Early February 2026, and $XPL is trading right around $0.102–$0.108, with daily volumes still pushing past $100 million on the bigger exchanges. Market cap sits in the $190–200 million range. After the brutal sell-off that followed the mainnet beta back in late 2025, the price has at least stopped bleeding out and is holding above that psychological $0.10 mark. Buyers seem to be stepping in again, though it’s hardly a roaring comeback yet.

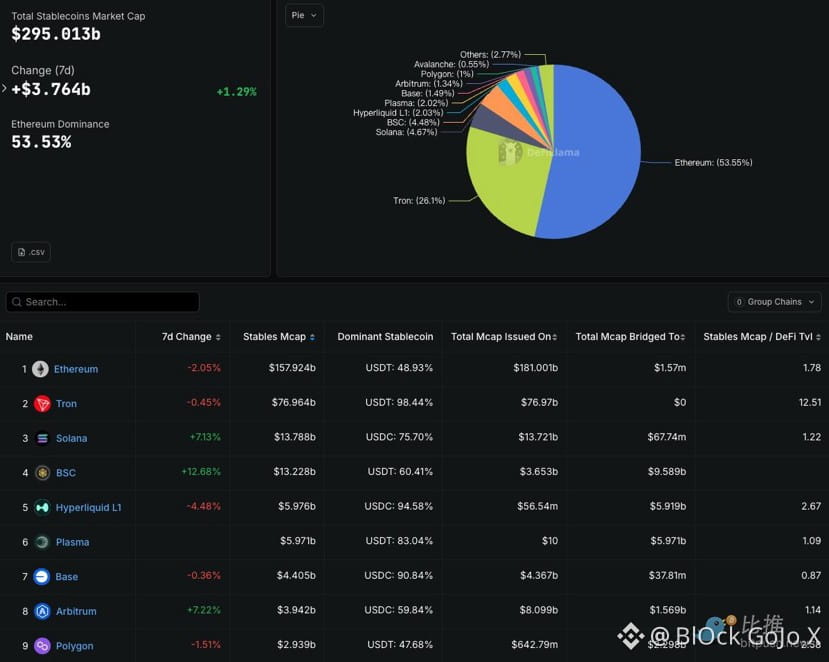

Plasma was built from the ground up as a Layer 1 focused on stablecoin payments—mostly USDT—at a time when the broader stablecoin market is well over $250 billion but still plagued by high fees and slow settlements on chains like Ethereum. The pitch is straightforward: make everyday transfers instant and essentially free, especially for remittances or commerce in places where costs matter.

What’s Under the Hood Technically

At its core, Plasma runs on PlasmaBFT, its own take on Byzantine Fault Tolerant consensus. That gives it sub-second finality and the ability to handle thousands of transactions per second without breaking a sweat. It’s fully EVM-compatible, so developers can port over Ethereum tools and contracts without much hassle.

The real differentiator is the gas abstraction layer. Simple USDT transfers—now badged as USDT0—are zero-fee because the protocol covers them through a paymaster. Anything more complicated, like DeFi interactions, still needs gas, which you can pay in XPL or even convert from stablecoins on the fly. Ties to Tether and Bitfinex mean tight integration with major stablecoin bridges, including pBTC for Bitcoin liquidity. All of that makes sense on paper for a payments-focused chain, though it’s still young and hasn’t faced truly extreme stress tests.

Tokenomics and Supply Dynamics

Total supply is capped at 10 billion XPL. Breakdown looks roughly like this:

• 10% went to the public sale (most unlocked, except U.S. buyers locked until late July 2026)

• 40% earmarked for ecosystem incentives and growth, with only a small slice liquid at launch and the rest vesting over three years

• 25% each to team and early investors, on longer cliffs and vesting

Fees follow an EIP-1559 model—base fee gets burned, which should turn deflationary once volume picks up meaningfully. Staking rewards are set to kick in properly this year, starting around 5% annual emission and tapering down. That introduces controlled inflation, but burns and staking lockups could offset it if usage grows.

The catch, of course, is the vesting schedule. Starting mid-2026, we could see roughly 100 million tokens hitting the market each month unless staking or organic demand soaks it up. That’s been a persistent overhang since launch and one reason the price got hammered so hard early on.

Recent Ecosystem Moves and Adoption Metrics

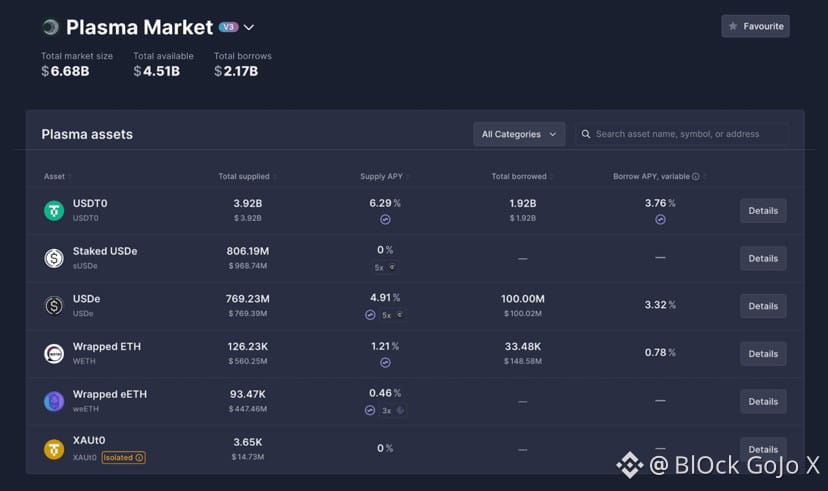

On-chain numbers remain the brightest spot. Stablecoin deposits have stayed north of $5–6 billion, putting Plasma solidly in the top tier for USDT holdings outside of Tron and Ethereum. Recent highlights include the NEAR Intents integration in late January for better cross-chain settlement, ongoing fiat on-ramps through partners like ZeroHash and Stripe Bridge, and regulatory progress with a VASP license in Italy.

DeFi side is growing slowly—Pendle, Equilibria, and a few lending platforms have deployed, offering yield on wrapped XPL or stablecoins. Consumer-facing stuff like the Plasma One card and neobank app is rolling out, aiming to bring stablecoin payments to everyday users. Listings on Binance, Kraken, and others keep liquidity decent, and occasional reward campaigns help visibility.

Still, transaction count is heavily skewed toward pure transfers rather than complex dApps. That’s by design, but it also means the ecosystem feels narrower than general-purpose chains.

Developer Activity

Because it’s EVM-compatible, the barrier for Ethereum devs is low. Public repos for core tooling exist, and we’ve seen steady if unspectacular commit activity. Most new projects are stablecoin utilities—bridges, yield vaults, payment gateways—rather than entirely novel applications. It’s early days, and growth seems tied directly to stablecoin volume rather than a broader developer rush.

Headwinds and Risks

Competition is fierce. Tron still dominates USDT volume with rock-bottom fees, while faster chains like Solana and Base eat into general payments. Plasma’s tight linkage to Tether creates single-issuer risk—if regulatory heat hits USDT specifically, the network feels it.

Validator set is still somewhat centralized ahead of full delegation rollout, and the token’s history of sharp dumps around liquidity events hasn’t been forgotten. Broader market correlation remains high; when Bitcoin sneezes, alts like XPL catch cold.

Looking Ahead

The bet on Plasma boils down to whether specialized stablecoin infrastructure can carve out meaningful share in a massive but fragmented market. Full staking delegation this year should tighten supply and improve security. More fiat ramps and regulatory wins could open real-world corridors.

That said, breaking convincingly above $0.15 or so will probably need visible transaction share gains and absorption of upcoming unlocks. The fundamentals address genuine friction in stablecoin UX, but execution in a crowded space is everything. For now, the price action around $0.10 feels like a tentative bottom—worth watching, but far from a clear all-in signal.