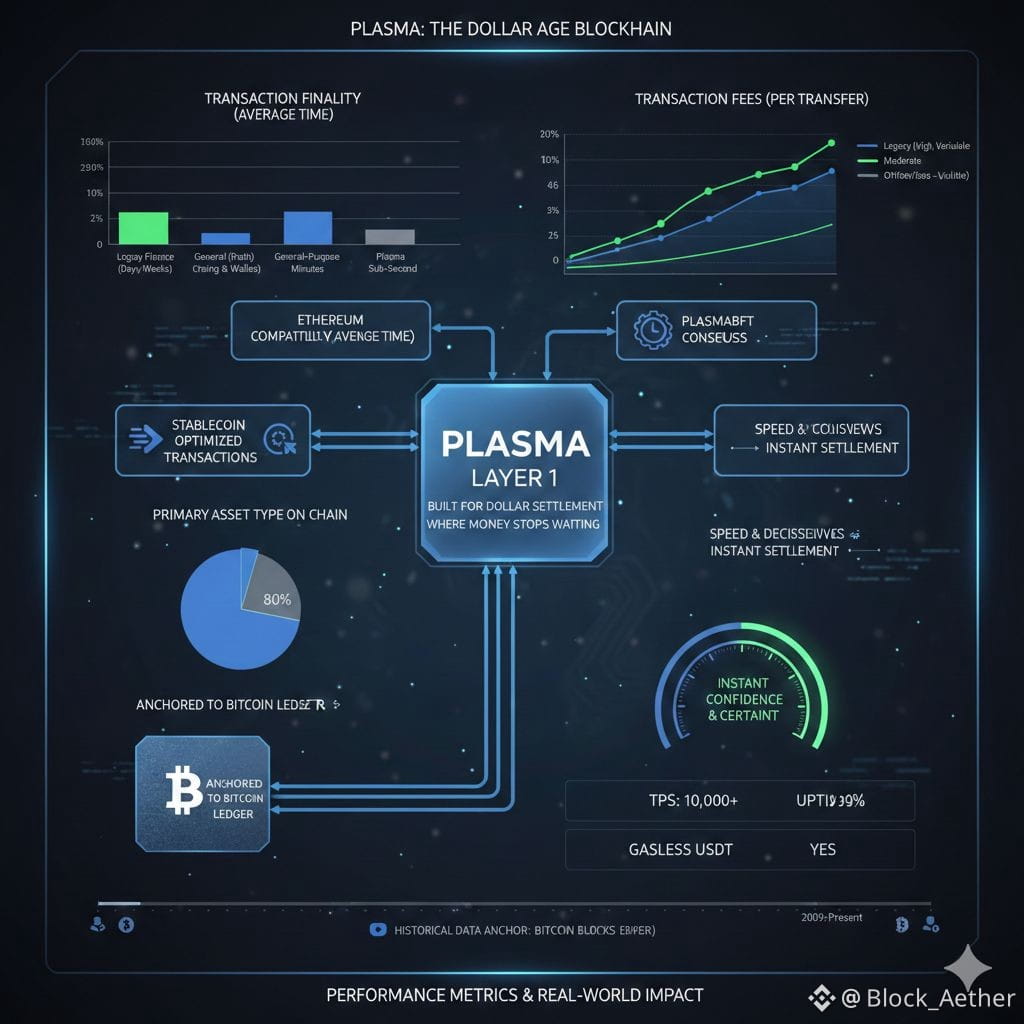

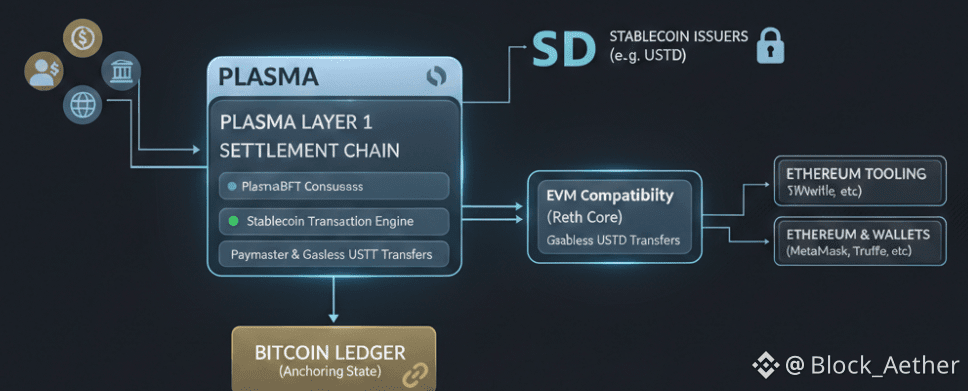

At its core, Plasma is a Layer 1 chain built specifically for stablecoin settlement. That choice quietly rewires everything. Instead of treating stablecoins as just another ERC-20 token floating in a sea of abstractions, Plasma treats them as the primary payload. Transactions are optimized for them. Fee mechanics bend around them. User experience is shaped by the assumption that people want to move money, not manage gas tokens or learn cryptographic rituals. The result is a system that feels less like a laboratory and more like infrastructure—something meant to be leaned on, not admired.

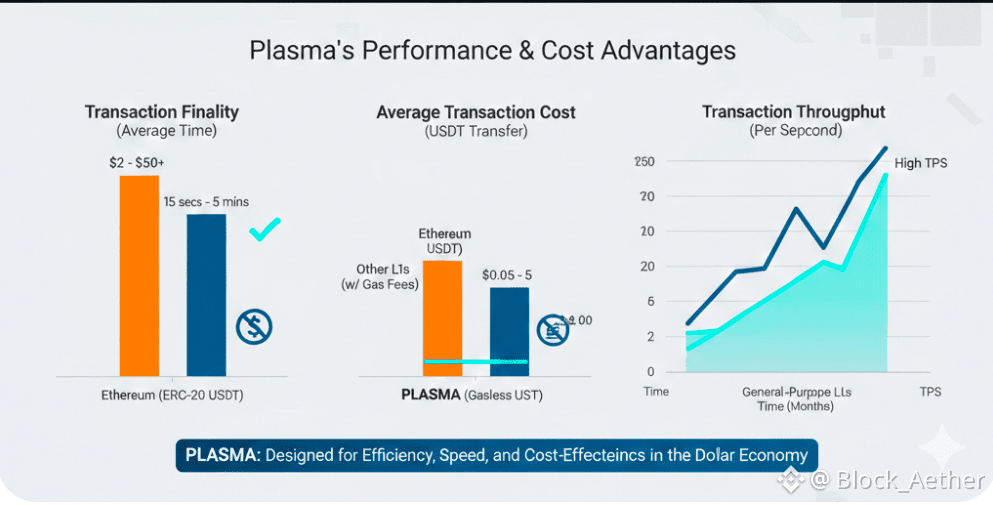

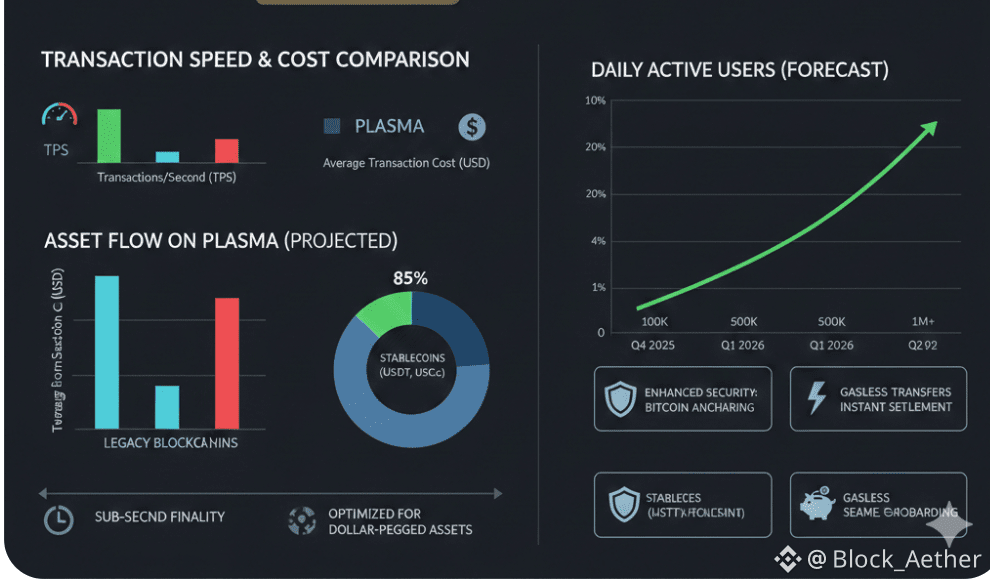

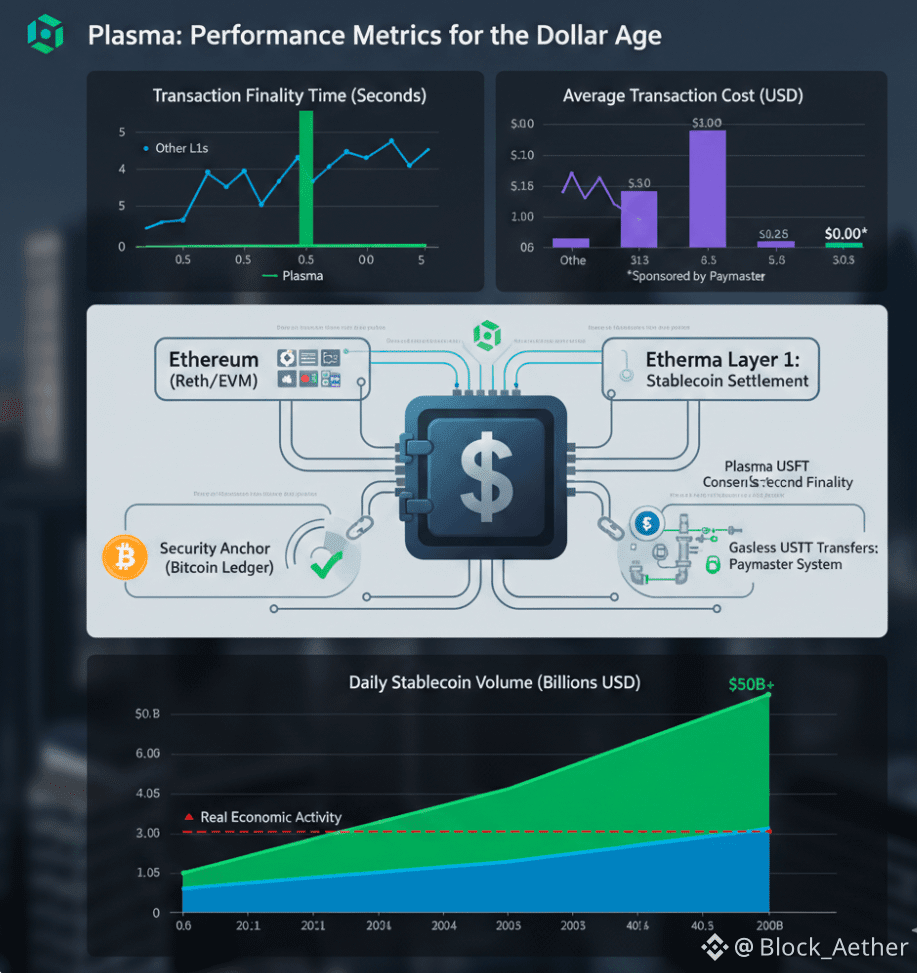

The chain speaks Ethereum fluently. Full EVM compatibility through Reth means developers don’t have to relearn the grammar of smart contracts. Wallets, tooling, mental models—much of it carries over. But beneath that familiar surface, the rhythm is different. Plasma’s consensus mechanism, PlasmaBFT, is engineered for speed and decisiveness. Transactions don’t hover in probabilistic limbo. They land. Sub-second finality changes the emotional texture of payments. A transfer doesn’t feel like a suggestion waiting to be confirmed by the universe. It feels done. For merchants, institutions, and users in high-velocity economies, that difference is not academic. It is the difference between trust and hesitation.

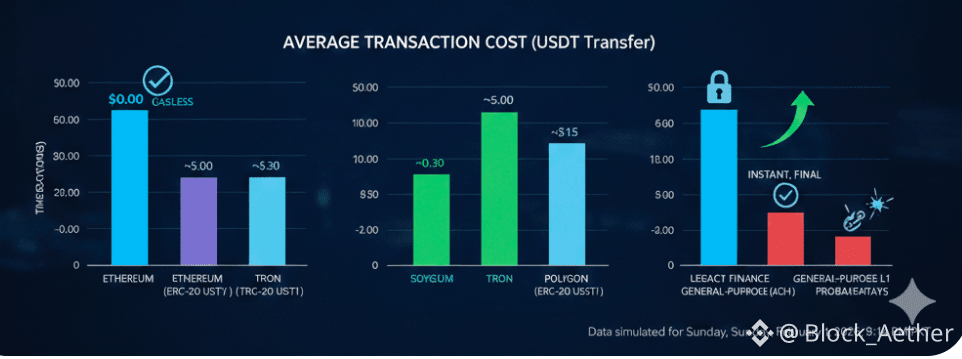

One of Plasma’s most quietly radical features is gasless USDT transfers. On most chains, the act of paying requires a second asset an internal fuel that users must acquire, manage, and often misunderstand. Plasma removes that friction for stablecoin users by sponsoring transaction fees through controlled paymaster systems. A person can receive dollars and send dollars without ever touching a native token. This is not a philosophical statement about free transactions. It is a practical decision about onboarding real humans. Every extra step in a payment flow is a chance for confusion, abandonment, or error. Plasma cuts those steps away with surgical intent.

But convenience always carries tension. Gasless systems raise questions about control, limits, and abuse. Plasma’s answer is not denial but constraint. Sponsored transactions are narrowly scoped. Rate-limited. Monitored. Designed to make everyday use smooth without turning the network into an open faucet for spam. This is a recurring theme in Plasma’s design philosophy: realism over purity. The system assumes that if it is useful, people will push against it. So it builds guardrails instead of pretending pressure won’t come.

Security, too, is approached with a kind of quiet seriousness. Plasma anchors its state to Bitcoin, not because Bitcoin is fashionable, but because it has become the closest thing the digital world has to a neutral clock. By tying its history to Bitcoin’s ledger, Plasma borrows a layer of credibility that is difficult to counterfeit. It is a statement about permanence. About censorship resistance. About the belief that a settlement layer should not only be fast, but hard to rewrite when power dynamics shift. This anchoring does not magically solve governance or regulatory risk, but it creates a reference point outside Plasma’s own ecosystem an external witness to its history.

The users Plasma is built for are not abstract. They are retail participants in regions where stablecoins already function as everyday money, shielding savings from inflation or capital controls. They are payment processors who need predictable settlement. They are institutions that care less about ideological debates and more about whether funds arrive on time, every time, with an audit trail that survives scrutiny. Plasma does not pretend these groups share the same values. It simply tries to give them a common rail.

That ambition comes with friction. A stablecoin-first chain inevitably inherits the politics of the stablecoins it prioritizes. USDT is not just a token; it is an institution with its own relationships, constraints, and controversies. Building infrastructure around it invites scrutiny from regulators, critics, and decentralization purists alike. Plasma sits in that tension without flinching. It neither markets itself as a rebellion nor as a compliant replica of legacy finance. It occupies a middle ground that is uncomfortable precisely because it is honest about trade-offs.

There is a deeper shift happening beneath the technical choices. Plasma reflects a maturation of blockchain thinking. Early networks chased maximal generality, believing one chain could do everything. Plasma suggests a different future: specialization. Purpose-built chains for specific economic functions. Settlement layers that optimize for money rather than novelty. In that world, blockchains stop competing to be everything and start cooperating as infrastructure, each doing one job extremely well.

Whether Plasma succeeds will depend less on benchmarks and more on behavior. How it responds when volumes spike. How it negotiates pressure from powerful counterparties. How it balances neutrality with usability as real money flows through it. These are not questions that whitepapers answer. They are answered in moments of stress, when incentives collide and design decisions reveal their true shape.

What Plasma offers today is not a promise of utopia, but a credible alternative to waiting. A system that treats time as a cost worth eliminating. A chain that assumes money should move at the speed people already expect from everything else in their lives. In that sense, Plasma feels less like a speculative project and more like a correction a quiet insistence that if digital dollars are here to stay, they deserve infrastructure that respects their role in the real world.

The most transformative technologies often arrive without spectacle. They don’t shout. They align. Plasma is built on the belief that when money stops waiting, everything around it begins to move differently. Whether the world is ready for that shift remains an open question. But the rail is being laid, block by block, finality by finality, with a confidence that suggests the waiting itself was always the anomaly.