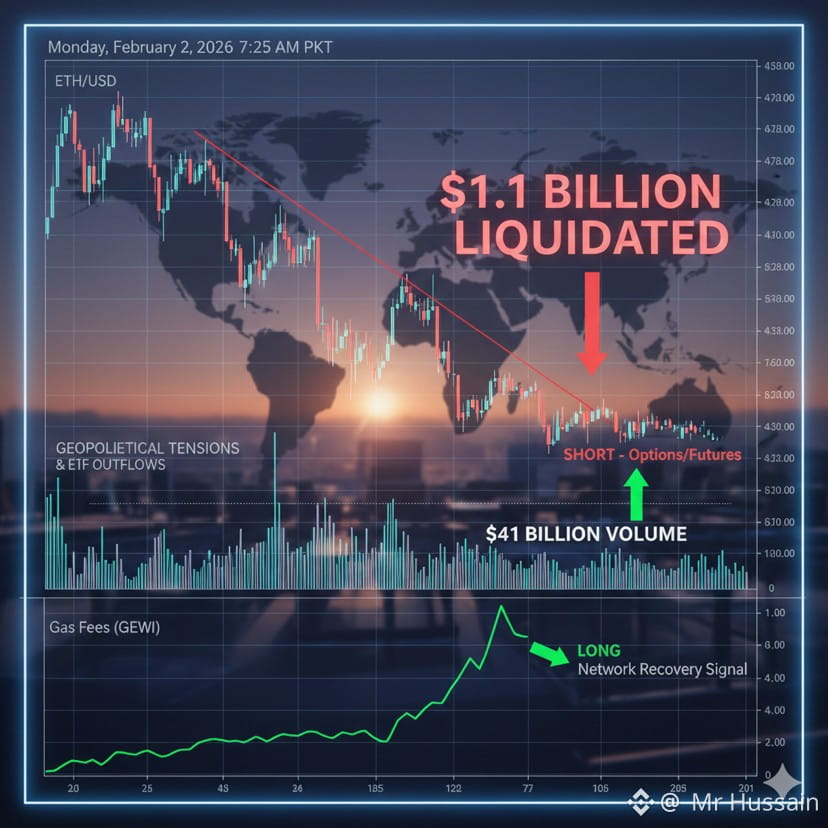

The Ethereum markets just took a massive hit, proving once again that crypto never sleeps—and it certainly doesn't play nice during geopolitical turbulence. In a perfect storm of global tensions and a sudden cooling of Spot ETF inflows, we just witnessed a staggering $1.1 billion in liquidations.

With trading volume surging to $41 billion, the "weak hands" have been flushed out, but the question remains: is this a structural collapse or a temporary discount?

The Strategic Playbook

When the chart turns red, emotion is your biggest enemy. Here is how the pros are looking at the current setup:

• The Bear Case: As long as the downtrend is fueled by institutional outflows, Shorting via Options or Futures remains a viable hedge to protect your capital.

• The Recovery Signal: Keep a sharp eye on on-chain metrics. A spike in Gas Fees often signals a return of network activity and dApp usage. If the network starts heating up despite the price action, that’s usually your cue to start scaling into a Long position.

The Bottom Line

Volatility is the price we pay for the highest-performing asset class of the decade. Those who can separate the geopolitical noise from the network fundamentals are the ones who will come out ahead when the dust settles.

🗨️ What’s your move?

Are you leaning into the short-side momentum, or are you hunting for a bottom while the "blood is in the streets"?

Drop a "🐻" if you think we go lower, or a "🚀" if you're watching the gas fees for a reversal!

#Ethereum #MarketCorrection #EthereumMarket #Write2Earn