I’ve spent so much time in blockchain trenches, and every now and then a project jumps out that just gets it—solving problems I’ve wrestled with for ages. Right now, that’s @Plasma for me. It’s an EVM-compatible Layer 1 chain, built from scratch for stablecoins, especially USDT. The clincher? Zero-fee transfers. Sending money feels less like a bank wire, more like shooting off a text. Stablecoins are everywhere these days, but let’s be real—most chains buckle under high fees and slow confirmations. Plasma flips that script. Their $XPL token keeps the whole thing moving, covering everything from validator rewards to staking and those rare non-USDT transactions. There’s no empty hype here—just smart engineering that actually gets me excited for what payments could look like if we get this right.

Why Plasma Actually Feels Like the Fix

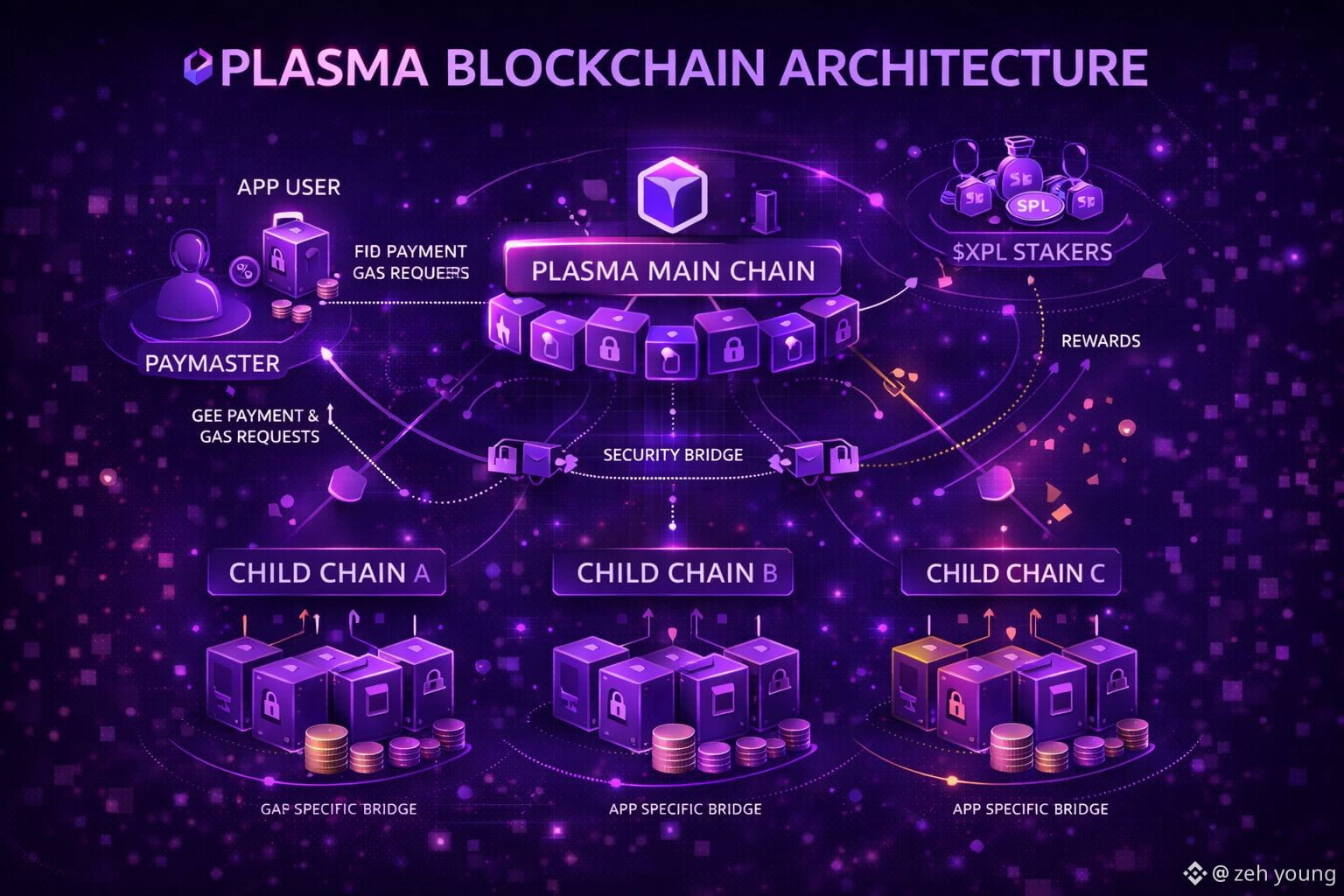

Remember the last time you tried to send stablecoins across borders—or even just tip someone online—and watched gas fees chew up half your money before it even landed? That’s the headache Plasma solves with its protocol-level paymaster. The system handles USDT gas costs for you, no juggling extra tokens, no mental math, no stress. Developers get even more flexibility with custom gas tokens rolling out, and private payments that don’t slow down your transactions. What really hooks me is the combo: proof-of-stake security, full EVM compatibility, and a setup where Ethereum devs don’t have to reinvent the wheel. If Plasma scales like it’s supposed to, suddenly stuff like remittances or micro-payments just… works. No more friction. And honestly, that’s been missing from crypto for far too long.

Diving Into $XPL: Not Just Another Token

XPL isn’t some pump-and-dump. It’s the utility token that ties Plasma together—staking, validator rewards, all backed by a sane tokenomics model. Controlled inflation keeps long-term holders happy without flooding the market, and distribution feels balanced: public sales, the team, investors, ecosystem reserves, all with clear vesting. It’s the kind of structure that inspires confidence because nobody’s set up to bail at your expense. Developers use XPL for smart contracts, Bitcoin bridges like native pBTC, and even early-stage governance where holders can help steer upgrades. I’ve seen plenty of tokens promise the moon and deliver empty charts, but XPL is baked right into real features—DeFi, enterprise payments—the backbone stuff. It’s a bet on actual infrastructure, not just speculation.

Plasma’s Roadmap: Building What’s Next

Looking forward, Plasma’s moving on trustless bridges and stablecoin-first smart contracts. That’s the kind of groundwork that unlocks apps we haven’t even dreamed up yet—maybe global gaming economies, maybe supply chains tracking every step, all without the usual fee drag. The community’s already active, poking and prodding at new tools, and since Plasma’s EVM-ready, I wouldn’t be shocked if a wave of dApps migrate just for the raw efficiency. Instead of chasing every shiny new trend, they’re laser-focused on payments—the one thing still holding crypto back from mass adoption. That focus is rare, and honestly, it’s why I keep coming back to Plasma’s docs late at night, trying to piece together how this might actually change things.

Why @plasma Actually Matter

When you zoom out, with trust in regular money getting shakier every year, @plasma and $XPL feel like the steady hand we need. It turns stablecoins from awkward tools into something smooth, intuitive—almost invisible. Plasma doesn’t shout for attention; it earns it by solving real problems. If they deliver, I think we’ll look back and realize this was the spark that made crypto part of everyday life for billions. That’s the future I’m pulling for.