Solana ($SOL ) is trading near $97 after a sharp sell-off dragged the token below the key $100 level. While the broader crypto market has been under pressure, Solana has taken a harder hit due to fresh security concerns that have shaken investor confidence.

Over the past few weeks, SOL has fallen from the $140–$145 range, erasing most of its late-2025 recovery. For many investors, this type of decline is driven more by fear, forced selling, and uncertainty than by any sudden breakdown in Solana’s core technology.

⚠️ Step Finance Hack Triggers Security Fears

A major catalyst behind the sell-off was a security breach at Step Finance, where roughly $30 million worth of SOL was moved from treasury wallets. Around 261,854 SOL was transferred rapidly, raising concerns that the incident may have involved internal access, not just an automated exploit.

Although Step Finance stated that user funds were not affected, the event still rattled the Solana DeFi ecosystem. Large treasury wallets are becoming prime targets, highlighting the need for stronger safeguards, including multi-signature approvals and tighter access controls.

In stressed market conditions, headlines often matter more than details—and security scares tend to accelerate selling pressure.

🌱 Jupiter Update Adds a Long-Term Bright Spot

Not all developments are negative. Jupiter recently launched explore.ag, a new analytics tool that combines data from Solscan and DeFiLlama into a single dashboard. The platform improves transparency by making it easier to track projects, transactions, and DeFi metrics across Solana.

While this may not impact prices immediately, such infrastructure upgrades signal that the Solana ecosystem continues to evolve, even during downturns—often a positive sign for developers and long-term participants.

📉 Solana Technical Outlook: Can $100 Be Reclaimed?

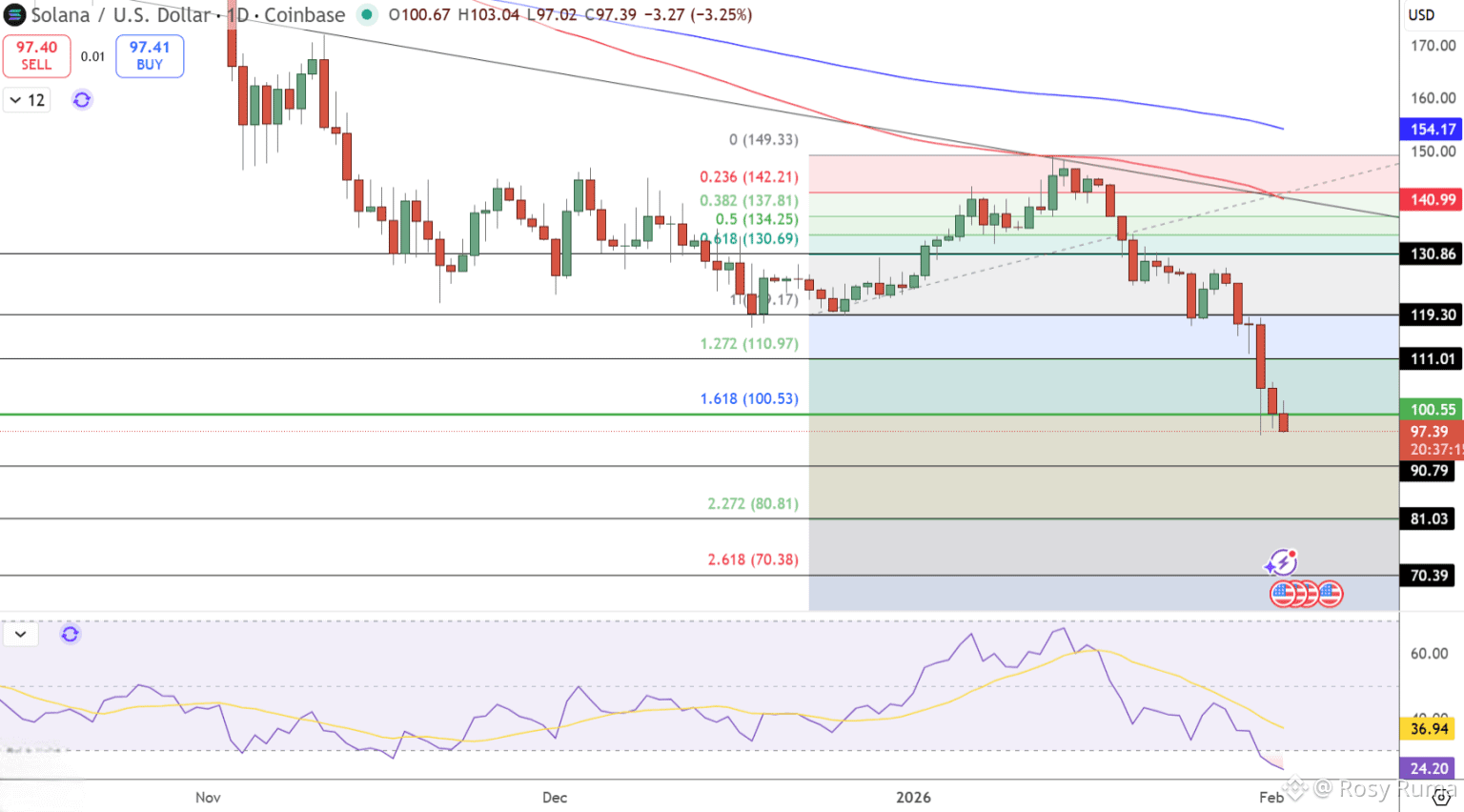

From a technical perspective, SOL remains in a short-term downtrend, trading within a descending channel that began in late 2025. Once price broke below the 100-day and 200-day EMAs near $140, it quickly slipped through $119 and $111, suggesting forced liquidation rather than healthy profit-taking.

Key levels to watch:

🔴 Resistance: $105–$111 (former support turned selling zone)

🟢 Support: $90–$81 (prior demand area)

⚠️ Deeper risk: A drop toward $70 if broader weakness continues

The RSI is in the mid-20s, indicating oversold conditions. While this can trigger short-term bounces, it does not guarantee an immediate trend reversal.

For a stronger recovery signal, SOL would need to hold above $100, form a higher low, and close above $111 on the daily chart. That could open the door to a move toward $120–$130.

🔍 Final Take

Solana appears to be going through a painful but familiar reset phase. Security concerns have amplified selling pressure, yet ecosystem development continues in the background. If volatility cools and confidence stabilizes, this phase could eventually set the stage for more sustainable gains—but patience will be key.