The recent, violent price correction in gold $XAU and silver was more than a sharp move in the precious metals market; it was a critical signal about shifting expectations across the global financial landscape. In a single session, these assets experienced one of their most significant daily declines, forcing market participants to confront a sudden wave of uncertainty. Understanding the anatomy of such shocks is strategically vital, as they often reveal deep-seated vulnerabilities and decode the true sentiment lurking beneath the market's surface.

This volatility raises a core question for every investor: Was this a temporary, sentiment-driven shakeout offering a tactical buying opportunity, or does it signal a fundamental change in the macroeconomic environment that has supported hard assets for years? The answer will have profound implications not only for precious metals but for the entire spectrum of risk assets.

This analysis will dissect the key factors at play. We will first review the powerful, long-term drivers that formed the bedrock of the bull market in gold. We will then identify the specific catalyst that triggered the precipitous drop and, finally, explore the strategic implications for investors trying to navigate the complex relationship between monetary policy, inflation, and asset valuation in this new, more ambiguous environment.

2. The Enduring Case for Gold: A Foundation of Macroeconomic Stress

To properly contextualize the recent sell-off, it is crucial to first understand the fundamental, long-term drivers behind gold's multi-year rally. These factors are not products of short-term speculation but represent deep-seated trends and stresses within the global economy. They form the structural foundation of the investment thesis for hard assets.

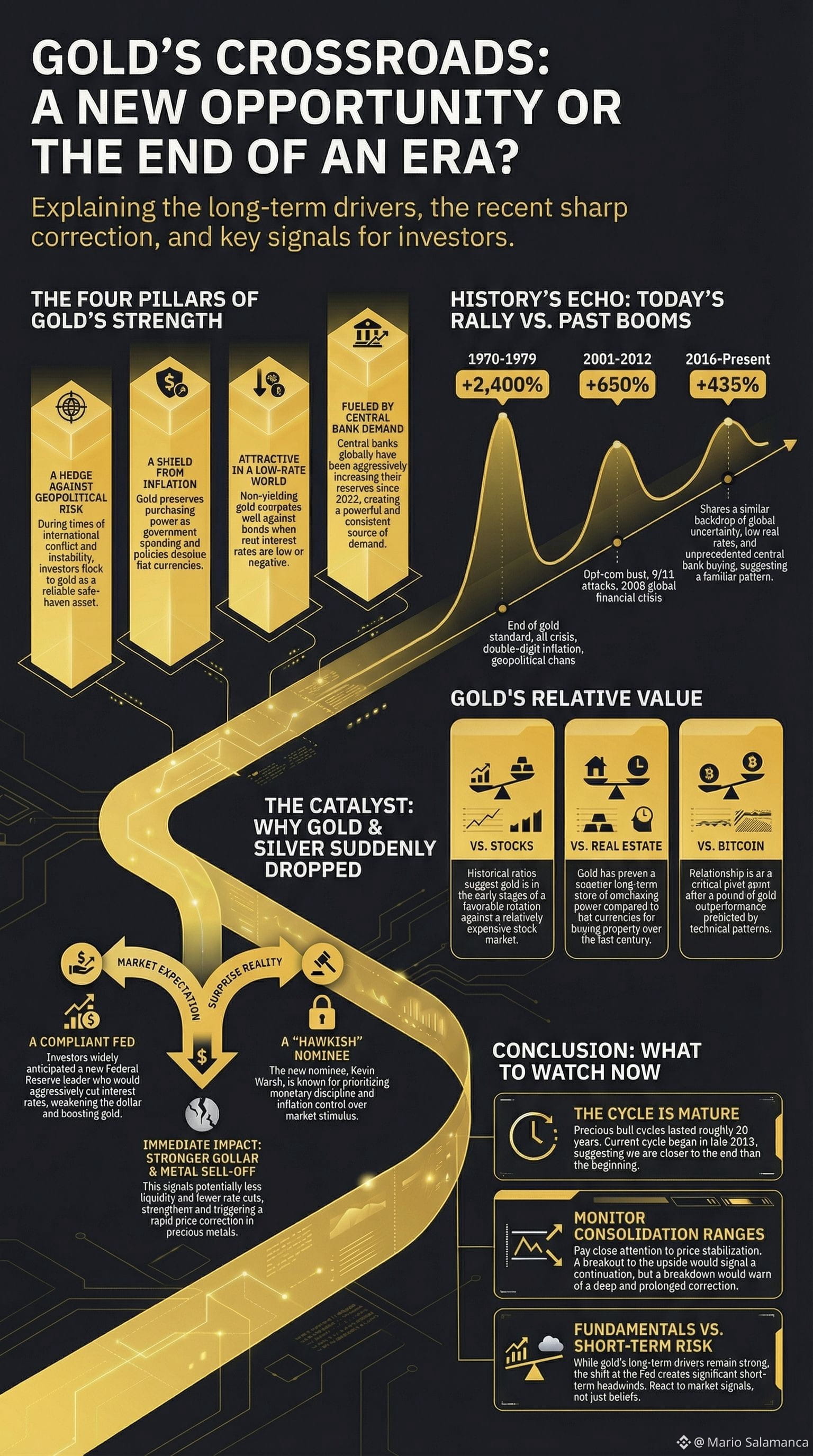

The historical and current macroeconomic arguments supporting a positive outlook for gold are multifaceted and interconnected:

Geopolitical and Global Uncertainty: A persistent state of global instability, marked by ongoing military conflicts, disruptive trade tensions, and the lingering economic scars of the recent pandemic, has consistently bolstered gold's role as a safe-haven asset.

Persistent Inflationary Pressures: There is a latent fear among investors of a new inflation regime, where price increases remain structurally higher than the low levels seen in the 2010-2020 decade. The potential for energy price spikes and trade disruptions adds to this concern, eroding the purchasing power of fiat currencies.

Ultra-Expansive Fiscal Policies: Governments, particularly in the United States, continue to run massive fiscal deficits, injecting enormous amounts of liquidity into the financial system. This policy stance, combined with the Federal Reserve's decision to halt its balance sheet reduction program (Quantitative Tightening), provides a powerful tailwind for tangible assets.

Low Real Interest Rates: In an environment where official interest rates, minus inflation, are low or even negative, the opportunity cost of holding a non-yielding asset like gold diminishes significantly. This makes gold relatively more attractive compared to fixed-income instruments.

Sustained Central Bank Demand: Perhaps the most direct and powerful driver has been the structural trend of global central banks increasing their gold reserves. This is not a cyclical trade but a long-term strategic shift, creating a consistent and significant source of physical demand that has accelerated exponentially since the year 2022.

A Weaker U.S. Dollar: Historically, there has been a strong inverse correlation between the value of the U.S. dollar and the price of gold. As gold is priced in dollars, a period of dollar weakness typically supports higher gold prices.

It is the confluence of these factors, rather than any single driver, that has created the powerful, long-term tailwind for gold. Yet, despite this robust foundation, the market's extreme consensus created a vulnerability where a single, narrative-breaking catalyst could trigger a disproportionate reaction.

3. The Catalyst: A Potential Paradigm Shift at the Federal Reserve

The primary catalyst for the sharp sell-off in precious metals was the surprise nomination of Kevin Warsh to lead the Federal Reserve. The leadership of the Fed is of paramount strategic importance; the market’s perception of the Chair's core philosophy can dramatically and instantaneously alter asset prices by reshaping expectations for future monetary policy.

The nominee's profile spooked markets because it represents a potential and significant departure from the policy status quo of the last decade. The key attributes driving this re-evaluation are:

A Challenge to "Dovish" Expectations: The market had largely priced in the continuation of a highly accommodative, or "dovish," Federal Reserve. The prevailing expectation was for a compliant Fed Chair who would aggressively cut interest rates to support markets and ease the government's debt financing costs. The nominee, in contrast, is perceived as being far less tolerant of inflation and less inclined to bow to political or market pressure.

Prioritizing Monetary Discipline: The nominee is viewed as an advocate for monetary discipline and the credibility of the central bank. This stands in stark contrast to the recent era defined by relentless stimulus and the implicit market backstop known as the "Fed Put"—the belief that the Fed will always intervene to prevent significant market downturns. A shift away from this policy could introduce significant risk back into the system.

Implications for the U.S. Dollar: A more credible and disciplined Fed, focused on price stability, could lead to a stronger U.S. dollar. This would create a direct and powerful headwind for gold and other commodities that are priced in the U.S. currency.

However, a strategist must question the durability of this new paradigm. While the market reacted to the nominee's historical profile, this "hawkish" turn is far from guaranteed. The great doubt lies in whether any Fed Chair can truly withstand the immense political pressure from a president like Donald Trump, who has a documented history of publicly attacking his own appointees—most notably Jerome Powell—for not adhering to his demands for lower interest rates. The market’s knee-jerk reaction may prove to be a head-fake if, in a few months, the new leadership bows to the same political pressures as the old.

4. Gold in Context: A Relative Value Analysis

Strategic asset analysis requires looking beyond absolute price movements and evaluating assets in relation to one another. Comparing gold to equities and leading digital assets provides a clearer picture of its role and potential trajectory in a modern investment portfolio. The first crucial comparison is between gold and equities, where a long-term historical analysis reveals a deeply cyclical pattern.

An analysis of the historical relationship between gold and the U.S. stock market, represented by the Dow Jones Industrial Average, shows distinct periods where one asset becomes profoundly expensive or cheap relative to the other. Historical peaks in the stock market-to-gold ratio, such as in 1929, 1971, and the year 2000, have signaled major turning points in favor of gold. Based on this long-term framework, the current ratio suggests that the favorable rotation from equities into gold may be in its early stages and remains far from the historical extremes that would signal gold is overvalued.

A more tactical view emerges when comparing gold to Bitcoin. A technical "Head and Shoulders" pattern that had been signaling a period of outperformance for gold relative to Bitcoin has just reached its price objective. This development does not serve as a definitive long-term signal that the trend has reversed permanently. However, it does indicate that the phase of gold's strong outperformance may be pausing. This could create a window for a short-term recovery in Bitcoin's value relative to gold, as the powerful relative-strength trend in favor of the precious metal has, for now, met its initial target.

5. Conclusion: Navigating the Noise in an Over-Consensus Market

The recent market action synthesizes the central tension facing investors today: the long-term macroeconomic arguments supporting hard assets remain largely intact, yet the short-term political and monetary landscape has become significantly more uncertain. While the pillars of high debt, geopolitical instability, and inflationary pressures endure, the surprise nomination for Fed Chair has introduced a powerful new variable that challenges the prevailing market narrative.

The core strategic takeaway from this event is a lesson in market positioning. The violent nature of the sell-off was amplified by an extremely high degree of consensus and crowded positioning among investors. When nearly everyone is on the same side of a trade, convinced of a single outcome, any contrary catalyst—no matter how unexpected—can create a panicked and disorderly rush for the exit. The resulting price action is often disproportionate to the news itself.

Ultimately, this shock serves as a crucial case study for investors in all asset classes. It underscores the importance of monitoring for shifts in underlying trends and maintaining a healthy skepticism of overly crowded trades. This is particularly true when considering the market cycle. Previous gold bull markets (1970-79, 2001-12) lasted approximately 10 years each. The current cycle, which began in late 2015, is now approaching that same duration, suggesting the market is more near its conclusion than its beginning. As this episode demonstrates, market narratives can shift with surprising speed, and even assets with a robust long-term thesis can become vulnerable when the consensus becomes too complacent.