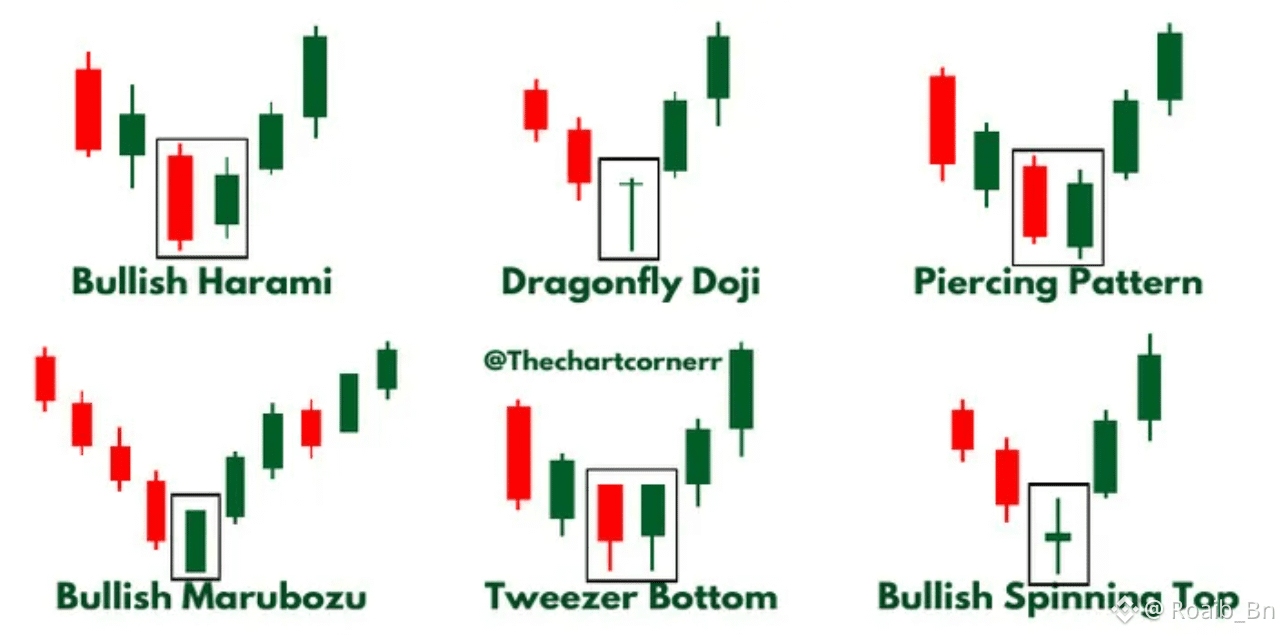

1. Bullish Harami

A Bullish Harami appears after a downtrend and consists of a large red candle followed by a small green candle inside it.

It signals weakening selling pressure and a possible trend reversal to the upside.

2. Dragonfly Doji

This candle has a long lower wick with little or no body and appears after a decline.

It shows that sellers pushed prices down but buyers regained control, hinting at a bullish reversal.

3. Piercing Pattern

The Piercing Pattern forms when a strong green candle opens below a previous red candle and closes above its midpoint.

It suggests buyers are stepping in aggressively after a bearish move.

4. Bullish Marubozu

A Bullish Marubozu has a long green body with no wicks on either side.

It indicates strong buyer dominance throughout the session and often signals trend continuation.

5. Tweezer Bottom

This pattern consists of two candles with nearly equal lows, usually red followed by green.

It shows strong support at the bottom and often marks the end of a downtrend.

6. Bullish Spinning Top

A Bullish Spinning Top has a small body with long upper and lower wicks.

It reflects market indecision, but after a downtrend, it may hint at a potential bullish reversal.

Here is the image👇

If you found this helpful then please follow like and comment on it thanks 👍

#WhenWillBTCRebound #PreciousMetalsTurbulence #MarketCorrection #CZAMAonBinanceSquare #USPPIJump