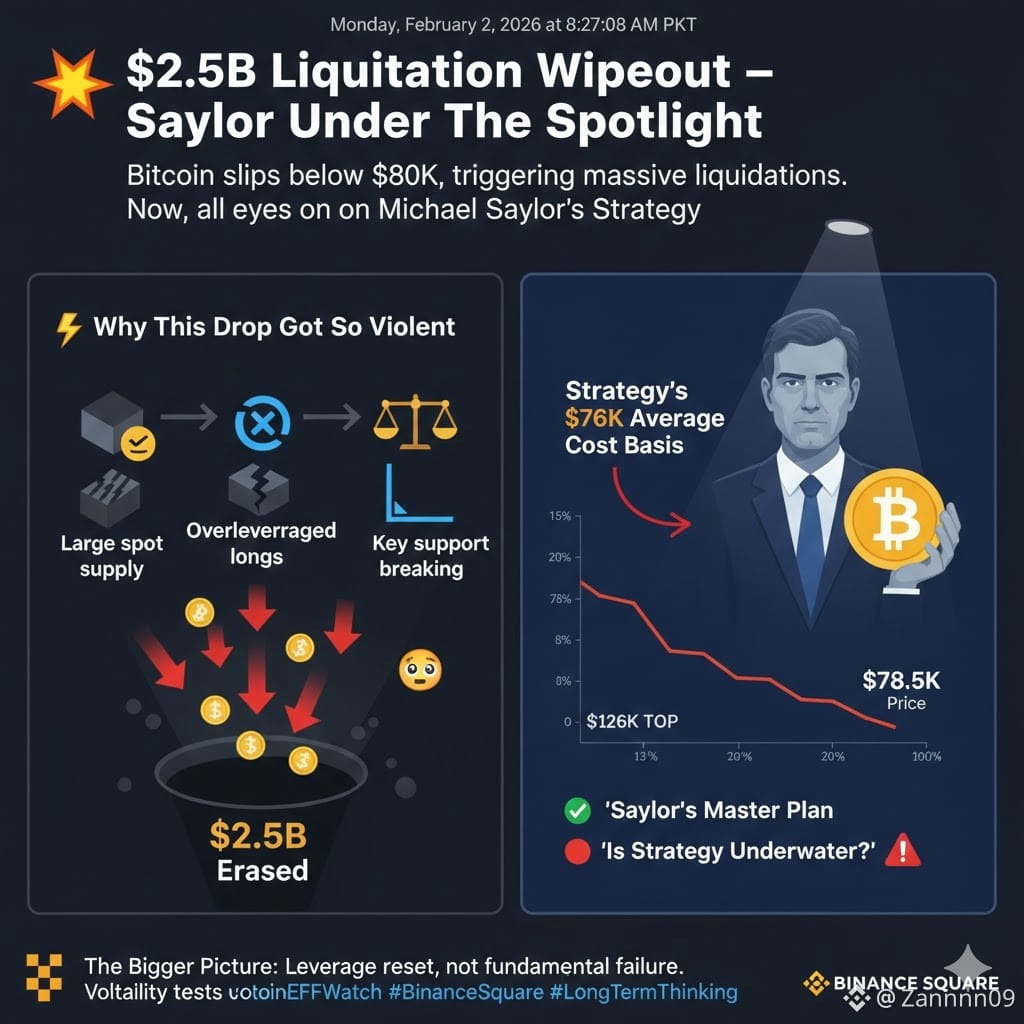

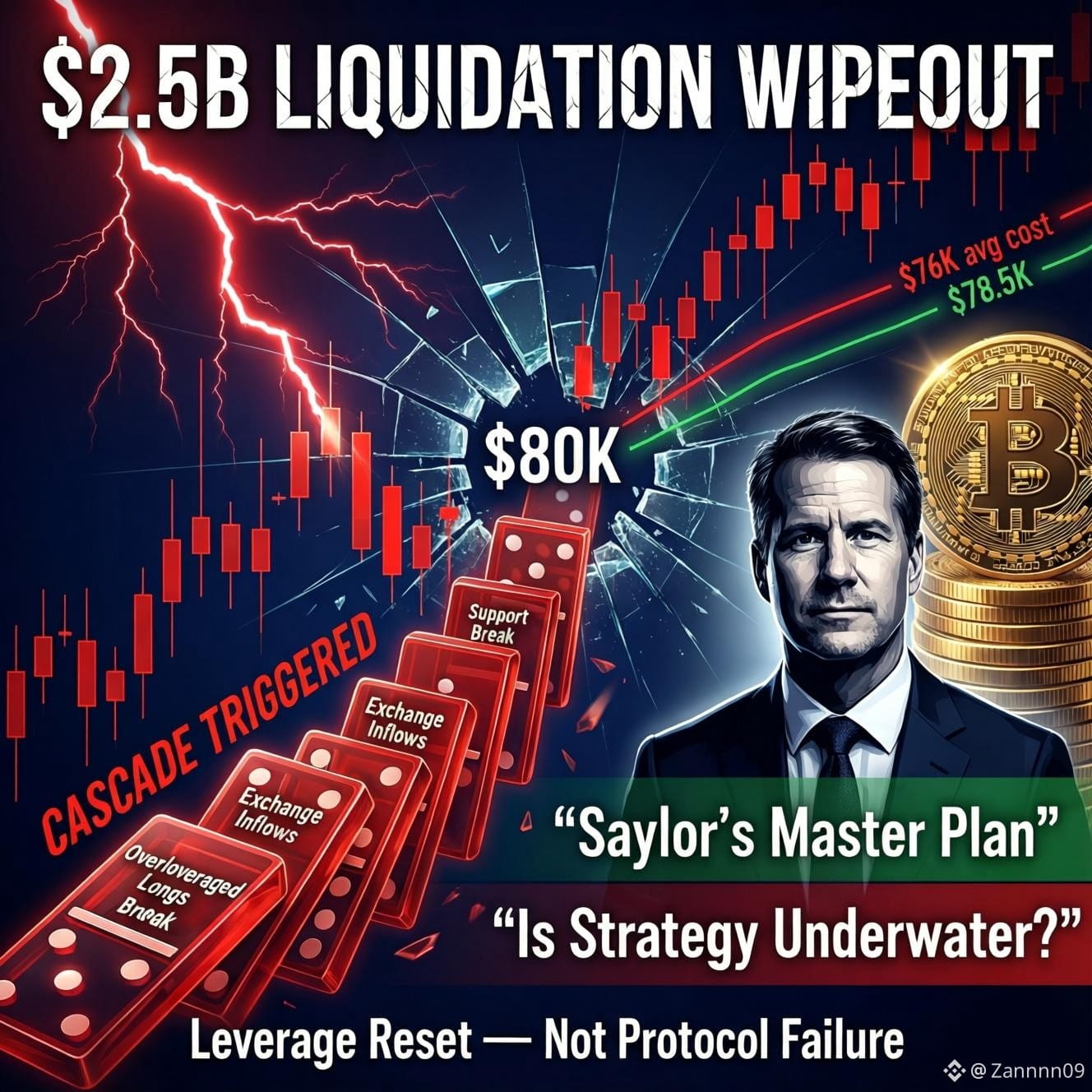

Bitcoin slipping below $80K didn’t just sting traders — it triggered a massive liquidation cascade.

Roughly $2.5 BILLION in leveraged positions were wiped out in a single wave 🤯📉

This wasn’t slow selling.

This was forced liquidation dominoes — the kind that rival the ugliest moments in crypto history.

📉 Thin liquidity + leverage = air pockets.

When price breaks, it doesn’t drift… it falls.

⚡ Why This Drop Turned Violent

This wasn’t just fear.

On-chain data shows large BTC inflows to exchanges right as price lost key levels.

Deadly combo:

📦 Heavy spot supply hitting exchanges

⚖️ Overleveraged longs

📉 Major support snapping

Once $80K broke, liquidations stacked on top of liquidations.

No reaction time. No clean bounce. Just volatility.

🧠 Now the Spotlight Shifts to Michael Saylor

Retail panic is normal — but this time, institutions are under the microscope too 👀

Strategy holds one of the largest BTC treasuries on Earth:

🪙 ~712,000+ BTC

💰 Avg cost ≈ $76K

📊 BTC recently traded near $78.5K

That’s a razor-thin buffer above breakeven.

Not forced selling. Not bankruptcy.

But psychologically? The narrative shifts fast.

📉 From “Genius” to “Under Pressure”

At the highs, Strategy’s BTC stack was worth $80B+.

Same coins today — very different valuation.

When a company ties its identity to Bitcoin,

📊 price = perception.

A few more % down and headlines flip from:

🟢 “Bitcoin masterstroke”

to

🔴 “Is Strategy underwater?”

💎 Historically, Saylor doesn’t sell.

But pressure builds — on sentiment, not solvency.

🧩 The Bigger Picture

This crash wasn’t about one company. It was about:

Excess leverage

Thin liquidity

Large holder movement

A key level breaking

That mix creates violent unwinds.

But here’s the key 👇

Liquidation crashes are mechanical, not fundamental.

They flush positions, not belief.

🎯 So What Now?

Bitcoin isn’t broken — it’s deleverage resetting

Strategy isn’t wrecked — it’s just closer to cost

The market is testing conviction, not technology

These moments feel the worst in real time…

and often become major turning points in hindsight.

📉 Scary chart.

🧱 Intact structure.

⚡ Big difference.

Welcome to crypto — where volatility writes the story before fundamentals catch up.

#bitcoin #CryptoLiquidationStats #MarketReset #BTC #InstitutionalFlows #BitcoinETFWatch