@Plasma Within crypto markets, the majority of genuine economic activity does not stem from speculation, NFTs, or even most DeFi applications. Instead, it comes from payments, settlement, and the transfer of stable value between participants. Exchanges moving liquidity, merchants accepting payments, funds adjusting exposure, and individuals sending money across borders all rely on the same fundamental operation: transferring value quickly, cheaply, and with low risk. Although this activity often goes unnoticed, it accounts for the largest share of real transaction volume and sustained demand for blockspace.

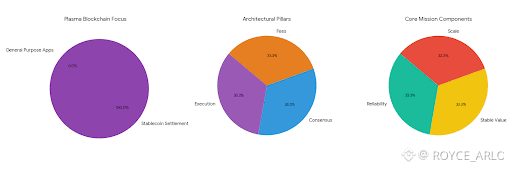

Historically, blockchains have optimized for features like programmability, decentralization, or composability. Very few, however, have been designed with settlement as their primary objective. On most general-purpose networks, payments are treated as just another application. This creates inefficiencies: gas costs fluctuate, finality is probabilistic, and system design does not match the requirements of real-world financial infrastructure. As a result, stablecoins despite dominating on-chain transaction volume operate on platforms that were never tailored to their core use case.

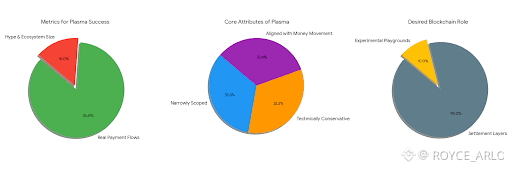

Plasma addresses this mismatch by positioning itself as a Layer 1 blockchain dedicated to stablecoin settlement. Rather than attempting to support every possible application, it focuses on a single goal: enabling the reliable movement of stable value at scale. Its architectural decisions, spanning execution, consensus, and fees, are shaped around this priority.

At the protocol level, Plasma is fully EVM compatible through Reth, allowing it to run standard Ethereum-style smart contracts and integrate with existing tooling. This compatibility is particularly important for traders and institutions, as it minimizes operational friction. Wallets, custody solutions, analytics platforms, and risk systems built for Ethereum can be reused with minimal modification. From a market standpoint, this lowers switching costs and lets Plasma connect to existing capital flows instead of attempting to bootstrap entirely new ones.

Plasma diverges from most EVM chains in how it handles finality and settlement. It relies on PlasmaBFT, a consensus design that delivers sub-second finality. In practice, transactions become irreversible almost immediately. For trading engines, payment processors, and treasury operations, fast finality matters more than peak throughput. It reduces counterparty risk, improves capital efficiency, and enables systems to operate closer to real-time accounting rather than relying on probabilistic confirmations.

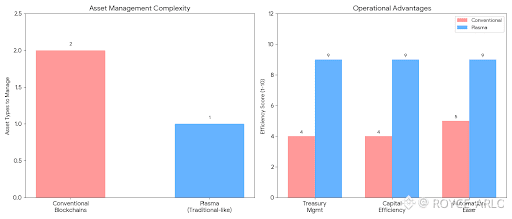

A defining characteristic of Plasma is its stablecoin-first fee model. Users are not required to hold a volatile native token to pay for gas. Instead, the network supports stablecoin-denominated fees and, in certain cases, gasless USDT transfers. This goes beyond user experience. It fundamentally changes the network’s economic behavior. Fees become predictable, accounting is simplified, and operational costs remain in the same unit of value businesses already use. For institutions, this eliminates a layer of FX-like risk that typically exists between the asset being transferred and the asset required to execute the transaction.

From the perspective of trading and capital movement, this structure more closely resembles traditional payment rails than conventional blockchains. On most networks, users must manage balances in both the asset they wish to move and the token needed to move it. Plasma collapses this into a single stable unit. While subtle, this distinction becomes significant at scale: treasury management is simpler, idle capital is reduced, and automation is easier to implement.

Plasma’s security model is anchored to Bitcoin. By using Bitcoin as a security reference point, Plasma increases neutrality and resistance to censorship. Although it operates independently as a Layer 1, anchoring to Bitcoin introduces an external settlement layer that is broadly trusted and extremely difficult to manipulate. For financial infrastructure, this is often more meaningful than abstract decentralization metrics. It provides a credible foundation for long-term state verification and dispute resolution, aligning more closely with how traditional systems think about systemic risk.

Importantly, this anchoring does not impose Bitcoin’s performance constraints. Plasma remains fast and programmable while gaining an additional security horizon. For long-lived financial applications handling large stablecoin volumes, this reduces exposure to governance capture or abrupt rule changes that can affect isolated chains.

Plasma’s reliability comes from the alignment between its technical design and its economic purpose. Because it is not attempting to support every use case, the network can tune block times, fee mechanics, and validator incentives specifically for consistent transaction processing. This leads to more predictable performance under load, which is essential for payment systems and trading infrastructure.

That specialization, however, also imposes limits. Plasma is not intended to serve as a broad ecosystem for complex DeFi strategies, experimental applications, or high-frequency on-chain trading. Its value proposition is intentionally narrow. If stablecoin settlement does not become the dominant use case on the network, its advantages lose relevance. Additionally, stablecoin-based and gasless fee models introduce reliance on specific issuers, adding a layer of centralized risk. Regulatory action against major stablecoins could directly affect network usage.

Network effects are another open question. Settlement systems derive value from scale: liquidity and counterparties attract more liquidity and counterparties. Plasma’s model succeeds only if it captures meaningful transaction volume from real economic users. Without that adoption, its technical strengths remain theoretical.

From an analytical standpoint, Plasma should be viewed as infrastructure rather than a growth story. It is not designed to create new speculative markets or financial products. Its goal is to make the existing stablecoin economy more efficient covering exchange settlement, cross-border payments, merchant rails, and institutional treasury flows. These activities already generate massive volume but currently rely on chains that were not built with settlement in mind.

Over the long term, the expansion of crypto markets depends less on new tokens and more on dependable financial plumbing. Stablecoins are already the dominant form of on-chain money, and their role continues to grow in payments, remittances, and digital banking. Plasma contributes to this shift by treating settlement as a primary concern rather than a side effect of smart contract platforms.

If crypto is to function as real financial infrastructure, it requires blockchains that behave like settlement layers, not experimental playgrounds. Plasma represents one approach to that challenge: narrowly scoped, technically conservative, and aligned with how money actually moves. Its success will not be measured by hype or ecosystem size, but by whether real payment flows choose it as their base layer. For institutions and serious market participants, that is the metric that matters most.