A beginner friendly, rules based method to stop emotional exits and build

long term confidence.

Panic selling is not a knowledge problem. It is a nervous system problem.

When the market turns red, your brain treats price movement like danger. You feel urgency. Your body wants relief. Your finger wants the sell button.

This article gives you a simple system that works because it respects reality.

Volatility is normal in crypto.

Your emotions are also normal.

What is not normal is letting emotions control execution.

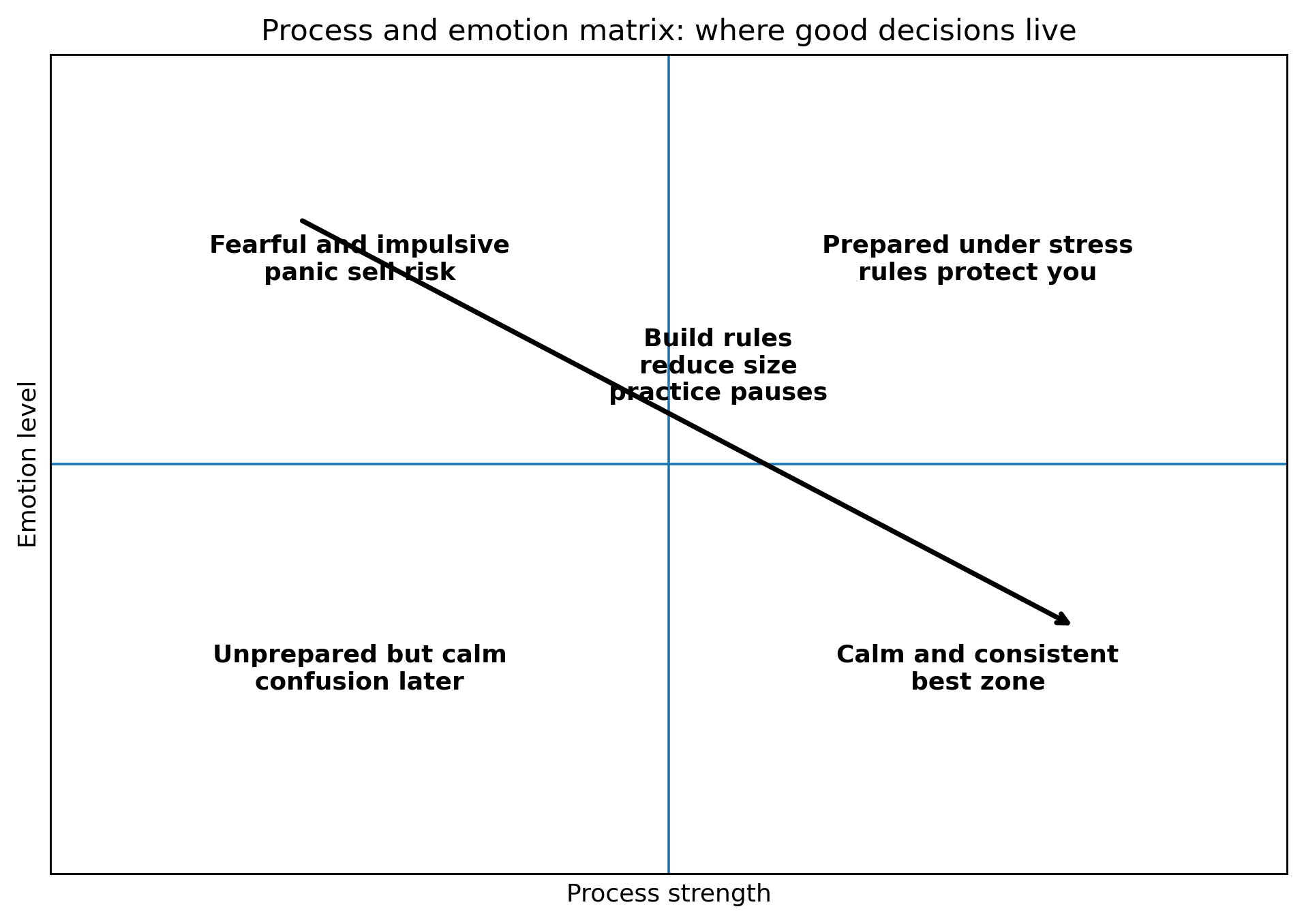

You do not need perfect predictions. You need repeatable behavior.

I will use the whole market as the context, because in heavy drawdowns almost everything drops together. I will mention BTC once or twice as an example of a widely watched market, and I will mention BNB when we talk about fees and overtrading costs, because costs matter when you act

emotionally.

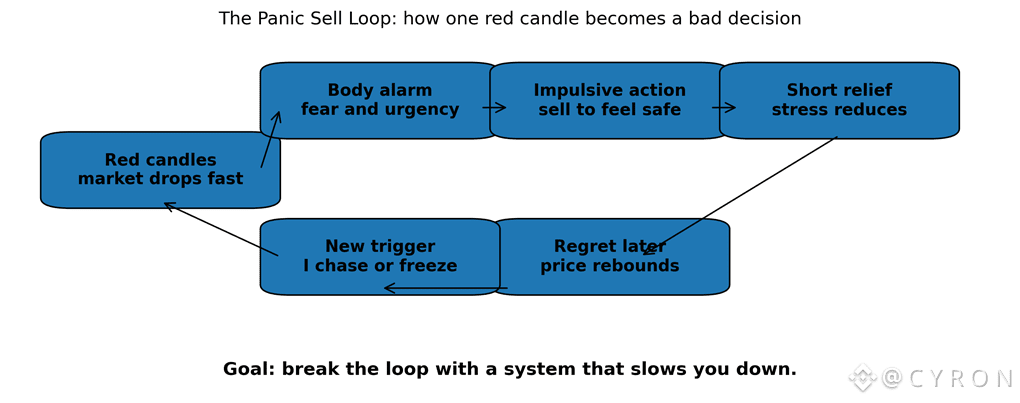

What panic selling really is

Panic selling is selling primarily to reduce stress, not to follow a plan.

It usually happens when these three things combine.

Price moves fast.

Your position size is too big for your risk tolerance.

You do not have a pre written decision rule.

When those conditions appear together, your brain searches for the fastest relief. Selling provides relief in the short term, even when it hurts you in the long term.

This is why panic selling repeats. The relief teaches the brain that selling equals safety. Next time, the urge appears faster.

The first step is to see the loop.

The data behind the urge: why losses feel bigger than gains

Behavioral research explains why the urge feels so strong.

Prospect theory describes loss aversion: losses feel psychologically larger than equal sized gains. Many summaries describe the effect as roughly two times stronger, meaning a loss hurts about twice as much as a gain feels good.

This matters in crypto because volatility delivers frequent losses on the way to long term gains. If you do not have a system, your brain will naturally overreact to losses and underreact to process.

Another well known bias is the disposition effect: investors tend to sell winners too early and hold losers too long. This is not a crypto only issue. It shows up across markets because it is human behavior.

The point is not to memorize bias names. The point is to accept a fact.

If you rely on feelings during volatility, you will usually act at the wrong time.

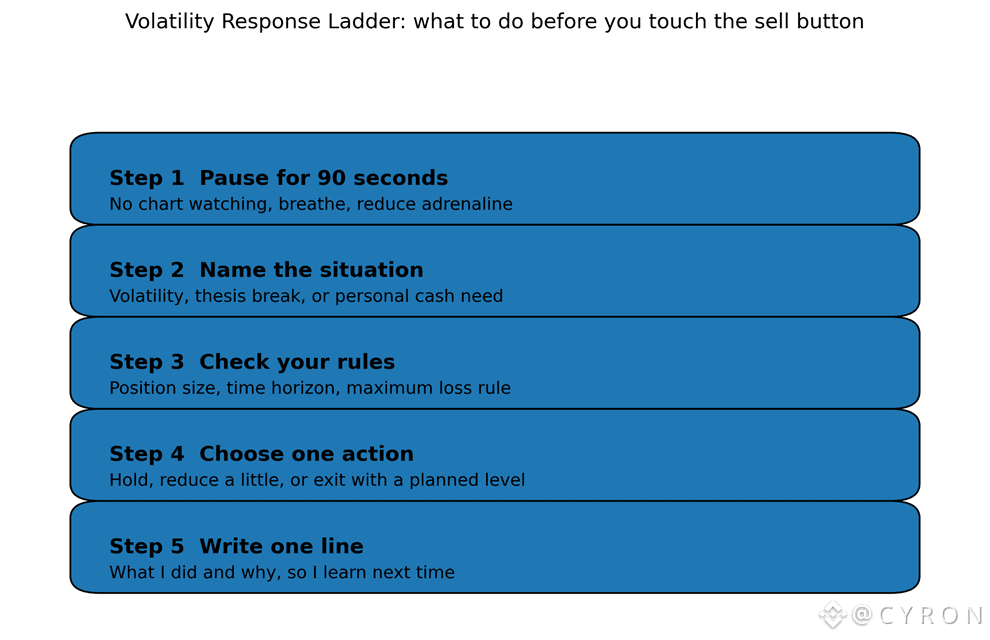

The simple system: the volatility response ladder

Your system must be short enough to use under stress. If it takes ten minutes, you will not follow it.

Here is the ladder. It slows you down, separates volatility from real risk, and forces one intentional decision.

The ladder is powerful because it creates friction before action. That friction is the difference between a planned exit and a panic exit.

If you want one rule to remember, remember this.

No selling inside adrenaline.

You can still sell. You just do it after the 90 second pause and after you name the situation.

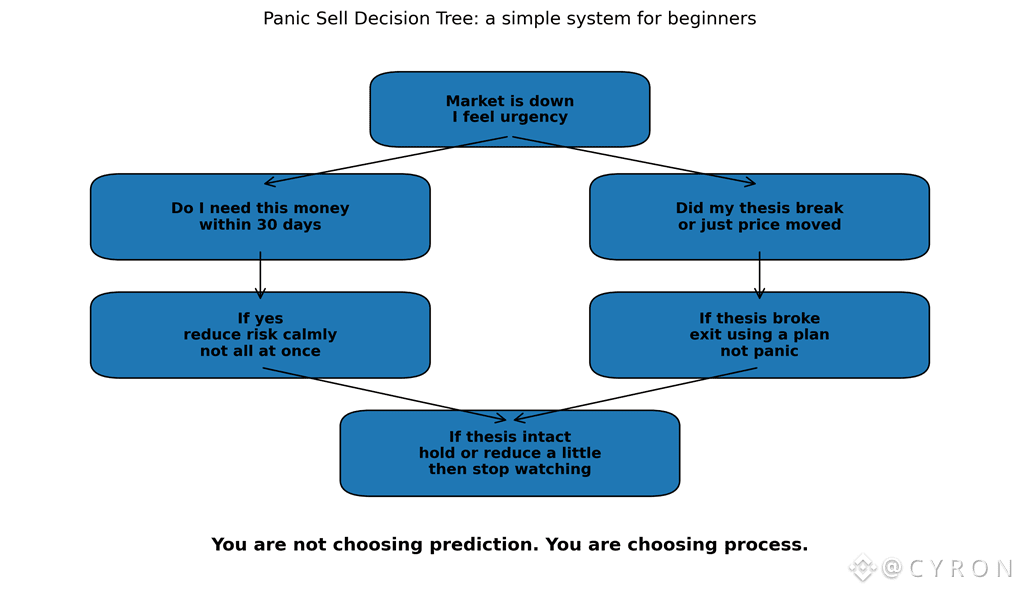

The panic sell decision tree: your emergency checklist

Most beginners panic sell for one of three reasons.

They actually need the money soon.

Their thesis is broken, but they never defined the thesis clearly.

They are reacting to price only.

A decision tree prevents you from mixing these reasons.

Why panic selling hurts most: drawdown math and recovery timing

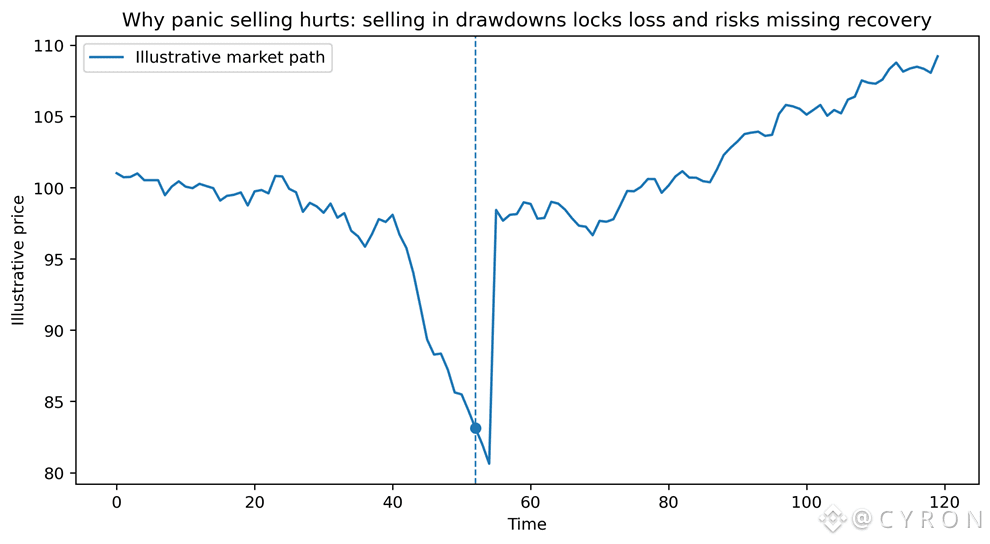

When the market is down, the pain is real. But the math is also real.

If you sell after a large drawdown, you lock in the loss.

If you stay invested with proper sizing, you keep the possibility of recovery.

If you sell and then hesitate to re enter, you risk missing the strongest rebound days.

Rebounds often cluster near the worst days, because markets snap back when forced selling ends and liquidity returns.

Here is a simple illustration of how a drawdown can later recover. It is not real market data. It is a teaching chart that shows the logic.

This is where Risk Management beats prediction.

You cannot control the market.

You can control your size, your time horizon, and your decisions.

When your size is small enough, you do not need to panic.

When your size is too big, every candle becomes emotional.

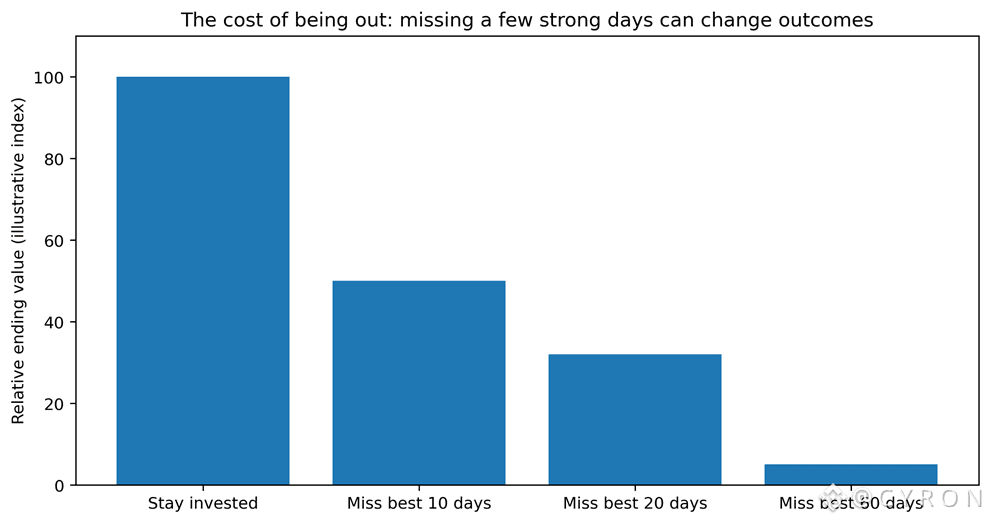

The cost of being out: missing the best days problem

Many investors learn a painful lesson: trying to avoid the worst days often causes them to miss the best days.

Some educational examples in traditional markets show that missing just a handful of the best days over long periods can significantly reduce long term outcomes. There is debate about how these examples should be interpreted, but the core warning is still valid for beginners.

Timing is hard.

The best and worst days often appear close together.

Emotional exits increase the chance you are out during the rebound.

Here is a concept chart that illustrates the idea. It is an index style illustration, not a guarantee and not a forecast.

Every red market creates two kinds of people. Those who react and those who learn. The difference is not intelligence or luck, it is discipline. When you stop selling inside fear, you give yourself the one advantage most traders never build: consistency. So make your rules visible, keep your risk small enough to sleep, and treat each volatile day as training for your future self. Your goal is not to win one trade. Your goal is to become the person who does not break when the market shakes.

$BTC $BNB