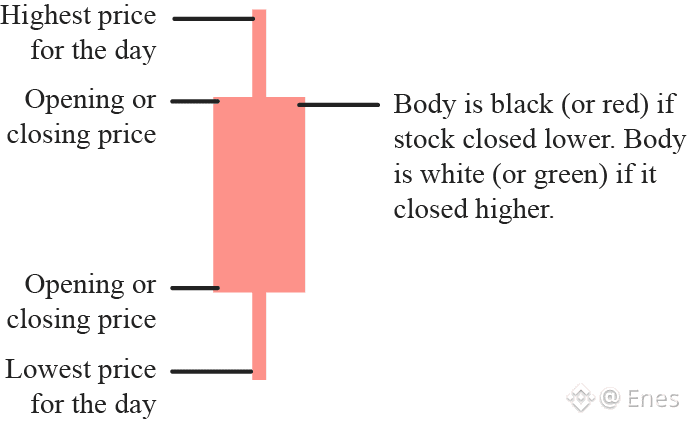

Candlesticks aren’t magic — but they do visualize trader psychology in real time.

Here are 5 classic patterns that show up again and again across all markets:

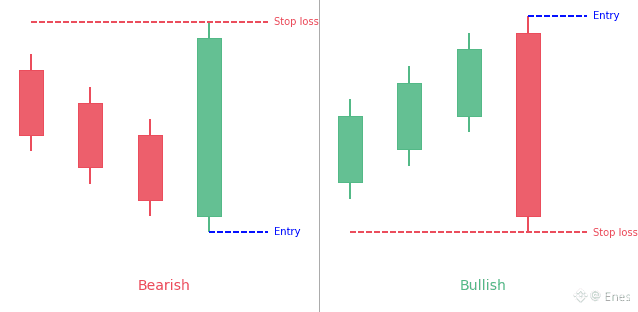

1️⃣ Three Line Strike

A strong reversal pattern. After three candles in one direction, price snaps hard the other way. High reversal accuracy when confirmed.

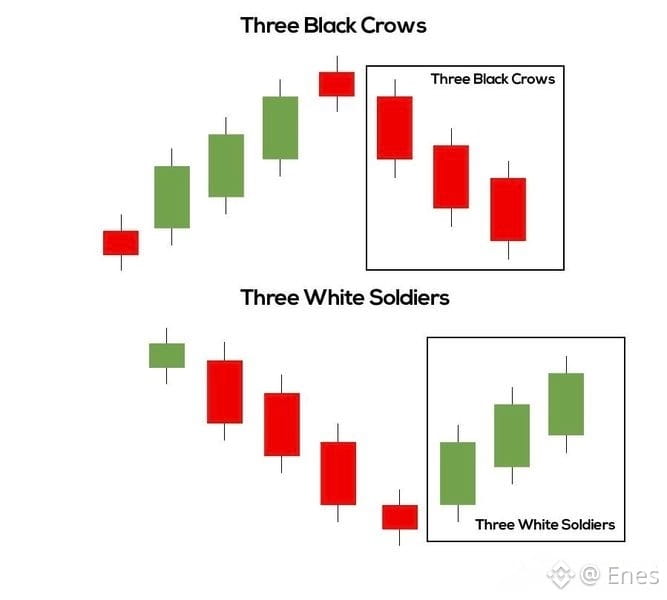

2️⃣ Three Black Crows

Three strong bearish candles after an uptrend. Often signals trend exhaustion and continuation to the downside.

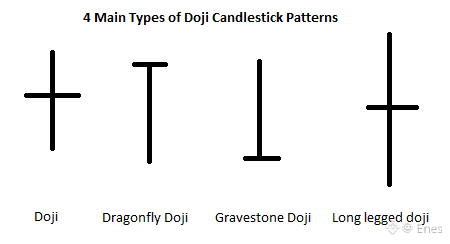

3️⃣ Doji

Indecision. Buyers and sellers are fighting — momentum is fading. Context matters more than the candle itself.

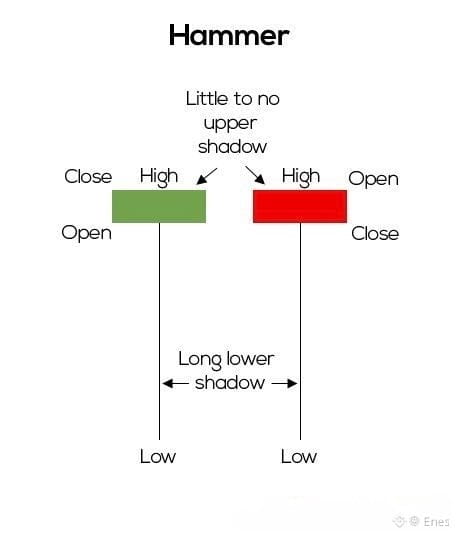

4️⃣ Hammer

Long lower wick, small body. Price gets rejected at lower levels → potential bullish reversal after a downtrend.

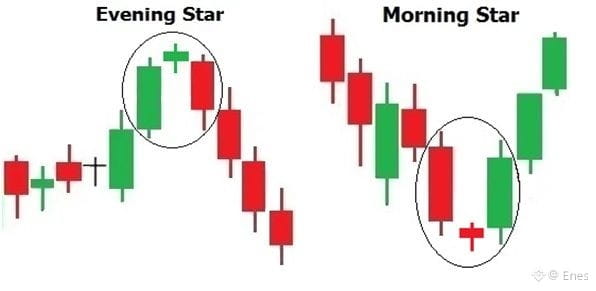

5️⃣ Morning & Evening Star

Three-candle reversal structures.

• Morning Star = bullish

• Evening Star = bearish

📌 Important:

Candlesticks alone can give false signals. The real edge comes from combining them with order flow, volume, and liquidity.

Price tells the story — but order flow confirms it.

Trade smarter, not harder.